Market Overview

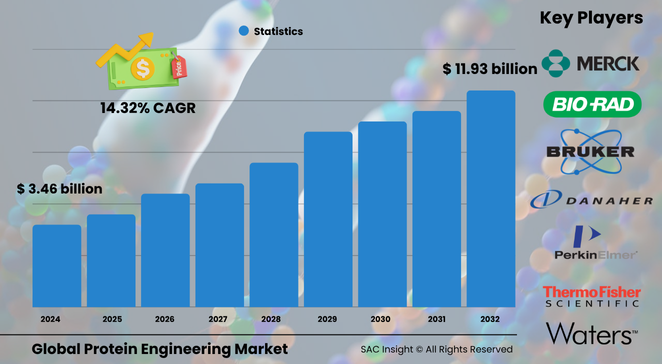

The global protein engineering market size is valued at roughly US$ 3.46 billion in 2024 and is projected to reach about US$ 11.93 billion by 2032, reflecting a strong at 14.32 % CAGR. SAC Insight industry insights show momentum coming from surging demand for targeted biologics, rapid advances in AI-assisted design, and expanding investment in synthetic biology platforms.

SAC Insight's deep market evaluation indicates the U.S. protein engineering market alone could mirror the global trajectory, advancing from nearly US$ 3.46 billion in 2024 to around US$ 11.93 billion by 2032 as biopharma groups accelerate protein-based drug pipelines and tool makers roll out high-throughput automation.

Summary of Market Trends & Drivers

• Automated, high-efficiency instruments are compressing protein discovery cycles from months to weeks, underpinning robust market growth in tools and reagents.

• AI-guided rational design and hybrid evolution workflows are raising success rates in antibody and enzyme optimization, steering market trends toward data-driven platforms.

• Rising prevalence of chronic and autoimmune diseases is fuelling market demand for next-generation biologics with superior specificity and lower side-effect profiles.

Key Market Players

Industry leadership rests with a blend of diversified life-science suppliers and focused biotech specialists. Companies such as Thermo Fisher Scientific, Danaher, Merck KGaA, Agilent Technologies, Waters, and Bruker command sizeable market share through broad instrument lines, global service networks, and active acquisition pipelines that deepen expertise in automation and analytics.

Alongside these incumbents, Bio-Rad Laboratories, Genscript Biotech, and Amgen push innovation in reagents, custom antibody services, and clinical development. Competitive dynamics increasingly revolve around AI partnerships, cloud-native software for protein analysis, and integrated CRO offerings that shorten time-to-clinic.

Key Takeaways

• Current global protein engineering market size (2024): about USD$ 3.46 billion

• Projected global market size (2032): nearly USD$ 11.93 billion at a 14.32 % CAGR

• Instruments account for the largest product market share, exceeding half of 2023 revenue

• Rational protein design leads technology uptake with roughly 30 % share, powered by bioinformatics advances

• Monoclonal antibodies represent the most lucrative protein type, capturing nearly one-quarter of revenue

• North America dominates with close to 41 % market share, while Asia Pacific posts the fastest regional CAGR above 17 %

Market Dynamics

Drivers

• Escalating R&D investment in biologics, vaccines, and cell-free manufacturing platforms

• Wider adoption of high-throughput automated instruments that reduce cost per experiment and boost data quality

Restraints

• High capital outlay for advanced spectroscopy, crystallography, and microfluidic systems

• Regulatory complexity surrounding data privacy and ethical sourcing of biological samples

Opportunities

• AI-first protein design services for rare-disease therapeutics and enzyme biocatalysts

• Emerging markets in Asia and Latin America seeking affordable contract research and pilot-scale manufacturing

Challenges

• Talent shortages in computational biology and structural bioinformatics

• Supply-chain bottlenecks for specialty reagents and precision robotics components

Regional Analysis

North America retains leadership thanks to deep venture capital pools, mature CRO ecosystems, and frequent pharma-biotech collaborations. Europe follows with strong government backing for precision medicine, while Asia Pacific shows the quickest market growth on rising chronic disease burdens and expanding research infrastructure.

• North America – Largest revenue base, dominant instrument adoption

• Europe – Robust public funding, expanding monoclonal antibody pipelines

• Asia Pacific – Fastest CAGR, untapped patient pools and local manufacturing incentives

• Latin America – Gradual uptake driven by contract manufacturing demand

• Middle East & Africa – Early-stage growth supported by academic-industry partnerships

Segmentation Analysis

By Product

• Instruments – More than 50 % share, rapid automation wave.

