Market Overview

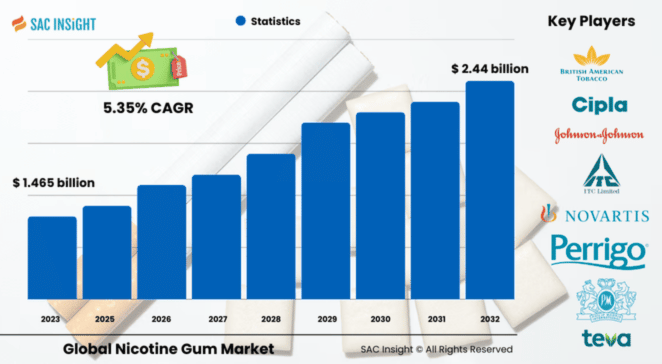

The nicotine gum market size is valued at roughly US$ 1.465 billion in 2024 and is on track to reach about US$ 2.44 billion by 2032, expanding at a 5.35 percent CAGR over 2023-2032. SAC Insight's deep market analysis shows three converging forces behind this steady market growth: intensifying anti-smoking regulations, rising consumer health awareness, and continuous product innovation ranging from long-lasting gums to flavor-rich formulations. The U.S. nicotine gum market alone is projected to top US$ 726.92 million by 2032 as health-conscious smokers seek medically endorsed cessation aids.

Summary Of Market Trends & Drivers

• Government-backed anti-smoking campaigns and reimbursement policies are nudging smokers toward nicotine replacement therapies, with gums viewed as the most familiar format.

• Product upgrades—ice-mint coatings, retro packaging, and higher-dosage 6 mg options—are keeping the category fresh and attracting younger quitters.

• E-commerce discounts and doorstep delivery are accelerating online adoption, widening global market reach beyond traditional pharmacies.

Key Takeaways

• Current nicotine gum market value (2024) about USD$ 1.465 billion

• Projected value (2032) roughly USD$ 2.44 billion at 5.35 percent CAGR

• North America leads with around 41 percent 2023 market share; Asia-Pacific is the fastest-growing region

• 2 mg gums dominate volume, while 4 mg and emerging 6 mg formats post the quickest unit gains among heavy smokers

• Pharmacies remain the top distribution channel, yet online sales show the sharpest climb

• M&A and flavor innovation dictate competitive momentum

Key Market Players

The global nicotine gum market leading the competitive field are diversified healthcare giants and specialist manufacturers that collectively command a significant market share. Well-established names such as Johnson & Johnson, Novartis Consumer Health, British American Tobacco, Philip Morris, and Cipla Health leverage broad distribution and ongoing R&D to retain customer loyalty. A second tier—including GlaxoSmithKline, Perrigo, Fertin Pharma, and fast-moving start-ups like blip—push market trends with dosage innovations and bold branding. Consolidation remains active; Philip Morris’ acquisition of Fertin Pharma exemplifies the race to build wider smoke-free portfolios.

Market Dynamics

Drivers

• Heightened public-health regulation and taxation on combustible tobacco push smokers toward nicotine gum as a lower-risk alternative.

• First-hand industry insights indicate that flavored, sugar-free gums boost adherence, increasing quit-success rates by more than 50 percent among motivated users.

Restraints

• Side effects such as jaw discomfort, hiccups, and mild gastrointestinal issues temper repeat purchases in a subset of consumers.

• Price sensitivity persists in low-income regions where generic patches or traditional cessation counseling cost less.

Opportunities

• Developing markets with tight smoking bans—India, China, and parts of Latin America—are opening new shelf space for flavored gums and value packs.

• Digital smoking-cessation apps that pair behavioral coaching with on-demand gum subscriptions can lift brand stickiness and recurring revenue.

Challenges

• Tightening advertising restrictions on nicotine products limit direct-to-consumer messaging, forcing companies to rely on slower clinician-led promotion.

• Counterfeit and gray-market gums sold online undermine brand trust and complicate regulatory compliance.

Regional Analysis

North America commands the largest share thanks to widespread health awareness, solid insurer support, and frequent product launches. Europe follows, buoyed by robust pharmacy networks and government-funded quit-programs. Asia-Pacific records the quickest market growth as stricter anti-smoking laws in Japan, India, and China spur demand for discreet, OTC solutions.

• North America – Strongest market size; innovation-driven consumer base and aggressive tax policies on cigarettes

• Europe – Stable demand with government-sponsored cessation services and pharmacy dominance

• Asia-Pacific – Fastest-growing; rising disposable income and stringent smoke-free legislation fuel uptake

• Latin America – Mid-single-digit growth; public health campaigns and expanding retail chains improve access

• Middle East & Africa – Early-stage market; urbanization and private-clinic recommendations stimulate gradual adoption

Segmentation Analysis

By Type

• 2 mg – Core volume driver

Designed for light to moderate smokers (fewer than 25 cigarettes daily), 2 mg gums capture the broadest audience because of easy availability and multiple flavor choices.

• 4 mg – High-dose relief for heavy smokers

Targeting users of 25 plus cigarettes per day, 4 mg gums deliver stronger nicotine doses to curb withdrawal, supporting consistent market growth.

• 6 mg – Emerging, niche yet fast-moving

The newest entrant offers an extra-strong option for highly dependent users and relapse-prevention programs, carving out rapid but small-scale traction.

By Distribution Channel

• Pharmacies – Trusted purchase point

Pharmacist guidance and bundled quit-kits keep pharmacies the prime channel, holding just under 40 percent of revenue.

• Supermarkets & Hypermarkets – Convenience with impulse appeal

Large-format retailers benefit from high foot traffic, especially for multi-pack promotions near checkout aisles.

• Online Stores – Fastest-rising channel

Competitive pricing, subscription models, and discreet home delivery are shifting consumer habits toward e-commerce, lifting double-digit online market share.

Industry Developments & Instances

• August 2023: Lifestyle brand blip launched peppermint-flavored 2 mg and 4 mg gums in CVS stores across the U.S., aiming at Gen Z smokers.

• July 2021: Philip Morris acquired Fertin Pharma for US$ 813 million, expanding its smoke-free portfolio into oral nicotine delivery.

• January 2020: Manitoba’s government partnered with a major pharmacy chain to provide free nicotine gum to registered quitters, boosting program enrollment.

• May 2019: A leading brand introduced ice-mint-coated gum, combining smoother texture with cooling sensation to improve user compliance.

Facts & Figures

• 2 mg gums represented about 56 percent of global revenue in 2022.

• Pharmacies accounted for roughly 38 percent of sales, yet online channels are growing at nearly 6.9 percent CAGR.

• North America held 41 percent market share in 2023.

• Asia-Pacific expected CAGR through 2030: around 6.5 percent.

• Heavy smokers using 4 mg gums show a 25 percent higher quit-success rate than patch-only regimens.

Analyst Review & Recommendations

A clear shift toward health-conscious lifestyles and supportive policy environments is sustaining nicotine gum market growth. Brands that pair higher-dosage offerings and engaging flavors with digital coaching platforms are likely to outpace competitors. Strategic focus on emerging markets—where smoke-free legislation and smartphone penetration converge—will prove pivotal for long-term expansion, while vigilance against counterfeit products remains essential to protect consumer trust and maintain market share.