Market Overview

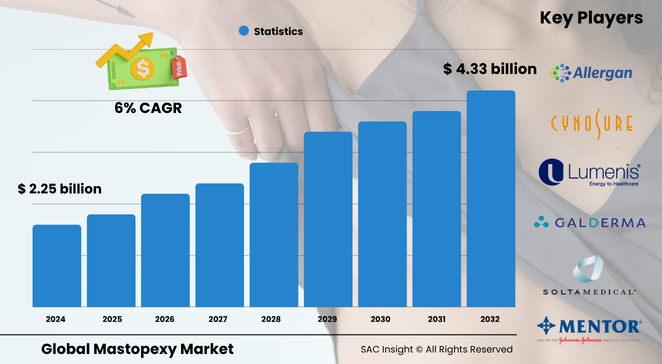

The global mastopexy market size was estimated at about US$ 2.25 billion in 2021 and is projected to approach US$ 4.33 billion by 2032, reflecting an average 6.0% CAGR through the 2025-2032 forecast window. SAC Insight's deep market evaluation points to three catalysts: growing demand for age-defying aesthetics, rapid adoption of energy-based surgical devices that cut theatre time, and a rebound in cross-border cosmetic procedures as travel restrictions ease. Within this landscape, the United States mastopexy market alone is expected to rise from roughly U$ 0.81 billion in 2024 to close to US$ 1.29 billion by 2032 as same-day breast-lift packages gain traction.

Summary of Market Trends & Drivers

• Energy-assisted scalpels, barbed sutures, and 3-D simulation software are shortening operative time and improving predictability, fuelling procedure counts.

• Shifting social norms and influencer-led awareness campaigns are normalising cosmetic surgery, particularly among women aged 30-54—the cohort that already accounts for two-thirds of breast lifts.

• Growing medical-tourism hubs in Thailand, Mexico, and India bundle hotel stays with board-certified care, expanding the addressable patient pool.

Key Market Players

Market analysis shows competition led by a blend of diversified healthcare firms and focused aesthetic specialists. Established names such as Allergan (now part of a larger pharma group), Mentor Worldwide, Galderma, and Cynosure command significant market share thanks to broad implant portfolios, strong surgeon training programmes, and consistent marketing spend. Rising challengers—including GC Aesthetics, Sientra, Lipoelastic, and Polytech Health & Aesthetics—differentiate through lightweight meshes, scar-minimising compression garments, and novel silicone gel formulations. Equipment innovators like Lumenis and Hologic contribute laser platforms and radio-frequency probes that integrate seamlessly into lift-and-augment procedures, underscoring the market’s technology-driven dynamic.

Key Takeaways

• Current global mastopexy market size (2021): about USD$ 2.25 billion

• Forecast global market size (2032): roughly USD$ 4.33 billion at 6.0 % CAGR

• U.S. mastopexy revenue could climb from nearly USD$ 0.81 billion (2024) to around USD$ 1.29 billion (2032)

• Full mastopexy remains the volume leader, while the Lollipop technique posts the fastest growth as patients seek balanced results with fewer scars

• Specialty clinics already capture more than 65 % of revenue and will widen their lead as outpatient anaesthesia protocols mature

• Energy-based devices and 3-D visualisation tools are reshaping pre-operative planning and intra-operative precision

Market Dynamics

Drivers

• Rising female workforce participation and disposable income increase willingness to invest in body-contouring procedures.

• Continuous device innovation—laser scalpels, plasma pens, robotic arms—improves outcomes and lowers complication rates, accelerating market growth.

• Insurance coverage for post-mastectomy reconstruction indirectly supports stand-alone lifts by expanding surgeon expertise.

Restraints

• High treatment cost—often between USD$ 9 000 and USD$ 16 000—limits uptake in price-sensitive segments.

• Post-surgical risks such as infection, delayed wound healing, and sensory changes deter a subset of potential patients.

Opportunities

• Bundled lift-with-augmentation packages meet demand for shape and volume correction in a single sitting.

• Customisable compression garments and regenerative tissue meshes open cross-selling potential for device and consumable vendors.

Challenges

• Regulatory scrutiny on marketing claims and implant safety raises compliance costs.