Lab-scale robotics, parallel capillary electrophoresis, and high-resolution mass spectrometers are trimming development timelines and elevating data reproducibility, making instruments the workhorse segment.

• Reagents – High-volume consumables.

Growth factors, expression vectors, and specialty buffers support vaccine production, monoclonal antibody engineering, and enzyme screening, keeping reagent sales on a steady upswing.

• Software & Services – Data-driven edge.

Cloud-based protein analysis suites and CRO offerings provide predictive modelling, freeing labs from heavy in-house infrastructure and expanding access to expertise.

By Technology

• Rational Design – Core approach.

Structure-guided mutagenesis and computational docking deliver predictable performance improvements, cementing rational design as the default starting point for therapeutic antibody and enzyme projects.

• Directed Evolution – Adaptive optimisation.

Iterative mutation–selection cycles uncover high-performance variants when structural data are limited, appealing to industrial enzyme developers seeking rugged catalysis.

• Hybrid Approach – Fastest-growing.

Combines computational insights with evolution libraries, boosting hit rates for complex targets such as redox proteins used in biosensors and nanodevices.

• De Novo Design & Others – Frontier research.

AI-generated scaffolds and novel folds offer bespoke activity profiles, opening doors to first-in-class therapeutics.

By Protein Type

• Monoclonal Antibodies – Revenue powerhouse.

High clinical success rates and expanding oncology indications keep mAbs at the centre of commercial pipelines, encouraging heavy investment in next-generation platforms such as bispecifics and antibody–drug conjugates.

• Insulin – Solid demand anchor.

Global diabetes prevalence drives sustained need for faster-acting and once-weekly formulations, leveraging protein engineering to enhance stability and absorption.

• Vaccines – Strategic growth area.

mRNA and recombinant subunit vaccines rely on engineered antigens for improved immunogenicity, a spotlight that intensified after the pandemic.

• Growth Factors, Coagulation Factors, Interferons, Others – Niche yet vital.

Tailored variants address regenerative medicine, rare bleeding disorders, and antiviral therapy, supporting diversified revenue streams.

By End-Use

• Pharmaceutical & Biotechnology Companies – Largest consumer.

In-silico design and proprietary libraries help pharma maintain market presence as blockbuster biologics approach patent cliffs.

• Contract Research Organizations – Fastest-rising user base.

Outsourced discovery and pilot manufacturing offer cost-effective access to specialised talent and equipment, accelerating smaller firms’ market entry.

• Academic Research Institutes – Innovation engine.

University labs drive fundamental breakthroughs in protein folding and allosteric control, often spinning out start-ups that commercialise disruptive tools.

Industry Developments & Instances

• January 2024 – Agilent launched an automated parallel capillary electrophoresis system, raising throughput for protein purity testing.

• January 2024 – Bruker acquired Chemspeed Technologies to integrate robotics and lab digitisation into its protein-analysis workflow.

• December 2023 – Thermo Fisher secured a distribution agreement to broaden automated IFA platforms in the U.S., enhancing clinical proteomics reach.

• December 2023 – Waters opened a global capability centre in Bengaluru, speeding software development for life-science instruments.

• April 2023 – Taros Chemicals partnered with Welab Barcelona to strengthen cross-border R&D in protein-driven drug discovery.

Facts & Figures

• Automated instruments captured approximately 51.76 % of product revenue in 2023.

• Rational protein design accounted for about 30.03 % of technology revenue last year.

• Monoclonal antibodies held close to 23.86 % market share in 2023.

• Asia Pacific is forecast to grow at roughly 17.50 % CAGR through 2032.

• Private funding rounds for AI-first antibody platforms exceeded USD$ 1 billion globally in 2024.

Analyst Review & Recommendations

Market analysis confirms a decisive swing toward integrated, AI-driven engineering suites that merge computational design with high-throughput lab automation. Suppliers that package instruments, reagents, and cloud analytics into turnkey workflows will outpace average market growth. We recommend prioritising hybrid design capabilities, securing reagent supply resilience, and deepening CRO alliances to offer end-to-end solutions for emerging biopharma innovators.