Market Overview

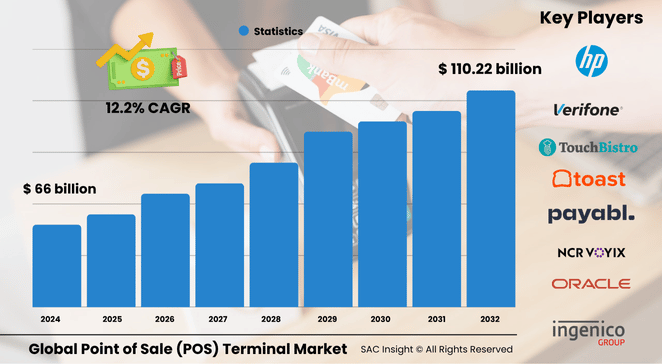

The Global point of sale (POS) terminal market was valued at US$ ≈66 billion in 2024 and is projected to reach at US$ 110.22 billion by 2032, expanding at 12.2% CAGR from 2025-2032. First-hand industry insights point to three structural tailwinds: surging demand for contact-free payments, rapid cloud migration that slashes upfront costs, and steady advances in AI-driven analytics that turn each checkout into a data node. SAC Insight market evaluation also shows volumes fully rebounding from pandemic-era disruptions, with device shipments now well above 2019 levels. The U.S. point of sale (POS) terminal market is forecast to top US$ 17.389 billion by 2032, reflecting brisk upgrades across grocery, quick-service, and fuel retail formats.

Summary of Market Trends & Drivers

• Mobile wallets, tap-to-phone, and QR code payments are shifting hardware mix toward lightweight mPOS and Android-based smart terminals.

• Cloud-native software suites that bundle inventory, loyalty, and AI-powered pricing are becoming the default choice for independent merchants.

• Governments in Asia-Pacific and Latin America are pushing cash-lite policies, accelerating terminal penetration in micro- and small-business segments.

Key Market Players

The report profiles global and regional point of sale (POS) terminal market leaders such as NCR Corp., Oracle, Toast, Block, Ingenico/Worldline, and a rising cohort of API-first challengers specializing in vertical SaaS for restaurants and specialty retail. Together, these firms set the competitive tempo through rapid product refreshes, aggressive subscription pricing, and strategic M&A aimed at folding payment processing into broader merchant-experience platforms. Emerging innovators in software-only “tap-to-pay” and AI-driven fraud detection are also mapped for competitive benchmarking.

Key Takeaways

• Point of sale (POS) terminal indsutry size (2024): ~US$ 66 billion

• Projected value (2032): ~US$ 110.22 billion at a 12.2% CAGR

• Asia-Pacific holds the largest market share (~33.5%) and posts the fastest gains.

• Fixed terminals still dominate revenue, but mPOS logs the highest unit market growth.

• Cloud deployment already accounts for >60% of new installs, up from <30% five years ago.

• AI-assisted dynamic pricing and real-time inventory sync are becoming must-have features in mid-market retail.

Market Dynamics

Drivers

• Explosive adoption of contactless and mobile payments, particularly among Gen Z and small merchants.

• Subscription-based, cloud POS that lowers total cost of ownership and speeds feature roll-outs.

• Government incentives for digital receipts and tax compliance in emerging economies.

Restraints

• Persistent data-security concerns and high-profile breach incidents that dent merchant confidence.

• Fragmented regulatory standards across regions, complicating global roll-outs for vendors.

Opportunities

• AI-powered upsell engines and personalized promotions delivered at checkout.

• SoftPOS (software-only) solutions that convert any NFC-enabled phone into a secure terminal, unlocking the long-tail of micro-businesses.

Challenges

• Intense price competition eroding margins for commodity hardware vendors.

• Short hardware refresh cycles creating e-waste and supply-chain complexity.

Regional Analysis

Asia-Pacific leads both revenue and unit installations in POS terminal market, thanks to pro-cashless policies, booming e-commerce, and domestic manufacturing scale. North America follows, buoyed by contactless adoption and omnichannel retail strategies, while Europe’s growth is anchored by stringent security standards and rapid Android migration.