• Skilled-surgeon shortages in rural and emerging markets constrain service capacity.

Regional Analysis

North America currently leads on revenue, driven by high patient awareness, a dense network of board-certified plastic surgeons, and premium pricing. Europe follows, buoyed by rising aesthetic consciousness and supportive reimbursement pathways for post-oncology reconstruction. Asia-Pacific is the fastest-growing region as urban middle-class populations expand and medical-tourism corridors mature.

• North America – Largest revenue base; high procedure volumes and technology adoption sustain leadership.

• Europe – Robust demand, especially in Germany, France, and Italy, where ageing demographics and cosmetic culture intersect.

• Asia-Pacific – Quickest CAGR; medical tourism in Thailand and rising incomes in China and India spur double-digit procedure growth.

• Latin America – Brazil and Mexico nurture sizeable domestic and inbound markets on the back of skilled low-cost surgeons.

• Middle East & Africa – Niche yet expanding as private clinics in the UAE and South Africa market minimally invasive options.

Segmentation Analysis

By Technique

• Full Mastopexy – Cornerstone of revenue, addressing advanced ptosis.

Full lifts remove excess skin and reposition tissue for a dramatic reshape, making them the go-to for women with significant sagging, especially post-pregnancy or weight loss.

• Lollipop (Benelli-Lollipop) – Fastest-growing, balances contour with limited scarring.

A vertical incision around and below the areola removes a modest skin envelope, appealing to patients seeking mid-level correction without anchor-style scars.

• Anchor Breast Lift – Preferred for major reshaping when combined with reduction or implant removal.

The inverted-T incision grants surgeons maximal access to excise redundant tissue and tighten the breast base, albeit at the cost of longer scars.

• Benelli (Donut) Lift – Popular for mild ptosis and areolar resizing.

A circular incision confines scarring to the areolar border, ideal for younger patients needing subtle elevation.

• Crescent Lift – Niche option for minimal elevation.

A half-moon cut above the areola offers discreet lifting in minor asymmetry corrections or implant-only augmentations.

By End-use

• Specialty Clinics – Hold the lion’s share and post the steepest growth.

Dedicated aesthetic centres offer shorter wait times, tailored financing, and spa-like recovery suites, aligning with patient expectations for privacy and convenience.

• Hospitals – Stable but slower-growing segment.

Large hospitals focus on complex reconstructions and high-risk patients, leveraging multidisciplinary teams yet facing higher overheads and scheduling constraints.

Industry Developments & Instances

• March 2025 – A major laser-device maker launched an AI-guided skin-tightening platform that reduces mastopexy operating time by up to 20 %.

• January 2025 – A global implant supplier introduced a lightweight silicone matrix designed to support breast-lift longevity, expanding its consumables roster.

• September 2024 – A leading specialty-clinic chain partnered with a travel agency to bundle surgery-plus-resort packages in Thailand, signalling renewed medical-tourism momentum.

• June 2024 – An insurance provider in Germany added limited mastopexy coverage for post-bariatric patients, expanding the reimbursable pool.

• May 2024 – A compression-garment start-up secured series-A funding to develop smart fabrics that monitor post-operative swelling and temperature.

Facts & Figures

• Women aged 40-54 account for roughly 40 % of global breast-lift procedures.

• Specialty clinics perform more than 65 % of total mastopexies worldwide.

• Energy-based surgical tools can cut average theatre time from 150 minutes to under 120 minutes.

• Post-operative complication rates have fallen below 5 % in accredited facilities, down from over 7 % five years ago.

• Silicone implants remain the choice in over 80 % of augmentation-with-lift cases.

Analyst Review & Recommendations

SAC Insight's first-hand industry insights confirm mastopexy’s steady transition from a hospital-based operation to an outpatient service line driven by device upgrades and consumer confidence. Providers that blend 3-D imaging consultations, minimally invasive techniques, and bundled aftercare will outpace average market growth. Vendors should focus on training programmes that shorten the proficiency curve for vertical lifts and anchor lifts while expanding accessory lines—meshes, smart garments, topical scar therapies—to capture recurring revenue across the patient journey.