Market Overview

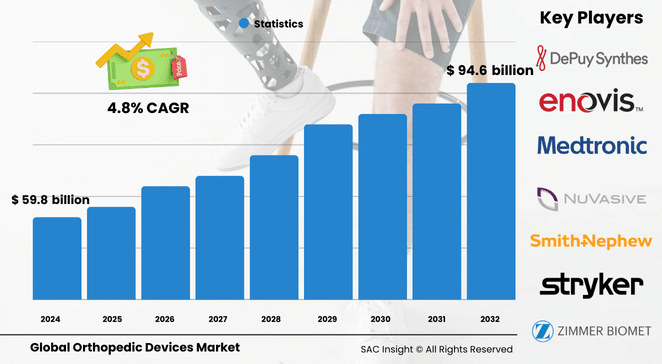

The global orthopedic devices market size was valued at roughly US$ 59.88 billion in 2024 and is on track to reach about US$ 94.06 billion by 2032, advancing at a 4.8% CAGR over the 2025-2032 forecast window. First-hand industry insights highlight four structural tailwinds: a rapidly aging population, rising sports and road traffic injuries, steady technology breakthroughs in robotics and 3D printing, and wider access to minimally invasive surgery.

SAC Insight's deep market evaluation shows procedure volumes already surpassing pre-pandemic levels, with hospitals regaining full surgical capacity. While exact figures for the U.S. orthopedic devices market projection were not detailed, North America collectively captured about a 50.17% market share in 2024.

Summary of Market Trends & Drivers

• Accelerated shift toward robot-assisted knee and hip replacements is boosting surgical precision and shortening recovery times.

• 3D-printed, patient-matched implants and AI-guided planning tools are moving from pilot to mainstream, supporting faster market growth across both mature and emerging economies.

• Strong demand for minimally invasive arthroscopy and trauma fixes among younger, active cohorts is widening the addressable patient base.

Key Market Players

Global competition is led by diversified giants that continuously refresh portfolios and pursue bolt-on acquisitions. Companies such as Stryker, Medtronic, Zimmer Biomet, DePuy Synthes, Smith & Nephew, and NuVasive dominate high-volume joint, spine, and trauma categories, while Enovis, CONMED, and Aesculap strengthen specialty niches through focused R&D. Their strategies range from expanding robot platforms and single-use instrumentation to rolling out orthobiologic materials that speed bone healing. In parallel, a nimble group of mid-sized innovators is carving out share with smart implants, bio-resorbable screws, and UV-treated surfaces that cut infection risk.

Key Takeaways

• Global market value (2024): USD$ 59.88 billion

• Projected value (2032): USD$ 94.06 billion at a 4.8% CAGR

• North America leads with just over half of global revenue, fueled by strong insurance coverage and high procedural intensity.

• Joint replacement/orthopedic implants hold the largest product slice at roughly 41.7% share.

• Robotics-enabled procedures now exceed 150,000 cases annually and are expanding double-digit each year.

• Orthobiologics and patient-specific implants are the fastest-growing niches, aided by heightened focus on quicker recovery and personalized care.

Market Dynamics

Drivers

• Rising incidence of osteoporosis, osteoarthritis, and obesity-linked musculoskeletal disorders worldwide.

• Growing acceptance of minimally invasive and robot-guided surgery that reduces hospital stay and complications.

• Expanding healthcare infrastructure and medical tourism in Asia-Pacific driving incremental demand.

Restraints

• High procedure and implant costs, especially in low- and middle-income countries.

• Post-surgical complications such as infection, thrombosis, and implant recalls temper patient confidence.

• Complex regulatory pathways and frequent updates raise time-to-market for novel devices.

Opportunities

• Surge in 3D printing opens doors for cost-efficient, bespoke implants.

• Biodegradable and antibacterial coatings create new revenue streams focused on infection control.

• Underserved emerging markets present scope for mid-priced, value-engineered product lines.

Challenges

• Pricing pressure from payers and group purchasing organizations in mature regions.

• Talent shortages in advanced orthopedic robotics and navigation systems slow widespread roll-out.

• Supply-chain constraints for specialty metals and medical-grade polymers.

