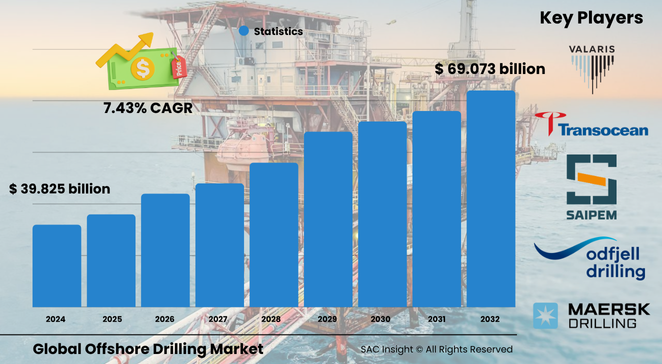

Market Overview

The global offshore drilling market size is valued at roughly US$ 39.825 billion in 2024 and is set to climb to about US$ 69.073 billion by 2032, expanding at an average 7.43% CAGR. SAC Insight's first-hand industry insights point to three growth engines: a rebound in exploration budgets after pandemic lows, steady improvements in deep-water well economics, and rising energy-security initiatives that encourage nations to tap domestic seabed reserves. SAC Insight's deep market evaluation shows the United States offshore drilling market alone could reach nearly US$ 3.75 billion by 2032, while Asia Pacific already commands the largest market share at roughly 45 % thanks to China, India, and Southeast Asia adding new acreage.

Summary of Market Trends & Drivers

• Operators are turning to unmanned wellhead platforms and remotely operated rigs to trim operating expenditures and boost safety.

• High crude prices and accelerated natural-gas demand support renewed multi-year drilling campaigns, lifting day-rates and rig utilization.

• Capital inflows into deep and ultra-deepwater plays are unlocking previously marginal reserves, strengthening long-term market growth.

Key Market Players

Global leadership rests with a mix of technically advanced contractors and regionally entrenched specialists. Transocean, Valaris, and Seadrill deploy high-spec drillships and harsh-environment semisubmersibles that dominate ultra-deepwater campaign awards. Saipem, Maersk Drilling, and Nabors complement this capability with strong jackup fleets for Middle East and Asia shallow-water hubs.

Competitive dynamics increasingly revolve around digital rig monitoring, life-cycle service contracts, and local content mandates. Firms such as COSL, Shelf Drilling, and Odfjell Drilling leverage cost-effective crews and region-specific know-how to win shorter-tenor charters, while integrated oilfield service providers form alliances to bundle drilling, well construction, and completion work.

Key Takeaways

• Current global market size (2024): about USD$ 39.825 billion

• Projected global market size (2032): roughly USD$ 69.073 billion at a 7.43 % CAGR

• Asia Pacific holds the dominant market share near 45 % and is expected to stay ahead through 2032

• Drillships capture the largest revenue slice in deep-water projects, but jackups remain the volume leader in shallow basins

• Unmanned platforms and dynamic-positioning systems are key technology trends reshaping project economics

• Deep-water wells now contribute more than one-third of new offshore volumes and continue to rise

Market Dynamics

Drivers

• Persistent global energy demand and high crude prices drive exploration capital toward untapped offshore basins.

• Advances in dynamic-positioning, managed-pressure drilling, and real-time analytics improve success rates and reduce non-productive time.

• Government incentives in Asia, Latin America, and the Middle East support local hydrocarbon development to cut import reliance.

Restraints

• Volatile oil pricing cycles make long-lead drilling programs financially risky, dampening steady rig utilization.

• Stringent net-zero targets and growth in electric-vehicle adoption temper long-term fossil-fuel demand expectations.

• Environmental compliance and decommissioning obligations inflate project costs.

Opportunities

• Digital twins and predictive-maintenance analytics extend rig life and lower downtime, opening premium service avenues.

• Carbon-capture-ready well designs and subsea tie-backs to floating LNG units create new revenue streams.

• Frontier basins off West Africa and the Eastern Mediterranean offer high-impact exploration upside.

Challenges

• Supply-chain bottlenecks for high-grade steel, pressure-control systems, and skilled personnel constrain rapid fleet expansion.

