Market Overview

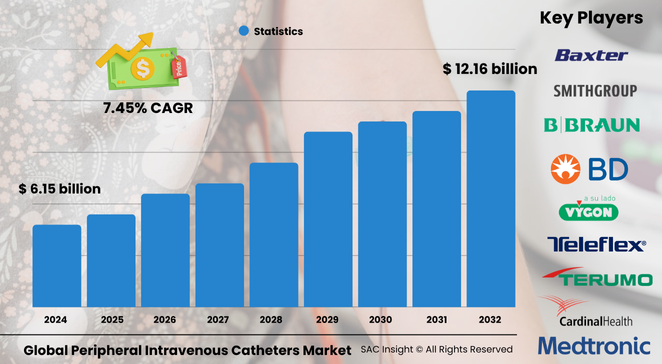

The global peripheral intravenous catheters market size stands at roughly US$ 6.15 billion in 2024 and is on track to almost double to about US$ 12.16 billion by 2032, translating to an average 7.45% CAGR over 2025-2032. SAC Insight's first-hand industry insights point to three clear growth engines: a steady shift toward outpatient and home infusion, rising adoption of safety-engineered catheters that cut needlestick risk, and broader use in chronic-disease management.

SAC Insight's deep market evaluation shows the United States peripheral intravenous catheters market alone could advance from about US$ 1.93 billion in 2024 to nearly US$ 3.49 billion by 2032 as hospitals, ambulatory centers, and home-health providers standardize closed systems for reliable vascular access.

Summary of Market Trends & Drivers

Demand is climbing as clinicians favor short peripheral IV access for rapid drug delivery, fluid resuscitation, and diagnostic imaging. Miniaturized designs, integrated valves, and needle-free connectors are improving dwell times and reducing complications, while payors increasingly reimburse at-home infusions that keep patients out of costlier inpatient beds.

Key Market Players

Industry leadership rests with a mix of multinational device makers and focused specialists. Companies such as Becton Dickinson, B. Braun Melsungen, ICU Medical, Boston Scientific, and Teleflex supply broad product portfolios spanning conventional and safety PIVCs, accessory sets, and vascular-access management programs. Alongside them, Terumo, AngioDynamics, and Lineus Medical emphasize incremental design tweaks—retractable needles, anti-reflux valves, or integrated stabilization—to capture niche clinical preferences.

Competitive dynamics increasingly revolve around needlestick-injury prevention and simplified blood-draw capability. Market share gains hinge on FDA-cleared innovations that shorten insertion time, lower occlusion rates, and integrate digital traceability, prompting frequent partnerships between catheter makers and health-IT vendors.

Key Takeaways

• Current global market size (2024): about USD$ 6.15 billion

• Projected global market size (2032): roughly USD$ 12.16 billion at a 7.45 % CAGR

• U.S. market expected to reach nearly USD$ 3.49 billion by 2032, supported by home-care reimbursement

• Safety PIVCs forecast to top USD$ 7.7 billion by 2032 as needlestick regulations tighten

• Short PIVCs already command more than half of product revenue thanks to ease of insertion

• Integrated closed systems and needle-free connectors are the fastest-growing technology niches

Market Dynamics

Drivers

• Growth in chronic-disease prevalence and chemotherapy sessions boosts recurring catheter demand

• Home-health expansion and payor cost-containment encourage at-home IV therapy adoption

• Occupational-safety mandates accelerate the switch from conventional to safety-engineered devices

Restraints

• High unit prices for advanced safety catheters burden budget-constrained facilities in emerging markets

• Insertion skill gaps in under-resourced settings raise phlebitis and infiltration rates, dampening acceptance

Opportunities

• Sensor-enabled catheters that signal early occlusion or infection offer new service revenue streams

• Training-as-a-service platforms can drive loyalty among outpatient clinics and home-nursing networks

Challenges

• Supply-chain disruption in medical-grade polymers and stainless steel can inflate lead times

• Growing antimicrobial-resistance concerns may trigger stricter coating-approval pathways, delaying launches

Regional Analysis

North America currently leads the market due to deep healthcare spending, stringent safety standards, and rapid uptake of integrated closed systems. Europe follows, buoyed by hospital modernization programs, while Asia-Pacific posts the quickest percentage gains as China and India scale surgical capacity and home-infusion services.

