Market Overview

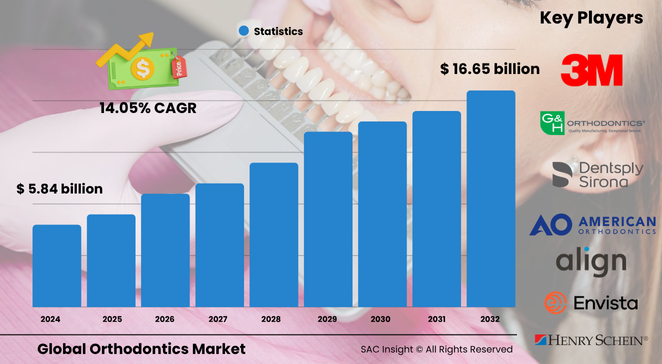

The global orthodontics market size is valued at roughly US$ 5.84 billion in 2024 and is projected to reach about US$ 16.65 billion by 2032, advancing at a solid 14.05% CAGR. This market growth rests on three clear pillars: rising demand for discreet tooth-alignment options, rapid digitalisation of treatment planning, and wider access to specialised dental care.

SAC Insight industry insights reveal that the U.S. orthodontics market could expand from about US$ 3.03 billion in 2024 to nearly US$ 8.64 billion by 2032 as adult patients and employer-backed dental benefits lift procedure volumes. SAC Insight's deep market evaluation confirms strong momentum across clear aligners, 3D-printed appliances, and chairside intra-oral scanning, signalling sustained market share gains for tech-forward suppliers.

Summary of Market Trends & Drivers

• Clear aligners, custom brackets, and 3D-printed retainers are reshaping consumer expectations around comfort and aesthetics.

• Artificial intelligence, cloud-based case management, and in-office 3D printing cut turnaround times and support personalised care.

• Growing social media influence on dental aesthetics, paired with higher disposable income in emerging economies, is accelerating treatment uptake.

Key Market Players

Industry leadership is anchored by a blend of established multinationals and nimble innovators. Clear-aligner pioneers continue to defend their market share through continuous software upgrades, while full-line manufacturers broaden portfolios with custom brackets, digital scanners, and treatment-planning platforms. Mid-tier companies focus on specialist instruments and anchorage devices, often partnering with digital workflow providers to expand reach in fast-growing Asia-Pacific and Latin America.

Key Takeaways

• Current global orthodontics market size (2024): US$ 5.84 billion

• Projected global market size (2032): US$ 16.65 billion at a 14.05 % CAGR

• U.S. market expected to approach US$ 8.64 billion by 2032, driven by adult patient demand and employer dental plans

• Supplies—particularly clear aligners—command the largest market share and continue to outpace instruments

• AI-guided diagnostics and chairside 3D printing are the standout market trends shaping competitive advantage

• Workforce shortages and high treatment costs remain the primary restraints on market expansion

Market Dynamics

Drivers

• Rising prevalence of malocclusion and heightened awareness of dental aesthetics

• Technological advances in aligner materials, digital imaging, and AI-powered treatment planning

• Expanded insurance coverage and flexible payment plans that improve affordability

Restraints

• High out-of-pocket costs for premium treatments in many countries

• Side-effects and discomfort associated with lengthy orthodontic procedures

• Limited orthodontic workforce in developing regions

Opportunities

• Direct-to-consumer aligner kits and teledentistry platforms that open new patient segments

• Partnerships between suppliers and dental chains to streamline end-to-end workflows

• Growing adult patient pool seeking cosmetic correction later in life

Challenges

• Regulatory hurdles and varying reimbursement rules across regions

• Ensuring treatment quality in mail-order aligner models

• Managing supply-chain complexity for customised, on-demand appliances

Regional Analysis

North America retains the largest revenue base thanks to high treatment awareness, robust insurance penetration, and rapid adoption of digital orthodontics. Europe follows, buoyed by strong public-health support and aesthetic-focused adult demand. Asia-Pacific posts the fastest CAGR as urban middle-class populations, especially in China and India, invest in cosmetic dentistry. Rest-of-world markets benefit from medical-tourism hubs and distributor partnerships.

• North America – mature reimbursement landscape and dense orthodontist network

• Europe – strong focus on aesthetics and public-health initiatives

• Asia-Pacific – highest market growth on back of expanding dental clinics and rising incomes

• Rest of World – emerging opportunities via cross-border dental tourism and distributor tie-ups

Segmentation Analysis

By Product Type

• Supplies – Core revenue engine.

Supplies cover both fixed and removable components, led by clear aligners that combine discretion with shorter chair time. Their soaring popularity, especially among adults, keeps this segment in front of instruments.

• Instruments – Stable but slower-growing.

Hand tools, pliers, and intra-oral scanners remain essential for clinical workflows. Digital scanners are gaining traction as practices modernise, supporting steady instrument demand.

By Supplies Breakdown

• Fixed – Brackets, Bands & Buccal Tubes, Archwires, Others.

Fixed systems still dominate teen cases and complex corrections, with custom 3D-printed brackets improving fit and comfort.

• Removable – Aligners, Retainers, Others.

Clear aligners and post-treatment retainers enjoy robust expansion as material science delivers thinner, stain-resistant trays.

By Age Group

• Adults – Fastest-growing cohort.

Adults now account for roughly one in four orthodontic patients, drawn by near-invisible aligners and flexible financing. Their willingness to pay for aesthetics propels premium product uptake.

• Teens – Traditional stronghold.

Early intervention remains common, particularly for bite issues. Wider adoption of custom brackets and intra-oral scanners streamlines teen treatment plans.

By End-user

• Dentist & Orthodontist Practices – Dominant channel.

Private clinics capture the bulk of case starts, aided by direct relationships with suppliers and manufacturer training programs that accelerate digital-workflow adoption.

• Others – Hospitals, multispecialty clinics, and teledentistry providers.

These settings benefit from broader referral networks, adding incremental volume and supporting rural access to orthodontic care.

Industry Developments & Instances

• November 2024 – A global foundation partnered with a leading research institute to accelerate innovation in digital orthodontics.

• August 2024 – Strategic collaboration formed to advance novel clear-aligner materials.

• July 2024 – Major scanner launch integrated cloud-based design tools for chairside 3D printing.

• January 2024 – Acquisition of a polymer-additive company to enhance in-house 3D-printing capabilities.

• December 2023 – Workflow-efficiency tie-up between a braces-on-demand platform and a digital-prescription software provider.

Facts & Figures

• Clear aligners already represent more than half of removable-supplies revenue in major markets.

• Adults comprise roughly 30 % of new case starts in key developed countries.

• Average treatment cost for traditional metal braces in the U.S. is about USD$ 6 000, while lingual systems can exceed USD$ 11 000.

• North America accounted for nearly 45 % of global market revenue in 2024.

• AI-supported treatment-planning tools can reduce chairside adjustment time by up to 20 %.

Analyst Review & Recommendations

Market analysis underscores a decisive shift toward digital, patient-centric care. Suppliers that integrate AI diagnostics, 3D printing, and cloud-based case management into a seamless workflow will capture outsized market share. Practices should invest in intra-oral scanning and aligner manufacturing partnerships to meet rising adult demand. Policymakers can accelerate adoption by expanding insurance coverage and supporting workforce training, ensuring the orthodontics market sustains double-digit growth through 2032.