• Rising deep-water complexity pushes up capital intensity, exposing contractors when day-rates soften.

• Political instability and shifting fiscal terms in emerging regions complicate long-range investment planning.

Regional Analysis

Asia Pacific dominates current market analysis owing to strong domestic demand, supportive licensing rounds, and growing deep-water discoveries in China and India. Latin America posts the fastest percentage gains as Brazil, Mexico, and Guyana sanction pre-salt and shallow-water campaigns, while the Middle East leverages abundant jackup capacity to maintain brownfield production.

• North America – Mature infrastructure underpins steady growth; Gulf of Mexico ultra-deep developments regain momentum

• Europe – Harsh-environment rigs secure longer charters in Norway and the U.K. as operators optimise mature fields

• Asia Pacific – Largest market share driven by energy-security policies and technology adoption in deepwater South China Sea

• Latin America – Highest forecast CAGR on the back of Brazilian pre-salt and Mexican shallow-water infill programs

• Middle East & Africa – Robust jackup demand and new gas targets in the Red Sea and West Africa sustain utilisation

Segmentation Analysis

By Rig Type

• Drillships – Top revenue generator in deep and ultra-deepwater.

Their dynamic-positioning thrusters, high hook-load capacity, and advanced blowout preventers make drillships the preferred choice for wells beyond 1 500 metres. Operators value the ability to relocate quickly without costly mooring, cutting idle days during multi-well campaigns.

• Semisubmersibles – Resilient choice for harsh environments.

A deep draft and heave-compensation systems allow semisubmersibles to maintain station in rough seas, making them ideal for North Sea and Atlantic margin work where wave loading is severe.

• Jackups – Volume leader in shallow-water basins.

Jackups provide cost-effective drilling up to 120 metres water depth. Upgrades such as offline stand-building and high-pressure mud pumps lengthen their economic lifespan in the Middle East, Southeast Asia, and the U.S. Gulf shelf.

By Water Depth

• Shallow Water – Reliable workhorse segment.

Lower day-rates and existing pipeline infrastructure keep shallow-water wells attractive for infill drilling and late-life field extensions, supporting predictable cash flow for contractors.

• Deepwater – Fastest-growing slice.

Improved subsea processing, dual-gradient drilling, and modular floating production systems have cut break-even prices, spurring new projects between 500 and 1 500 metres depth.

• Ultra-Deepwater – Technology-intensive frontier.

Beyond 1 500 metres, wells demand high-spec drillships, high-pressure risers, and robust well control. Successful presalt exploits demonstrate the commercial viability of these reservoirs despite elevated capital outlays.

Industry Developments & Instances

• July 2022 – China commissioned its first fully unmanned offshore platform, slashing topside weight by two-thirds and proving remote-operated field concepts.

• April 2022 – Saipem secured twin five-year jackup contracts in the Middle East, highlighting long-term demand for modern rigs.

• March 2022 – Nabors invested in deep-geothermal drilling technology, signalling contractor diversification into low-carbon applications.

• January 2022 – Major EPCI award in Australia and Guyana for subsea umbilicals and flowlines underscored renewed capital spend in frontier regions.

• December 2021 – Petrobras set Brazil’s deepest exploration record at 7 700 metres, confirming appetite for ultra-deep targets.

Facts & Figures

• Drillship day-rates rose more than 25 % year-on-year between 2023 and 2024 as utilisation tightened.

• Asia Pacific accounted for about 16.7 billion in offshore drilling revenue in 2024.

• Deepwater and ultra-deepwater wells now make up over 35 % of new offshore discoveries worldwide.

• Unmanned wellhead platforms can cut life-cycle costs by up to 30 % compared with manned installations.

• Global upstream gas & LNG investment grew roughly 13.9 % in 2022, boosting offshore rig demand.

Analyst Review & Recommendations

Market analysis indicates a clear pivot toward automation, data-driven maintenance, and integrated service models that span exploration through abandonment. Contractors that pair high-spec fleets with predictive analytics and carbon-capture-ready designs are best positioned to outpace average market growth. Strategic focus on flexible contract structures, regional partnerships, and talent development in digital operations will help mitigate commodity-price swings and supply-chain pressure while capturing upcoming opportunities in deep-water gas and frontier oil provinces.