Market Overview

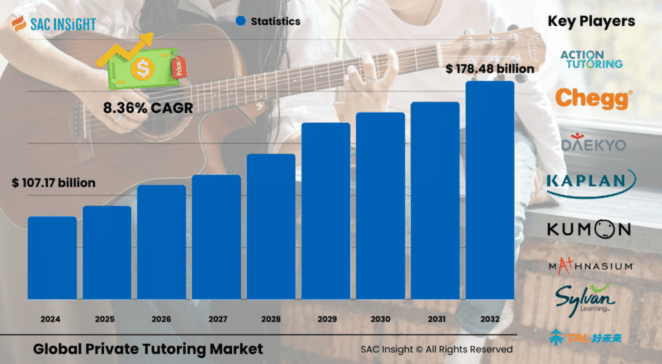

The private tutoring market size was valued at US$ 91.65 billion in 2022 and is projected to reach near US$ 107.17 billion in 2024. Driven by rising academic competition, growing EdTech adoption, and widening parental spending power, the sector is forecast to reach US$ 178.48 billion by 2032, expanding at a robust 8.36% CAGR over the 2025-2032 outlook. First-hand industry insights highlight three structural tailwinds: digital platforms that make one-to-one coaching borderless, a surge in test-prep enrollments across Asia and North America, and widening skill-gap awareness among mid-career adults.

SAC Insight's deep market evaluation also shows the U.S. private tutoring market is on track to touch roughly US$ 15.74 billion by 2032, while Asia Pacific captures nearly half of global revenue thanks to strong after-school “shadow education” demand.

Summary of Market Trends & Drivers

Personalized micro-learning, AI-powered adaptive curricula, and hybrid (online-offline) business models are reshaping how tutors reach students. Parents and adult learners alike view tailored coaching as a fast track to exam success, language fluency, and coding competence—key factors propelling market growth. Meanwhile, institutional partnerships that embed tutoring dashboards into school systems are becoming a preferred route to scale.

Key Takeaways

• 2022 private tutoring market size: USD$ 91.65 billion

• 2032 projection: USD$ 178.48 billion at an 8.36% CAGR

• Asia Pacific holds roughly 46.9% market share and is the growth engine

• Academic tutoring commands about 67.1% of revenue, led by math and science

• Offline tutoring still dominates with a 74.1% share, but online channels grow near 8% annually

• U.S. market poised for US$ 15.74 billion by 2032 on back of AI-centric platforms

Key Market Players

The global private tutoring market leaders include Chegg, Mathnasium, Kaplan, Kumon, TAL Education, Sylvan Learning, Varsity Tutors, and BYJU’S. These companies balance large offline footprints with rapidly growing digital subscriptions, often securing market share by bundling practice tools, analytics, and on-demand mentor access. A second tier of innovators—Action Tutoring, Educomp Solutions, Ambow Education, Daekyo, and Tutors International—focuses on niche offerings such as low-cost STEM drills, ultra-flexible scheduling, or premium concierge tutoring for high-net-worth families. Competitive centers around pricing creativity, AI integration, and regional language support.

Market Dynamics

Drivers

• Heightened entrance-exam intensity and scholarship competition push families toward supplementary coaching

• Rapid EdTech penetration enables anytime-anywhere personalized lessons at lower incremental cost

• Expanding middle class in emerging economies allocates greater discretionary spend to education

Restraints

• High session fees limit adoption among lower-income segments, widening educational inequality

• Methodological clashes between school curricula and private tutors can confuse learners and dampen outcomes

Opportunities

• AI-driven adaptive learning paths and generative-content tools promise scalable customization for mass markets

• Corporate upskilling programs open fresh demand streams for non-academic and professional-development tutoring

Challenges

• Fragmented regulatory oversight raises quality-control concerns and hinders standard pricing structures

• Tutor recruitment and retention, especially for niche subjects, remains difficult in rural and low-density regions

Regional Analysis

Asia Pacific is the undisputed leader, fueled by exam-heavy education systems in China, South Korea, Japan, and India, plus aggressive mobile learning uptake. North America follows, propelled by sophisticated online platforms and rising college-prep spending. Europe shows steady penetration, while Latin America and the Middle East & Africa are early-stage but accelerating on digital infrastructure gains.

