Market Overview

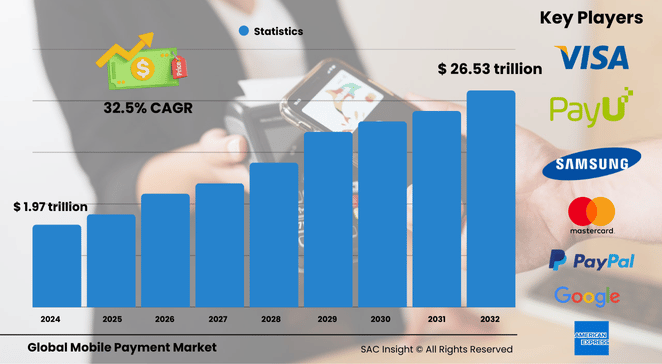

The global mobile payment market size was valued at roughly US$ 1.97 trillion in 2024 and is projected to surge to US$ 26.53 trillion by 2032, reflecting a powerful 32.5% CAGR during the 2025-2032 forecast window. First-hand industry insights point to several structural tailwinds: the global shift from cash to digital wallets, real-time rails such as UPI and FedNow, and central bank digital-currency pilots that normalize app-based spending.

SAC Insight's deep market evaluation also highlights m-commerce’s rapid climb—especially among Gen Z shoppers—and the steady expansion of merchant acceptance networks that now cover everything from street vendors to luxury retailers. The U.S. mobile payment market is expected to cross the US$ 5 trillion mark by 2032 as loyalty-linked tap-to-pay and embedded finance gain scale. Asia Pacific holds the largest market share today at about 35.4%, fueled by QR codes and super-apps.

Summary of Market Trends & Drivers

• Contactless convenience has shifted from “nice to have” to table-stakes, pushing banks and fintechs to embed NFC and QR options in every wallet.

• Sound-wave and tokenized offline modes are emerging to serve feature-phone users and regions with patchy coverage, widening financial inclusion.

• Reward economies—cash-back, micro-credit, and pay-later perks—are intensifying user stickiness and enlarging the addressable base.

Key Market Players

Global competition is led by wallet giants and network innovators that combine scale with continuous feature roll-outs. Brands such as Google Pay, Alipay, Amazon Pay, Apple Pay, PayPal, WeChat Pay, Samsung Pay, Visa, and MasterCard drive technology standards, merchant tie-ups, and high-frequency consumer engagement. Their playbook blends in-house engineering for security layers with strategic alliances—ranging from telecom operators in Africa to ride-hailing apps in Southeast Asia—to deepen reach and accelerate market growth.

Key Takeaways

• Market value 2024: USD$ 1.97 trillion.

• Projected value 2032: USD$ 26.53 trillion at a 32.5% CAGR.

• Asia Pacific commands the leading regional slice at 35%+, while North America posts the highest average ticket size.

• Mobile web payment accounts for around 24% of 2024 revenue; NFC is the fastest-rising technology segment.

• B2B transactions top current volume, but B2C wallets show the quickest uptake thanks to subscriptions and micro-credit.

• Remote payments dominate by value, yet proximity payments clock the sharpest CAGR on the back of contactless POS upgrades.

Market Dynamics

Drivers

• Smartphone ubiquity, 5G rollout, and cheap mobile data make app-based checkout effortless.

• Government pushes for cash-light economies and digital public infrastructure streamline onboarding and interoperability.

• Merchant demand for lower interchange and richer customer data encourages direct-to-wallet billing.

Restraints

• Persistent security concerns over identity theft and data breaches moderate adoption among late movers.

• Fragmented technical standards add complexity for cross-border acceptance and raise integration costs.

Opportunities

• Central bank digital currencies can ride on existing wallet rails, opening new payment corridors.

• Wearable and IoT-embedded payments create fresh touchpoints—from smart rings to in-car dashboards.

Challenges

• Regulatory scrutiny on fees and data privacy may compress margins for intermediaries.

• Uneven internet penetration in rural pockets slows full replacement of cash.

Regional Analysis

Asia Pacific sets the pace, propelled by super-app ecosystems, real-time QR frameworks, and supportive policy mandates. North America follows with high transaction values and rapid fintech-bank collaborations, while Europe accelerates through open-banking APIs and declining cash usage. Emerging markets in Latin America, the Middle East, and Africa are catching up as telco wallets and low-cost smart-POS devices proliferate.

