Market Overview

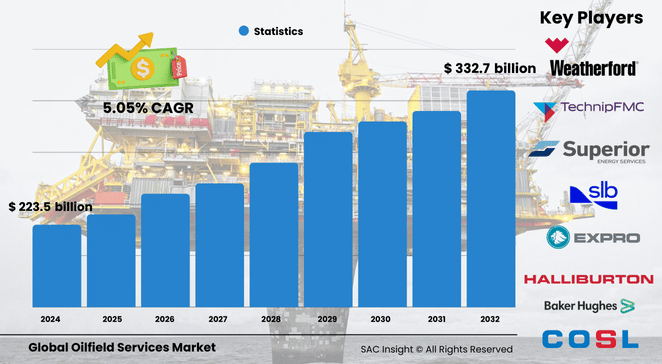

The global oilfield services market size is valued at approximately US$ 223.5 billion in 2024 and is projected to reach about US$ 332.79 billion by 2032, reflecting a solid 5.055% CAGR. First-hand industry insights highlight three structural growth levers: sustained shale and tight-oil activity, rising subsea investments that reopen complex offshore plays, and rapid technology adoption—from digital well planning to fit-for-purpose completion fluids—that lift recovery factors and compress costs. SAC Insight's deep market evaluation shows North America holding close to 35.01% market share, while the U.S. oilfield services market alone is on track to exceed US$ 111 billion by 2032 as exports of crude and LNG expand.

Summary of Market Trends and Drivers

• Operators are bundling drilling, completion, and production contracts, favoring integrated service models that lower well life-cycle costs.

• Novel seismic imaging, high-pressure hydraulic fracturing, and real-time downhole data are pushing market growth by unlocking marginal reservoirs and improving time-to-first-oil.

• Energy-transition pressures are steering capital toward lower-carbon barrels and carbon-capture-ready fields, fueling demand for advanced analytical and consulting services.

Key Market Players

The global oilfield services market leading participants include Baker Hughes, Halliburton, SLB, Weatherford, Superior Energy Services, NOV, China Oilfield Services Limited, Archer Oilfield Engineers, Expro Group, and TechnipFMC. These firms set the competitive tempo through continuous tool upgrades—think adaptive drill bits and simplified frac iron—as well as regional joint ventures that deepen local content and shorten supply chains. Their strategies revolve around fleet modernization, digital workflows, and selective M&A. For example, recent collaborations between large service houses and local operators in Latin America and the Middle East pair global process expertise with low-cost rig capability, protecting margins even as day-rates fluctuate.

Key Takeaways

• Global market value (2024): USD$ 223.5 billion.

• Projected value (2032): USD$ 332.79 billion at a 5.055% CAGR.

• North America commands about 35.01% market share, driven by shale productivity gains.

• Onshore operations account for roughly two-thirds of market revenue; offshore is the fastest-growing application.

• Workover & completion services hold just over 20% of service revenue thanks to widespread refracturing and enhanced-oil-recovery work.

• Integrated field operation contracts and real-time analytics are the key technology market trends shaping competitive advantage.

Market Dynamics

Drivers

• Persistent global energy demand combined with aging reservoirs boosts drilling, workover, and production optimization activity.

• Advanced drilling systems, automation, and AI-based asset monitoring cut non-productive time and accelerate market growth.

• Capital inflows into shale, deepwater pre-salt, and LNG backfill projects sustain a robust project pipeline through 2032.

Restraints

• Crude-price volatility discourages long-cycle investments and can trigger rapid rig-count declines.

• Skills shortages in complex subsea engineering and digital domain expertise slow execution schedules.

• Environmental regulations tighten flaring limits and water-handling standards, increasing compliance costs.

Opportunities

• Carbon-capture-ready well designs and geothermal repurposing create new revenue streams for service firms.

• Digital twins and edge analytics open premium advisory markets for real-time reservoir management.

• Consolidation among mid-tier players offers scope for accretive acquisitions and expanded tool portfolios.

Challenges

• High capital intensity of offshore campaigns leaves contractors exposed when day-rates soften.

• Supply-chain disruptions in specialty metals, proppants, and electronics inflate project costs and extend lead times.

