Market Overview

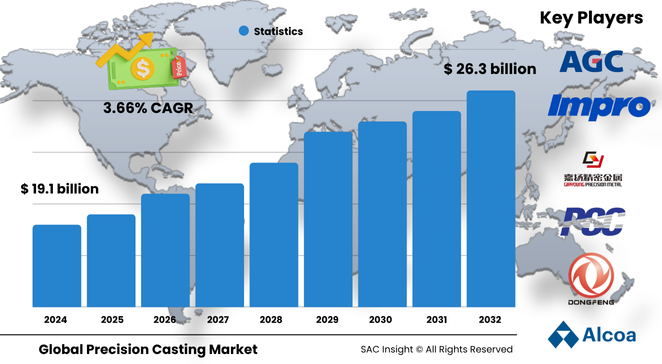

The global precision casting market size is valued at roughly US$ 19.10 billion in 2024 and is projected to reach about US$ 26.35 billion by 2032, expanding at an average 3.66% CAGR. Sac Insight's first-hand industry insights highlight three growth engines: persistent demand for near-net-shape components in automotive and aerospace, steady market growth in medical implants and industrial machinery, and rapid adoption of simulation-driven production that cuts scrap and energy use.

SAC Insight's deep market evaluation shows North America leading revenue today, while the U.S. precision casting market portion alone could advance from around US$ 4.7 billion in 2024 to roughly US$ 6.2 billion by 2032 as defense and electric-vehicle programs specify lighter, tighter-tolerance parts.

Summary of Market Trends & Drivers

Digital foundries that pair 3D-printed wax patterns with real-time process monitoring are compressing lead times and improving first-pass yield. At the same time, market analysis confirms rising use of lightweight aluminium and titanium alloys to meet fuel-efficiency targets, especially in electric drivetrains and next-generation jet engines. Sustainability mandates are another tail-wind: foundries are investing in closed-loop wax recovery and low-carbon power sources to protect market share with environmentally conscious OEMs.

Key Market Players

Global competition centres on a mix of diversified metals majors and specialised jobbing foundries. Hitachi Metals and Thyssenkrupp leverage broad alloy portfolios and captive R&D to supply turbine blades, structural brackets, and medical implants. Alcoa, Meyer Powders, and Metal Technologies focus on aluminium and nickel superalloy billets, feeding value-added casting lines across three continents. Regional specialists such as Dynacast, Hamilton Casting Solutions, and DGS Technical Services win niche contracts by offering quick-turn prototypes and cost-effective medium-volume runs, while Mitsubishi Materials and KSM Casting expand aggressively in Asia to capture localisation opportunities.

Key Takeaways

• Current global market size (2024): USD$ 19.10 billion

• Projected global market size (2032): USD$ 26.35 billion at a 3.66 % CAGR

• Automotive retains the largest application share thanks to lightweight power-train demand

• Investment casting dominates process revenue, but die casting shows the fastest percentage gain in high-volume EV parts

• Aluminium and titanium alloys together exceed 40 % of material demand as lightweighting intensifies

• Smart foundry initiatives that pair data analytics with automated pouring lines are lifting overall equipment effectiveness above 85 %

Market Dynamics

Drivers

• Electrification of vehicles and stricter emissions rules accelerate demand for thin-wall, high-strength aluminium castings

• Aerospace fleet renewal fuels long-term orders for nickel-based turbine components with tight tolerances

• Growing surgical implant volumes boost stainless and titanium precision cast parts in medical devices

Restraints

• Volatile energy and refractory prices squeeze margins, especially for small and mid-size job shops

• Skilled labour shortages in pattern design and metallurgical quality control limit capacity expansion

• Stringent certification cycles in aerospace and healthcare prolong time-to-market for new alloys

Opportunities

• Adoption of simulation-guided gating design opens room for defect-free castings and premium pricing

• Emerging economies in Southeast Asia and Africa require affordable industrial machinery, widening addressable market

• Recycled metal feedstock programs align with OEM sustainability goals and can unlock green-procurement contracts

Challenges

• Maintaining dimensional stability with ultra-light aluminium-lithium alloys demands new tooling and process windows

• Increasing automation heightens cybersecurity risk across networked furnaces and ERP systems

• Fragmented regulatory frameworks for waste wax disposal complicate global compliance efforts

Regional Analysis

North America currently leads precision casting revenue owing to deep aerospace supply chains and EV ramp-ups, while Asia-Pacific records the quickest market growth as China, India, and Southeast Asia scale transport and infrastructure projects. Europe follows closely, supported by advanced automotive hubs and tightening CO2 regulations.

