Market Overview

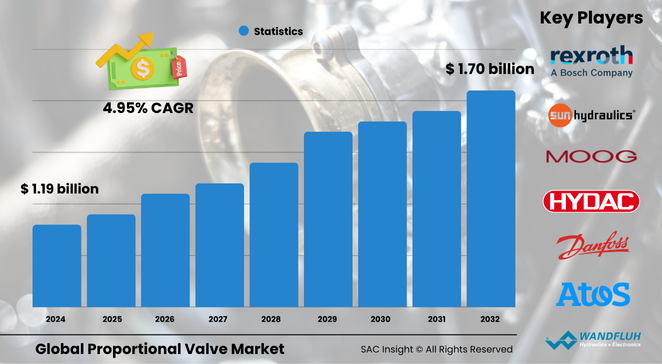

The global proportional valve market size is valued at about US$ 1.19 billion in 2024 and is projected to reach roughly US$ 1.70 billion by 2032, advancing at an average 4.95% CAGR through the 2025-2032 forecast window. First-hand industry insights highlight three structural growth engines: rising automation intensity across discrete and process industries, persistent demand for compact medical dosing systems, and renewed investment in energy-efficient hydraulic and pneumatic platforms. SAC Insight's deep market evaluation shows the United States proportional valve market alone could approach US$ 0.45 billion by 2032 as modernized factories and life-science cleanrooms upgrade to closed-loop flow-control architectures.

Summary of Market Trends & Drivers

• Manufacturers are replacing on/off valves with proportionally controlled units to trim cycle times, cut energy losses, and meet stricter emissions goals.

• Smart, IO-Link-enabled proportional valves are gaining traction, feeding plant-wide data lakes that support predictive maintenance and quality tracking.

• Miniaturization in diagnostic devices and portable ventilators is spurring demand for low-power micro-proportional valves that deliver sub-milliliter precision.

Key Market Players

Global proportional valve market share is shaped by a mix of diversified motion-control leaders and specialist valve makers. Companies such as Emerson, Parker Hannifin, Eaton, Bosch Rexroth, Burkert, and SMC leverage broad fluid-power portfolios and global service networks, underpinning customer confidence. Niche innovators—including Kendrion, HAWE Hydraulik, Moog, and Magnet-Schultz—differentiate through high-response spool designs, low-leakage seat valves, and application-specific actuator packages. Competitive dynamics increasingly revolve around digital feedback integration, modular manifolds, and region-specific certification (FDA, CE, K-type oxygen compatibility).

Key Takeaways

• Current global proportional valve market size (2024): around US$ 1.19 billion

• Projected global market size (2032): roughly US$ 1.70 billion at a 4.95% CAGR

• Europe accounts for the largest market share thanks to its advanced manufacturing base and early Industry 4.0 adoption

• Hydraulic proportional valves remain the revenue core, but electric variants post the fastest market growth in clean-room and battery-assembly lines

• Precision dosing in anesthesia and infusion pumps is a fast-growing medical niche, opening steady margins for micro-valve suppliers

• Ongoing consolidation among component makers seeks scale economies and a wider software toolkit for closed-loop control

Market Dynamics

Drivers

• Wider automation roll-outs in automotive, semiconductor, and packaging plants demand finer motion and pressure control.

• Energy-efficiency mandates in Europe and East Asia favor proportional valves that modulate flow rather than vent excess pressure.

• Aging industrial infrastructure in North America triggers retrofit programs that replace legacy solenoids with programmable units.

Restraints

• Upfront unit costs are higher than binary valves, slowing adoption in cost-sensitive segments.

• Integration complexity—valve drivers, sensors, and PLC logic—can stretch commissioning times for small OEMs.

Opportunities

• Growing hydrogen and e-fuel pilot plants need corrosion-resistant proportional valves rated for ultra-clean gases.

• Surge in telehealth equipment broadens the addressable market for silent, battery-friendly miniature valves.

Challenges

• Semiconductor shortages for power electronics can lengthen lead times and inflate BOM costs.

• Stringent medical-device approval cycles delay revenue realization for new micro-valve designs.