• Asia Pacific – QR dominance, super-app integration, fastest user expansion.

• North America – Large baskets, strong loyalty programs, early wearable uptake.

• Europe – Open banking, SEPA Instant, tourism-linked wallet spend.

• Latin America – Telco-led wallets, booming e-commerce, rising fintech investment.

• Middle East & Africa – Government e-wallets, remittance corridors, feature-phone solutions.

Segmentation Analysis

By Technology

• Mobile Web Payment – Roughly 24% share, trusted for browser-based checkout.

Mobile web payments thrive on bookmarked URLs and seamless cart hand-off, making them the default for e-tailers and social-commerce links.

• Near Field Communication (NFC) – Highest CAGR, loyalty integration.

NFC’s tap-and-go ease plus instant coupon redemption elevate in-store engagement, spurring rapid merchant deployment of NFC-enabled terminals.

• Sound-Wave, SMS, IVR, and Others – Inclusion-driven alternatives.

These offline or low-bandwidth methods bridge the gap for basic-phone owners and regions with intermittent connectivity, widening overall market reach.

By Payment Type

• B2B – Largest current revenue slice.

Enterprises embrace mobile invoicing and supplier payments for speed and audit trail clarity, especially in logistics, media buying, and gig platforms.

• B2C – Fastest growth trajectory.

Consumers flock to wallets for subscriptions, ride-sharing, and micro-insurance, buoyed by cash-back and buy-now-pay-later options.

• B2G and Others – Niche but rising.

Tax collections, fines, and government benefits are steadily migrating to mobile rails, boosting transparency and reducing leakages.

By Location

• Remote Payments – Majority share.

Online shopping, bill pay, and super-app ecosystems anchor remote volume, enlarged by real-time ACH alternatives that settle instantly.

• Proximity Payments – Steepest CAGR.

Upgraded POS networks, dynamic QR codes, and tap-on-phone technology drive in-store acceptance, shrinking checkout queues and operating costs.

By End Use

• BFSI – Revenue leader.

Banks deploy white-label wallets and instant loan disbursals, using transaction data to cross-sell wealth and insurance products.

• Retail & E-commerce – Fastest expansion.

Quick-commerce, social shopping, and in-app checkout fuel relentless volume increases, pressing merchants to integrate multiple wallets.

• Healthcare, Transportation, Media & Entertainment, IT & Telecom, Others – Steady adopters.

From hospital bill settlement to transit fare capping, sector-specific use cases reinforce everyday relevance and habitual wallet use.

Industry Developments & Instances

• Aug 2024 – A leading Asia-Pacific payments firm partnered with an Australasian acquirer to enable frictionless mobile acceptance for inbound tourists.

• Nov 2023 – A major European bank rolled out a generative-AI powered virtual assistant to streamline wallet customer support.

• Feb 2023 – A global card network teamed with an African agritech operator to embed wallet rails for nine million farmers.

• Jan 2023 – A top super-app expanded QR acceptance for foreign visitors, enhancing cross-border spend capture.

• Sep 2022 – Three Nordic wallets merged, creating a single regional super-wallet targeting 11 million users.

• Aug 2022 – A leading U.S. issuer launched a global pay platform offering multi-currency B2B transfers through one mobile interface.

Facts & Figures

• Over 79% of consumers used contactless payments at least once in the past year.

• UPI transactions surpassed 12 billion monthly in India by late 2024.

• NFC-enabled smartphones exceed 4 billion units worldwide.

• Average POS transaction time drops by up to 50% when moving from chip-and-PIN to tap-to-pay.

• Digital-wallet reward redemptions grew 60% year-over-year, underpinning retention rates above 90%.

Analyst Review & Recommendations

Mobile payment adoption is no longer a question of “if” but “how fast.” Players that fuse rock-solid security with frictionless UX, embed loyalty seamlessly, and support offline modes will capture disproportionate wallet share. Strategic priorities should include tokenization at scale, AI-driven fraud mitigation, and adaptive fee models that satisfy regulators while protecting margins. With real-time rails maturing and central-bank digital currencies on the horizon, the market outlook remains strongly positive, backed by double-digit user growth and accelerating average spend per user.