• Geopolitical tensions can delay cross-border pipeline and LNG infrastructure that underpin service demand.

Regional Analysis

North America remains the reference market, benefiting from resilient shale economics, a deep service ecosystem, and aggressive LNG export build-outs. Europe follows, buoyed by Norway’s high-efficiency fields and renewed North Sea appraisal drilling, while Asia-Pacific posts the fastest growth on the back of Chinese and Indian exploration spend and early-stage carbon-capture pilots.

• North America – About 35.01% share; shale productivity gains and technology upgrades sustain activity.

• Europe – Offshore revitalization and stricter environmental standards spur demand for high-efficiency services.

• Asia-Pacific – Quickest CAGR as China, India, and Southeast Asia expand exploration and pilot CCS projects.

• Latin America – Deepwater Brazil and Guyana discoveries keep rigs busy; national content rules influence contract awards.

• Middle East & Africa – National oil companies increase brownfield rehabilitation and gas monetization projects.

Segmentation Analysis

By Application

• Onshore – Dominant revenue contributor

Onshore projects absorb around two-thirds of spending thanks to established infrastructure, lower breakevens, and intensive shale stimulation campaigns. Continuous pad drilling, high-horsepower fleets, and modular surface facilities keep costs competitive.

• Offshore – Fastest-growing slice

New deep- and ultra-deepwater discoveries plus tie-backs to existing hubs propel offshore demand. Operators favor high-capacity drillships, subsea processing, and remote operations centers to tame cost inflation and extend field life.

By Service

• Workover & Completion Services – Roughly 20% share

These services prosper as operators refracture legacy shale wells and deploy smart completion tools that boost recovery while shrinking water cut.

• Drilling Services – High share, tech-intensive

Directional drilling, managed-pressure systems, and drill-bit automation drive better rate of penetration and lower wellbore risk.

• Production Services – Steady demand

Artificial lift, well testing, and digital well surveillance keep legacy assets producing at target levels.

• Seismic and Subsea Services – Niche yet rising

High-resolution imaging and compact subsea boosting units support frontier exploration and marginal field tie-backs.

• Processing & Separation Services – Compliance-led growth

Produced-water treatment and gas-sweetening packages gain traction as emissions and water-recycling targets tighten.

By Type

• Field Operation – Leading share near 40%

Crewed rigs, intervention vessels, and production platforms require continuous services to keep operations safe and efficient.

• Equipment Rental – Capital-light option

Operators lease high-spec pressure-pumping spreads, logging tools, and workover rigs to stay flexible in volatile markets.

• Analytical & Consulting – Fastest CAGR

Data-rich reservoir modeling, carbon-intensity benchmarking, and investment optimization studies create a premium advisory niche.

Industry Developments and Instances

• March 2024 – Azad Engineering sealed a five-year precision-machining supply deal with a major global service firm, extending potential for three additional years.

• November 2023 – A leading service integrator partnered with a subsea specialist to streamline deepwater drilling equipment and reduce time-to-spud.

• June 2023 – A subsea production-system award for an Angolan infill project highlighted renewed momentum in brownfield life-extension work.

• April 2024 – Indigenous-owned drilling venture launched in Canada, signaling broader participation and local-content growth in North American projects.

Facts & Figures

• Onshore operations captured roughly 65.9% of global revenue in 2023.

• Workover & completion services accounted for just over 20% of total service spend in 2023.

• Average rig-count utilization climbed by nearly 15% between 2021 and 2024 as deferred projects restarted.

• Digital wellsite management can shave up to 25% off non-productive time, improving cash breakevens.

• Offshore contract backlog for high-spec drillships increased by more than USD$ 10 billion in the last 18 months, underscoring deepwater revival.

Analyst Review and Recommendations

Our market analysis indicates a decisive shift toward data-driven, integrated contracts that span drilling through late-life optimization. Service providers that pair hardware upgrades with real-time analytics and low-carbon solutions stand to outpace average market growth. We recommend prioritizing modular equipment that scales across onshore pads and subsea tie-backs, investing in talent for advanced reservoir characterization, and pursuing partnerships that widen regional reach without ballooning capital intensity.