Regional Analysis

Europe dominates proportional valve market growth on the back of high automation density, eco-design directives, and robust vehicle electrification projects. North America follows, driven by reshoring of electronics and battery manufacturing, while Asia-Pacific posts the quickest percentage gains as China, India, and ASEAN nations scale smart-factory initiatives.

• Europe – Largest revenue base; leadership in machine tools and process automation maintains demand.

• North America – Retrofit wave in brownfield plants and strong life-science capex sustain steady market analysis momentum.

• Asia-Pacific – Fastest CAGR; electric-vehicle supply chains and expanding semiconductor fabs lift orders.

• Latin America – Mining and food-processing upgrades spark niche demand for rugged hydraulic variants.

• Middle East & Africa – Oil, gas, and water-treatment projects open pockets of opportunity for explosion-proof models.

Segmentation Analysis

By Operation

• Direct-Acting – Quick response, compact footprint.

Direct-acting units move the spool directly with the solenoid, delivering millisecond reaction times suited to high-speed robotics and packaging machinery.

• Pilot-Operated – High flow capacity, energy saving.

A small pilot stage drives a larger power stage, enabling stable control of high-pressure circuits in presses, test stands, and mobile hydraulics while keeping coil power low.

• Others – Specialty reducing and flow-control valves.

Custom designs handle proportional pressure reduction or split-range flow tasks in labs, HVAC, and niche aerospace systems.

By Technology

• Hydraulic – Heavy-duty, dominant share.

Hydraulic proportional valves withstand high pressures and contaminant loads, making them indispensable in construction equipment, metal forming, and injection molding.

• Electric – Fast switching, clean-room friendly.

Stepper- or voice-coil-driven electric valves eliminate hydraulic fluid, providing precise, oil-free control for semiconductor wet benches and battery cell assembly.

• Pneumatic – Cost-effective, maintenance light.

Pneumatic variants modulate compressed-air flow in carton sealers, pick-and-place arms, and tire inflation stations where cleanliness and low force are priorities.

By Application

• Industrial Equipment – Core demand engine.

From CNC machine tools to plastic extruders, proportional valves set clamping pressure, axis speed, and cooling flow, directly influencing cycle time and product quality.

• Instrument & Meter – Precision flow metering niche.

Analytical gas chromatographs and mass-flow controllers rely on micro-valves to maintain stable baselines and rapid calibration cycles.

• Medical Equipment – High-accuracy dosing growth driver.

Portable ventilators, anesthesia machines, and infusion pumps require silent, low-current micro-valves to safeguard patient safety and extend battery life.

• Others – Automotive, aerospace, and mobile hydraulics.

Engine management, active suspension, and flight-surface actuation use proportional control to balance performance, emissions, and comfort.

Industry Developments & Instances

• April 2023 – Emerson acquired a test-and-measurement specialist, expanding motion-control and proportional-valve diagnostics offerings.

• October 2022 – A leading multinational divested its legacy climate-technology arm to focus capital on high-growth automation and valve segments.

• April 2020 – A major U.S. firm purchased an American hydro governor manufacturer, strengthening its position in renewable hydropower control systems.

• Ongoing – Multiple vendors are rolling out IO-Link-ready proportional valves, simplifying plug-and-play integration into smart manifolds.

Facts & Figures

• Europe accounts for roughly 30 % of global market revenue in 2024.

• Hydraulic proportional valves hold nearly 45 % market share, but electric variants are posting double-digit annual market growth.

• Energy-efficient pilot-operated designs can cut coil power consumption by up to 60 % compared with legacy solenoids.

• Micro-proportional valves under 10 mm diameter now deliver repeatability better than ± 1 % of setpoint.

• IO-Link adoption in new industrial valve installations exceeded 25 % in 2024, up from 15 % two years earlier.

Analyst Review & Recommendations

Market analysis indicates a steady pivot from open-loop hydraulics to sensor-rich proportional control. Suppliers that pair responsive valve mechanics with embedded diagnostics and field-bus versatility are positioned to outpace average market trends. We recommend focusing R&D on low-power coils and corrosion-resistant materials for hydrogen service, while expanding application engineering teams to help OEMs shorten commissioning times and capture untapped market share."