• North America – Largest revenue base; high penetration of safety PIVCs and home-health networks

• Europe – Steady market growth as hospitals upgrade to needle-free connectors and closed systems

• Asia-Pacific – Fastest CAGR thanks to rising surgical volumes and government spending on basic care

• Latin America – Expanding private hospitals and medical tourism stimulate catheter imports

• Middle East & Africa – Gradual uptake amid infrastructure upgrades and training initiatives

Segmentation Analysis

By Product

• Short PIVC – Workhorse of everyday care, dominant share.

Short catheters support quick infusions, imaging contrast delivery, and routine hydration, making them the default choice across emergency, pediatric, and outpatient settings.

• Integrated/Closed PIVC – Infection-control favorite, fast-growing.

These all-in-one sets combine catheter and extension tubing to minimize manipulations, lowering bloodstream infection risk and reducing line restarts.

By Technology

• Conventional PIVC – Budget option, declining share.

Standard open-hub designs remain prevalent in low-acuity wards but face gradual replacement where safety legislation is strict.

• Safety PIVC – Compliance engine, leading growth.

Built-in retractable needles or shielding mechanisms cut needlestick injuries, helping hospitals meet occupational-safety targets and avoid costly post-exposure testing.

By Lumen

• Single Lumen – Simplest and most common.

Ideal for single-drug infusions, hydration, or quick blood draws, offering cost-efficient access without extra complexity.

• Double Lumen – Versatile for concurrent therapies.

Allows simultaneous administration of incompatible drugs or rapid switch between medications, valued in critical-care and oncology units.

• Multi-Lumen – Specialized, higher ticket.

Supports complex regimens requiring multiple infusion channels, reducing the need for additional lines in intensive care or trauma settings.

By End-use

• Hospitals – Core demand engine.

High patient turnover and need for rapid vascular access keep hospitals the top buyer, especially for emergency and critical-care wards.

• Ambulatory Surgical Centers – Rising outpatient share.

Short-stay procedures rely on quick-insert, quick-remove catheters that support same-day discharge and lower infection risk.

• Home Care & Others – Emerging high-value stream.

Infusion pumps paired with closed catheters allow chronic-care patients to receive antibiotics, parenteral nutrition, or pain management at home, easing hospital-bed pressure.

Industry Developments & Instances

• November 2023 – BD launched PIVO Pro, a needle-free blood-draw device compatible with integrated peripheral catheters, aiming for a “one-stick hospital stay.”

• October 2023 – B. Braun expanded its Peripheral Advantage program to tackle health inequities and improve first-stick success.

• March 2022 – Shockwave Medical began global rollout of the M5+ peripheral IVL catheter following U.S. and EU approvals, trimming treatment time in large vessels.

• September 2020 – Philips debuted the QuickClear mechanical thrombectomy system, adding a compact option to its peripheral-vascular portfolio.

• Recent – Terumo advanced R&D on antimicrobial-coated catheters to curb catheter-related bloodstream infections.

Facts & Figures

• Short PIVCs generated roughly USD$ 3.6 billion in 2023 revenue, over 58 % of product sales.

• Safety-engineered catheters are expected to command more than 63 % market share by 2032 as regulations tighten.

• Integrated/closed systems can reduce catheter replacement frequency by up to 40 %, cutting consumable spend.

• U.S. hospitals perform more than 200 million peripheral IV insertions each year, underscoring volume potential.

• Home-infusion payors report up to 30 % cost savings versus inpatient therapy, reinforcing outpatient market growth.

Analyst Review & Recommendations

SAC Insight's market analysis indicates a decisive shift from open, single-use catheters toward closed, safety-engineered systems that support bundled vascular-access programs. Manufacturers that pair intuitive designs with training, digital traceability, and infection-control analytics will outpace average market growth. We recommend prioritizing needle-free connectors, antimicrobial coatings, and sensor-enabled occlusion alerts, while forging partnerships with home-health providers to capture the fast-expanding outpatient opportunity.