Regional Analysis

The North America orthopedic devices market retains leadership thanks to robust reimbursement models, rapid uptake of smart implants, and strong presence of market incumbents. Europe follows, underpinned by high elective surgery rates and aging demographics. Asia-Pacific is the fastest-growing geography, propelled by rising middle-class incomes, expanding hospital networks, and government investment in medical tourism corridors.

• North America – High procedural volumes, technology early-adopter mindset, and favorable payment landscape.

• Europe – Strong public health spending and rapid adoption of next-gen arthroplasty and spine systems.

• Asia-Pacific – Double-digit gains anchored by China and India; local manufacturing incentives cut device costs.

• Latin America – Growing trauma caseloads and expanding private hospital chains drive steady uptake.

• Middle East & Africa – Gradual growth as premium care centers invest in advanced joint-replacement suites.

Segmentation Analysis

By Product

• Joint Replacement / Orthopedic Implants – Core revenue engine

Demand for knee, hip, and extremity implants keeps this segment in pole position, with robot-assisted procedures accelerating the shift toward personalized alignment and faster discharge.

• Spinal Devices – Resilient growth on degenerative spine burden

Fusion cages, pedicle screws, and emerging motion-preservation systems cater to the rising prevalence of lumbar and cervical disorders in both older and desk-bound populations.

• Trauma Devices – Essential plates, screws, and nails for fracture repair

Urbanization and road-traffic trauma sustain steady consumption, while bio-resorbable fixations gain traction for pediatric cases.

• Orthobiologics – Fastest-growing adjunct therapy

Products such as demineralized bone matrix and stem-cell-enriched grafts are increasingly bundled with hardware to enhance union and cut healing times.

• Arthroscopy & Sports Medicine – Minimally invasive favorite

Single-use shavers, suture anchors, and soft-tissue scaffolds see high uptake among athletic and weekend-warrior patients seeking rapid return to activity.

• Others – Niche instruments and accessories

Includes power tools, navigation sensors, and wearable rehab devices that support surgical efficiency and post-op recovery.

By End-Use

• Hospitals – Dominant care setting

Robust infrastructure, comprehensive imaging, and broader implant inventories position hospitals as the go-to venue for complex reconstruction and trauma cases.

• Outpatient Facilities – Rapidly scaling alternate site

Ambulatory surgery centers benefit from shorter wait times, lower costs, and rising insurer acceptance for same-day arthroplasty.

Industry Developments & Instances

• January 2024 – A leading U.S. group completed the acquisition of a European joint-replacement specialist to broaden its revision hip and knee portfolio.

• November 2023 – A major player launched an ultraviolet-treated dental implant surface designed to cut early infection risk and accelerate osseointegration.

• September 2023 – Roll-out of a miniature robot for bunion correction widened the scope of minimally invasive foot procedures.

• July 2023 – Launch of an autonomous imaging-guided navigation platform enhanced intra-operative accuracy for spine deformity correction.

• February 2023 – Introduction of bio-composite compression staples enabled metal-free fixation across midfoot and hindfoot fusion indications.

Facts & Figures

• Around 13,000 robot-assisted hip and knee replacements are performed each month worldwide.

• Global musculoskeletal disorder cases are projected to exceed 1 billion by 2050, more than doubling 2020 levels.

• Joint replacements in the U.S. surpass 1.2 million annually, with knee procedures accounting for nearly two-thirds.

• Children under 14 sustain roughly 3.5 million sports injuries each year, feeding demand for arthroscopy tools.

• Seven of the largest public orthopedic firms invested over USD$ 2.3 billion in R&D during 2019-2020, underscoring continuous innovation pressure.

Analyst Review & Recommendations

The orthopedic devices landscape is transitioning from commodity hardware to integrated, data-driven solutions. Vendors that combine implants with smart navigation, rapid 3D printing, and biologic accelerants will outpace peers on both outcomes and margin. For new entrants, mid-priced joint and trauma kits adapted for Asia-Pacific offer the quickest scale. Incumbents should double down on surgeon training and lifecycle service models to defend share amid tightening reimbursement and rising competition. Overall, market analysis suggests solid but disciplined market growth ahead, anchored by technology, demographics, and a widening focus on value-based care.