Market Overview

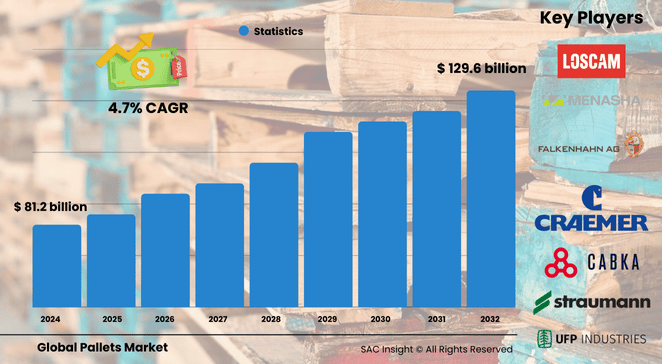

The global pallets market size is estimated at US$ 81.2 billion in 2024 and is projected to reach roughly US$ 129.6 billion by 2032, reflecting a steady 4.7% CAGR across the 2025-2032 forecast window. SAC Insight industry insights point to three structural engines of market growth: expanding e-commerce volumes that demand reliable unit-load handling, rising automation in warehouses that favors standardized pallet footprints, and growing awareness of circular packaging solutions that pair recycled wood or plastic with track-and-trace technologies.

SAC Insight's deep market analysis also shows a swift rebound from pandemic-era supply-chain disruptions, with shipment volumes back on their long-term trajectory. The U.S. pallets segment alone is on course to top US$ 37.34 billion by 2032 as retailers upgrade fleets to RFID-enabled and pooled platforms.

Summary of Market Trends & Drivers

• Accelerating e-commerce and omnichannel logistics are pushing pallet demand beyond pre-COVID levels, especially for lightweight, nestable plastics that cut reverse-logistics costs.

• Smart pallets with embedded RFID or IoT sensors are moving from pilot to scale, giving shippers granular visibility into humidity, impact, and temperature across the cold-chain.

• Brands are prioritizing low-carbon procurement; recycled composites and certified-sourced wood now command a noticeable premium in new purchasing contracts.

Key Market Players

The global pallets market landscape features both global pooling giants and regional specialists. Leaders such as Brambles, Loscam, PECO, Orbis, Cabka, Craemer, and PalletOne shape competitive dynamics with large rental networks, extensive repair loops, and continuous design upgrades. Meanwhile, mid-sized innovators like Falkenhahn and Schoeller Allibert are carving share through high-performance plastic formats and turnkey tracking ecosystems. Together, these players set the pace on sustainability targets, pallet durability standards, and digital add-ons that tilt total cost of ownership in their favor.

Key Takeaways

• Current market value (2024): approximately USD$ 81.2 billio

• Forecast value (2032): USD$ 129.6 billion at a 4.7 percent CAGR

• Asia-Pacific holds the largest regional market share, with wood and plastic usage rising sharply in cross-border trade corridors.

• Wood remains the volume leader, but plastic registers the fastest market growth on the back of hygiene, weight, and lifecycle advantages.

• Warehousing & transportation is the dominant application, while pharmaceuticals and food & beverage are pivoting quickly toward pooled, smart platforms.

• RFID-enabled pallets have shifted from niche to mainstream in fresh-produce and cold-chain lanes, improving asset turns and shrinkage control.

Market Dynamics

Drivers

• Explosion of e-commerce SKUs demanding rapid, small-lot fulfillment.

• Push for supply-chain transparency that favors pallets with sensor-ready decks.

• Sustainability commitments encouraging recycled and repairable units.

Restraints

• Volatile lumber prices in North America and Europe inflate wood pallet costs.

• Up-front capital for plastic or composite formats can deter small shippers.

• Inconsistent global standards complicate pallet interchangeability.

Opportunities

• Integration of IoT chips, GPS, and blockchain opens new value-added services such as real-time asset tracking and predictive maintenance.

• Emerging markets in Southeast Asia and Africa are ripe for pooled rental models that lower capex for fast-growing exporters.

• Advanced manufacturing (injection and thermoforming) enables lighter, custom pallets for automated storage and retrieval systems (AS/RS).

Challenges

• Tightening phytosanitary and safety regulations require strict compliance and documentation, especially for wood shipments.

• Circular-economy expectations put pressure on recyclability certifications and end-of-life collection infrastructure.

• Labor shortages in pallet repair and recovery networks threaten turnaround times.