• Asia-Pacific: Fastest CAGR (~9.5%); China and India drive mPOS roll-outs.

• North America: High per-store spending on analytics-rich software; strong upgrade cycle.

• Europe: Contactless ubiquity and EMV mandates sustain steady replacements.

• Latin America: Digital-wallet boom spurs first-time terminal adoption among SMEs.

• Middle East & Africa: Mobile-money ecosystems and tourism recovery underpin gradual uptake.

Segmentation Analysis

By Product

• Fixed Terminals – Reliability for high-volume lanes.

Large retailers and grocers favour fixed units for durability, integrated scanners, and multi-lane management, keeping this segment above 60% of global revenue.

• Mobile POS – Double-digit CAGR, portability edge.

mPOS lets staff transact anywhere in-store or curb-side, cutting queues and boosting table-turns in restaurants—key to its rapid share gains.

By Component

• Hardware – Core revenue engine.

Cash drawers, scanners, and touchscreen displays remain essential, especially in fixed setups where ruggedness and peripheral density matter.

• Software – Fastest-growing slice.

Cloud-native apps layer inventory, CRM, and AI analytics on top of payment acceptance, creating sticky subscription revenue.

• Services – Integration & support.

Managed services for security patches, compliance audits, and data analytics add recurring value for enterprise clients.

By Deployment

• Cloud – 10%+ CAGR.

Pay-as-you-go models appeal to cost-sensitive SMBs; real-time updates cut maintenance overhead.

• On-premise – Niche but critical.

Chosen by high-volume grocers and petrol chains needing local data control and custom integrations.

By End-User

• Retail (Supermarkets, Convenience, Specialty).

Omnichannel fulfilment and loyalty integration drive terminal upgrades.

• Restaurants (QSR, Casual, Fine-dine).

Tableside ordering and kitchen display sync shorten service times and raise spend per cover.

• Hospitality & Entertainment (Hotels, Cinemas, Casinos).

Unified guest-experience platforms embed POS with room management and ticketing.

• Healthcare & Others.

Pharmacies and clinics adopt terminals to streamline co-pays and patient record linkage.

By Operating System

• Windows/Linux – Familiarity & peripheral support.

Favoured in enterprise roll-outs needing custom drivers and legacy system hooks.

• Android – Leading growth curve.

Open ecosystem slashes hardware cost and speeds app innovation, propelling adoption in emerging markets.

• iOS – Premium niche.

Chosen by boutiques and high-end F&B outlets seeking seamless Apple-Pay integration and sleek form factors.

Industry Developments & Instances

• Jan 2024: A leading connectivity provider unveiled a resilient, cloud-ready platform showcased at NRF, promising “five-nines” uptime for multi-store chains.

• Sep 2023: A cannabis-focused vendor released a scalable POS 2.0 suite with compliance tools for age-restricted goods.

• Jun 2023: A fintech launched an omnichannel terminal that merges online and in-store payments on one device, boosting SMB adoption.

• May 2023: A global handset maker rolled out an Android workstation that bundles inventory, loyalty, and staff-roster modules.

• Mar 2023: A payment giant acquired a SoftPOS specialist, signalling acceleration toward phone-based acceptance.

Facts & Figures

• Contactless transactions accounted for >55% of global in-store card payments in 2024, up from 38% in 2021.

• Cloud deployments represent ≈62% of new POS installs, doubling since 2019.

• AI-driven dynamic pricing tools can lift average basket value by 4-6% for early adopters.

• Average terminal replacement cycle has shortened to 4.5 years, down from 6 years pre-pandemic.

• Asia-Pacific shipped over 25 million units in 2024, nearly half of global volume.

Analyst Review & Recommendations

SAC Insight evaluation confirms the POS terminal market is pivoting from pure payment hardware to data-centric merchant platforms. Vendors that pair sleek Android or SoftPOS form factors with cloud analytics, AI-driven fraud screening, and plug-and-play app marketplaces will outpace slower rivals. For new entrants, mobile-first bundles targeting micro-merchants in Asia and Latin America offer the quickest route to scale, while incumbents should double down on managed security services to offset hardware margin pressure and cement long-term trust.