• North America – Largest market share; strong defense and electric-vehicle pipelines

• Europe – Innovation hub; strict emission standards spur alloy development

• Asia-Pacific – Fastest CAGR; industrial expansion and localisation policies drive capacity additions

• South America – Steady mining and construction demand sustains iron and steel castings

• Middle East & Africa – Niche aerospace maintenance clusters and energy projects create targeted opportunities

Segmentation Analysis

By Material Type

• Aluminium – Preferred lightweight option.

Automakers and drone manufacturers favour aluminium for its strength-to-weight ratio, pushing foundries to master thin-wall sections without porosity.

• Steel – Workhorse for wear resistance.

Industrial pumps, valves, and rail couplings rely on steel castings to survive harsh operating cycles at competitive cost.

• Iron – Cost-effective volume choice.

Construction machinery housings and engine blocks benefit from iron’s damping properties and price stability.

• Nickel – High-temperature performer.

Gas-turbine blades and chemical-plant fixtures depend on nickel superalloys to withstand creep and corrosion above 1 000 °C.

• Titanium – Premium biomedical and aerospace alloy.

Orthopaedic implants and airframe brackets exploit titanium’s biocompatibility and fatigue resistance to cut lifetime ownership costs.

By Process Type

• Investment Casting – Precision benchmark.

Wax-pattern trees and ceramic shells deliver near-net shapes with minimal machining, ideal for complex aerospace and medical parts.

• Sand Casting – Flexible and economical.

Large industrial frames and prototypes benefit from quick tooling and broad material compatibility.

• Die Casting – High-volume productivity.

Automotive gearcases and electronic housings leverage rapid-fire aluminium die casting for consistent mass production.

• Shell Molding – Superior surface finish.

Thin shell molds enable sharper edges and tighter tolerances than traditional sand, suiting gearbox covers and pump casings.

• Centrifugal Casting – Cylindrical integrity.

Pipes, bushings, and ring gears achieve dense, defect-free walls through rotational molding under centrifugal force.

By Application

• Automotive – Core demand engine.

Lightweight chassis, transmission carriers, and battery enclosures keep order books full as EV production scales.

• Aerospace – High-value niche.

Every new jet engine or airframe upgrade requires intricate castings qualified to extreme fatigue standards.

• Medical – Precision critical.

Hip stems, dental crowns, and surgical tools rely on casting for complex geometries and biocompatible finishes.

• Industrial – Broad, steady base.

Compressors, pumps, and robotics joints need robust cast components for uptime in aggressive environments.

• Electronics – Smaller but rising.

Thermal management and shielding components in 5G hardware turn to thin-wall aluminium and magnesium castings for weight savings.

By End-Use Industry

• Transportation – Largest contributor.

Automobiles, aircraft, and rail vehicles specify castings to reduce mass and assembly steps.

• Manufacturing – Versatile uptake.

Machine tool builders and automation OEMs require durable, dimensionally stable parts at medium volumes.

• Construction – Growing structural use.

Prefabricated connectors and façade elements benefit from iron and steel casting’s load-bearing capability.

• Healthcare – High-margin sector.

Custom implants and minimally invasive tools push foundries toward superior surface quality and traceability.

• Electronics – Precision thermal parts.

Miniaturised heat sinks and RF shields drive demand for fine-grain die cast alloys.

Industry Developments & Instances

• March 2025 – A leading Japanese foundry commissioned an AI-controlled vacuum investment line that cut defect rates by 28 %.

• December 2024 – A U.S. aerospace OEM signed a ten-year supply agreement for nickel superalloy turbine vanes valued above USD$ 600 million.

• July 2024 – European consortium launched a pilot project using green hydrogen to melt aluminium for precision casting, targeting net-zero certification.

• April 2024 – Indian start-up introduced cloud-based gating simulation software enabling small foundries to slash trial-and-error cycles.

Facts & Figures

• Aluminium and titanium together account for roughly 42 % of current material volume, up from 35 % five years ago.

• Digital twins reduce first-article approval time by nearly 20 % on average.

• Automated wax-recycling systems recover up to 95 % of pattern material, saving about USD$ 1.8 million annually per mid-size plant.

• Centrifugal casting of ductile-iron pipes exceeds 1.1 million tonnes globally each year.

• Advanced ceramic cores allow wall thickness as low as 0.5 mm in aerospace fuel nozzles.

Analyst Review & Recommendations

Market growth through 2032 will hinge on lightweight alloys, digital foundry investments, and sustainability credentials. Foundries that integrate real-time analytics with closed-loop wax and metal recycling will outpace peers on cost and carbon metrics. We recommend prioritising vacuum investment casting capacity for nickel and titanium, adopting AI-driven defect prediction, and forming regional partnerships to secure recycled feedstock and local certification pathways.