Regional Analysis

Asia-Pacific dominates current market share thanks to its outsized manufacturing base and export-driven logistics networks. Rising intra-regional trade, especially between China, India, and ASEAN, sustains double-digit shipment growth. North America ranks second, buoyed by sophisticated pooling schemes and retailer mandates for RFID tags. Europe benefits from strict pallet-exchange standards and robust recycling channels, while Latin America and the Middle East & Africa show accelerating uptake as e-commerce penetration deepens.

• North America – High penetration of pooled rental programs and sensor-ready plastics

• Europe – Stringent standardization (EPAL/CP) and strong repair networks underpin adoption

• Asia-Pacific – Fastest volume growth; wood and plastic pallets support booming export corridors

• Latin America – Modernizing warehousing spurs demand for durable, stackable units

• Middle East & Africa – Logistics investments and waste-reduction initiatives drive incremental gains

Segmentation Analysis

By Material

• Wood – Cost-effective workhorse with ready repairability

Wood retains the lion’s share because it delivers a balance of strength, price, and established recycling channels, especially in grocery and construction trades.

• Plastic – Hygiene-centric and lightweight, fastest-growing category

Food processors, pharmaceuticals, and automated warehouses favor plastics for moisture resistance and dimensional consistency that aligns with robotic handling.

• Composite Wood – Hybrid strength and moisture resistance

Blended boards extend service life versus traditional softwood, making them attractive where climate swings are severe.

• Metal – Niche for heavy loads and corrosive environments

Aluminum and steel pallets carry extreme weights in chemical and automotive plants, despite higher upfront costs.

• Corrugated & Others – One-way export and air-freight solutions

Cardboard-based designs offer ultra-light, ISPM-15-exempt options for low-return lanes, trimming freight bills.

By Type

• Stackable – Dominant choice for closed-loop and racked storage

Interlocking blocks enable stable vertical stacking, maximizing cubic utilization in DCs.

• Rackable – Engineered for high-bay automation

Perimeter-base frames support heavy unit loads on open-beam racking, critical for AS/RS operations

• Nestable – Space-saving return logistics

Nine-leg designs nest together, slashing empty transport volume by up to 70 percent.

• Display – Retail-ready presentation pallets

Half- and quarter-sizes roll straight to store floor, cutting labor for merchandising fast-moving goods.

By Application

• Warehousing & Transportation – Core revenue engine

Large 3PLs and retailers drive bulk orders for standardized units that cycle rapidly through closed loops.

• Manufacturing – Growing automation fit

OEMs integrate dimensionally stable pallets into robotic lines, lowering downtime and product damage.

• Food & Beverage – Hygiene-critical segment

Moisture-proof plastics meet stringent HACCP guidelines and simplify wash-down routines.

• Pharmaceuticals – High-value, traceability-driven

Smart pallets ensure temperature integrity and chain-of-custody for sensitive therapeutics.

• Retail and Others – Flexibility and aesthetics

Display and half-pallets support in-store efficiency and impulse merchandising across big-box and convenience formats.

Industry Developments & Instances

• March 2023 – Craemer expanded UK capacity, trimming lead times and cutting import-related CO2 emissions.

• December 2022 – Millwood acquired Southworth Wood Products, boosting reach in southern Ohio’s manufacturing belt.

• September 2022 – Millwood purchased Austin Pallet, adding 30 employees and strengthening Texas coverage.

• September 2021 – Orbis rolled out a 44 × 56 inch Universal Container Pallet aimed at automotive supply chains.

• September 2020 – Orbis launched Odyssey heavy-duty rackable pallet rated at 2,800 lb in open-span racks.

Facts & Figures

• Approximately 5 billion pallets circulate globally each day; wood accounts for nearly 90 percent of those units.

• Smart pallets with RFID tags are expected to exceed 200 million active units worldwide by 2030.

• Switching from one-way wood to pooled plastic can cut carbon emissions by up to 30 percent over ten cycles.

• Automated warehouses demand pallets with dimensional tolerances within ±2 mm, twice as strict as conventional standards.

• Recycled content in new plastic pallets has climbed to an average of 35 percent, up from 20 percent five years ago.

Analyst Review & Recommendations

Momentum in the pallets market is shifting toward smarter, lighter, and more sustainable platforms. Vendors that pair rugged design with embedded intelligence stand to capture share as shippers demand real-time visibility and carbon savings. For incumbents, deepening repair networks and deploying predictive analytics on pallet condition will lift asset turns and customer retention. New entrants should target modular plastic ranges with high recycled content, especially for Asia-Pacific’s fast-scaling e-commerce hubs. Overall, disciplined capital allocation to pooled, tech-enabled fleets will separate leaders from laggards through 2032.