Market Overview

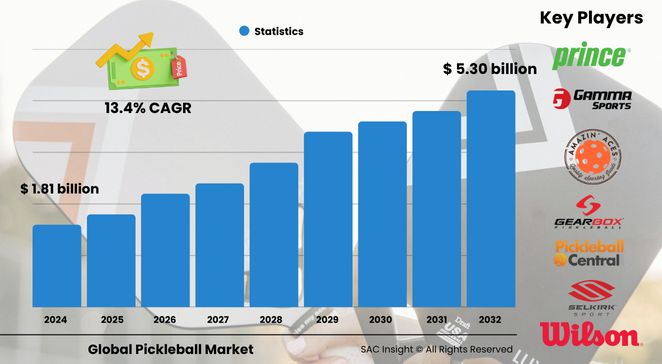

The global pickleball market size is valued at roughly US$ 1.813 billion in 2024 and is set to climb to about US$ 5.305 billion by 2032, expanding at an average 13.4 % CAGR. First-hand industry insights highlight three clear growth engines: a surge in recreational participation, rapid court construction, and brisk e-commerce adoption for Pickleball Equipment. SAC Insight’s deep market evaluation shows the United States pickleball market alone could advance from about US$ 449.8 million in 2024 to roughly US$ 1.26 billion by 2032 as community centers, private clubs, and retailers widen access.

Summary of Market Trends & Drivers

Social-media buzz, televised pro tours, and low-impact fitness appeal are propelling market growth across age brackets. Equipment innovation—especially lightweight, carbon-faced Pickleball Paddles—and direct-to-consumer sales are compressing replacement cycles and elevating average selling prices. At the same time, municipalities are repurposing under-used tennis and basketball courts, lifting demand for nets, lighting, and digital booking apps.

Key Market Players

Franklin Sports, Selkirk Sport, Paddletek, Onix Sports, Gamma Sports, Engage Pickleball, Amazin’ Aces, and Wilson Sporting Goods anchor the competitive landscape of the global pickleball market. Each brand focuses on performance-tuned Pickleball Paddles, proprietary core materials, and player-centric apparel lines to gain market share.

Smaller specialists such as Gearbox and ProLite push niche carbon-fiber designs, while large multinationals leverage omnichannel distribution. Continuous engagement through sponsored tournaments, tutorial content, and athlete endorsements strengthens brand stickiness and fuels recurring Pickleball Equipment revenue.

Key Takeaways

• Current global pickleball market value (2024): about USD$ 1.813 billion

• Projected global market value (2032): roughly USD$ 5.31 billion at a 13.4 % CAGR

• North America commands approximately 42.9 % market share on the back of 8.9 million core players

• Equipment holds the largest product-type slice at 41.5 %, led by high-end Pickleball Paddle upgrades

• Online channels generate more than 55 % of sales, highlighting digital’s role in market trends

• Men represent 51.7 % of end-user revenue, but women and youth cohorts are the fastest-rising segments

Market Dynamics

Drivers

• Broad appeal as a social, low-impact activity boosts participation from teens to retirees

• Continuous Pickleball Paddle R&D (thermo-regulated faces, AI swing tracking) enhances player experience

• Health-and-wellness culture positions pickleball as a fun cardiovascular option

Restraints

• Limited awareness in parts of Asia, Africa, and Latin America slows facility rollout

• Up-front investment for high-quality Pickleball Equipment may deter first-time players

• Court-noise complaints in dense neighborhoods can stall municipal approvals

Opportunities

• Converting idle tennis or warehouse space into dedicated clubs offers attractive ROI for operators

• Bundled lessons, leagues, and resort packages can deepen ancillary revenue streams

• Smart-court sensors and data-driven coaching apps open new SaaS monetization paths

Challenges

• Supply-chain volatility for composite materials raises cost pressure on premium paddles

• Lack of unified global governing body complicates rules harmonization and Olympic bid efforts

• Intensifying competition from startup brands heightens price transparency and squeezes margins

Regional Analysis

The North America pickleball market remains the demand epicenter thanks to established governing bodies, corporate sponsorships, and extensive media coverage. Asia-Pacific records the fastest percentage gain as Australia, China, and India invest in courts and school programs, while Europe’s adoption accelerates through Spain, the UK, and Germany.

• North America – Largest revenue base, mature retail networks, strong pro-tour calendar

• Europe – Rapid uptake via club conversions and wellness tourism in Mediterranean markets

• Asia-Pacific – Quickest CAGR driven by urban leisure spending and school sports initiatives

• Latin America – Early-stage market; resorts and expat communities act as beachheads

• Middle East & Africa – Nascent adoption, centered on expatriate compounds and multi-sport complexes

Segmentation Analysis

By Product Type

• Equipment – 41.5 % share, core revenue driver.

Paddles, balls, nets, and training aids form the backbone of Pickleball Equipment spending; frequent technological refreshes encourage repeat purchases.

• Apparel – 35.8 % share, style meets function.

Breathable, UV-protective tops, skorts, and compression sleeves cater to all-day play and rising female participation.

• Footwear – 22.7 % share, lateral-movement support.

Dedicated outsoles and reinforced toe-caps minimize slip risk and extend shoe life on textured acrylic and indoor wood courts.

By End User

• Men – Leading slice at 51.7 %.

Higher early-adopter numbers translate into robust paddle and shoe upgrades.

• Women – 33.2 % and climbing.

Targeted paddle weights, apparel cuts, and community leagues amplify engagement.

• Kids – 15.1 %, emerging.

Scaled-down paddles and starter kits integrate pickleball into physical-education curricula.

By Sales Channel

• Online Channel – 55.8 % share, convenience factor.

Brand websites and multi-sport platforms allow easy comparison shopping and quick delivery of Pickleball Equipment bundles.

• Offline Channel – 44.2 %, experiential edge.

Pro shops and specialty retailers offer demo days, swing analysis, and instant grip adjustments that nurture loyalty.

Industry Developments & Instances

• October 2024 – Los Alamos County partners with Pajarito Pickleball Club to add evening open-gym sessions.

• October 2024 – Chaifetz Group invests in The Picklr franchise network to accelerate indoor-club rollouts.

• June 2024 – Reebok debuts Nano Court, its first pickleball-specific shoe with enhanced lateral stability.

• May 2024 – Selkirk releases AMPED Pro Air paddle featuring FiberFlex+ fiberglass for extra pop.

• March 2024 – QVC launches live match broadcasts coupled with on-air paddle and apparel sales.

Facts & Figures

• Roughly 48.3 million Americans tried pickleball at least once in 2023.

• Core players average 47.5 years of age, yet 27.8 % fall in the 18–34 bracket.

• An average pickleball session elevates heart rate to about 143 bpm, supporting its cardio credentials.

• Over 300 million US$ was invested in new facilities worldwide during 2023.

• The International Federation of Pickleball now counts 58 member nations, up from 36 in 2021.

Analyst Review & Recommendations

SAC Insight's market analysis indicates a decisive shift toward data-enhanced play and lifestyle positioning. Brands that combine performance-driven Pickleball Paddle innovation with community-building programs will outpace average market growth. Facility owners should prioritize flexible court designs and digital reservation systems to maximize utilization, while retailers can bolster margins through curated gear bundles, subscription ball deliveries, and skill-level-based paddle trade-ins.