• Asia Pacific – High enrollment in cram schools and nationwide EdTech consortiums drive fast adoption

• North America – Strong disposable income and AI-enhanced platforms underpin stable market growth

• Europe – Increasing use of private tutors to bridge learning gaps and language skills

• Latin America – Growing middle class and bilingual ambitions expand the addressable base

• Middle East & Africa – Government education initiatives and STEM focus create emerging opportunities

Segmentation Analysis

By Type

• Academic – Core revenue pillar, covering STEM, languages, and social sciences

Academic tutoring remains the prime choice for parents keen on grade improvement and competitive-exam readiness, commanding the lion’s share of spend.

• Non-Academic – Fastest riser, from coding bootcamps to music and life-skills coaching

As holistic development gains traction, demand for extracurricular coaching in arts, languages, and digital skills grows steadily.

By Delivery Mode

• Offline – 74.1% share, prized for face-to-face engagement and local syllabus fluency

Traditional in-person sessions thrive where personal rapport and immediate feedback are paramount.

• Online – Near-8% annual growth, unlocking global tutor pools and flexible scheduling

Cloud classrooms, recorded sessions, and AI-driven diagnostics make digital tutoring increasingly appealing for busy families and adult learners.

By End-Use

• High School Students – Largest slice at roughly 40% of revenue

Grade-10 and Grade-12 benchmark exams prompt heavy investment in subject mastery and competitive-exam coaching.

• Middle School Students – Rapid growth around 7.6% CAGR

Parents leverage tutoring to reinforce fundamentals without sacrificing extracurricular pursuits.

• Preschool & Primary; College Students – Niche yet expanding markets, driven by early literacy focus and career-oriented upskilling.

By Duration

• Long-Term Courses – Dominant for continuous skill reinforcement and measurable academic progress

Institutes package year-long programs with periodic assessments and parent dashboards.

• Short-Term Courses – Popular for exam sprints or targeted skill boosts

Bootcamps and seasonal intensives cater to learners seeking rapid improvement.

By Tutoring Style

• Subject Tutoring Service – Preferred for micro-learning and personalized pacing

Students cherry-pick tutors for specific weak areas, boosting confidence and exam scores.

• Test Preparation Service – Rising demand amid globalized entrance exams

Comprehensive coaching for SAT, IELTS, JEE, and similar tests remains a lucrative niche.

Industry Developments & Instances

• April 2023 – Chegg rolled out CheggMate, an AI co-pilot that curates study pathways and practice sets.

• February 2022 – BYJU’S announced 500 hybrid tuition centers across 200 Indian cities, blending app-based content with onsite mentoring.

• September 2022 – Tutor.com launched LEO, a 24/7 institutional platform offering analytics-rich academic support.

• June 2020 – Chegg added Mathway to deepen mathematics problem-solving capabilities.

• April 2023 – Mathnasium expanded to 70+ overseas centers, signaling aggressive international franchising.

Facts & Figures

• Around 43% of students worldwide receive some form of private tutoring during K-12 years.

• Offline session fees vary widely, averaging 25% higher in urban hubs than rural regions.

• Online tutoring usage grew more than 900% since 2000 and now involves roughly half of all students globally.

• Girls’ participation in extracurricular lessons rose from 33.5% to 37% between 1998 and 2020.

• Adaptive platforms report up to 30% faster syllabus completion versus traditional group classes.

Analyst Review & Recommendations

Market analysis shows private tutoring moving rapidly toward an omnichannel, AI-enabled model where data-driven insights personalize every lesson. Providers that combine rigorous pedagogy with scalable tech will capture disproportionate market share. Strategic priorities include expanding subject depth in growth regions, refining outcome-based pricing, and building tutor-training pipelines to safeguard quality as demand accelerates. Overall, market trends point to sustained, high-single-digit market growth through 2032, with digital leaders setting the competitive tempo.