Market Overview

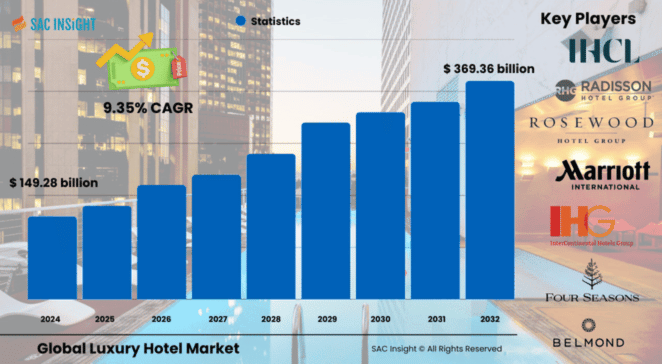

The luxury hotel market size was valued at US$ 149.28 billion in 2024 and is projected to reach roughly US$ 369.36 billion by 2032, registering steady market growth at a 9.35% CAGR throughout the 2025-2032 forecast window. This market analysis highlights several structural tailwinds: an expanding global base of affluent travellers, the rise of experience-led stays for milestone events, and a sharp pivot toward eco-luxury properties that balance indulgence with sustainability. First-hand industry insights show average stays climbing to 7.6 nights and investment yields topping 6% as owners capitalize on premium room rates and diversified food-and-beverage offerings.

In the United States luxury hotel market alone, market share translates into an estimated US$ 103.87 billion opportunity by 2032 as domestic leisure and corporate demand remains resilient.

Summary of Market Trends & Drivers

• Immersive wellness retreats, destination weddings, and "bleisure" extensions are fuelling double-digit occupancy gains at high-end resorts and spas.

• Direct digital booking, supported by mobile concierge apps and dynamic personalization, is squeezing intermediaries while deepening guest loyalty.

• Sustainability has become a baseline expectation: carbon-neutral construction, on-site renewables, and local sourcing now underpin competitive differentiation.

Key Market Players

Global brands such as Marriott International, Hilton Hotels & Resorts, Hyatt Hotels Corporation, Accor, InterContinental Hotels Group, and Four Seasons collectively shape pricing discipline, loyalty-program reach, and multi-continent pipelines. Their scale advantages allow them to roll out contact-free check-in, data-driven revenue management, and soft-brand collections that bring independent flair under a corporate umbrella.

Alongside these giants, specialist operators including Aman, Six Senses, Bulgari, Soneva, Mandarin Oriental, Rosewood, and select lifestyle portfolios capture premium ADRs by curating deeply localized design, high staff-to-guest ratios, and signature wellness concepts. Their strong brand equity attracts sovereign wealth funds and private equity eager for stable, experience-based yields.

Key Takeaways

• The global luxury hotel market value (2024): US$ 149.28 billion

• Projected value (2032): US$ 369.36 billion at a 9.35% CAGR

• North America leads with 32.23% market share, while Asia-Pacific shows the fastest regional CAGR at 8.6% through 2032.

• Chain hotels captured roughly 65% of global revenue in 2024; independent boutiques remain the growth engine at more than 8% annualized.

• Direct booking accounts for 42% of high-end room revenue, reflecting travellers' preference for personalized add-ons and flexible upgrades.

• Wellness-centred resorts and spas are projected to outpace traditional holiday hotels, supported by demand for holistic health programs and eco-design.

Market Dynamics

Drivers

• Rising disposable incomes and a growing cohort of high-net-worth individuals prioritizing premium travel experiences

• Corporate retreats and strategy off-sites boosting demand for secure, tech-enabled business hotels

• Rapid expansion of lifestyle-oriented soft brands that marry local authenticity with loyalty benefits

Restraints

• Price-sensitive travellers shifting to upscale vacation rentals and peer-to-peer lodging platforms

• Geopolitical uncertainties and fluctuating visa regulations discouraging cross-border leisure travel in some regions

Opportunities

• Green building certifications, regenerative tourism models, and circular-economy practices that align luxury with planet-positive goals

• Bundled "work-from-anywhere" packages combining extended stays, co-working spaces, and family-friendly amenities

Challenges

• Talent shortages in culinary, spa, and guest-services roles driving wage inflation

• Heightened cybersecurity risks as hotels collect larger volumes of personal guest data through mobile apps and smart-room systems

Regional Analysis

North America retains the largest slice of global revenue thanks to high domestic travel spend, strong corporate demand, and robust asset-repositioning pipelines in gateway cities. Europe's heritage properties and Michelin partnerships keep ADRs elevated, while Asia-Pacific delivers the fastest market growth on the back of rising intra-regional tourism and luxury-friendly infrastructure projects.

• North America – resilient premium leisure demand, strong loyalty-program penetration

• Europe – heritage refurbishments and culinary prestige sustaining occupancy

• Asia-Pacific – double-digit pipeline growth and surging domestic high-end tourism

• Middle East & Africa – flagship openings aligned with mega-events and ultra-luxury desert resorts

• Latin America – upscale coastal developments benefiting from currency-driven inbound travel

Segmentation Analysis

By Category

• Chain – Broad reach and diversified brand ladders

Global chains leverage economies of scale, unified loyalty platforms, and hub-and-spoke expansion strategies to maintain dominant revenue share and consistent guest expectations.

• Independent – High-touch, place-specific experiences

Boutique and independently managed properties win loyalty through bespoke design, cultural immersion, and flexible service ethos, appealing to travellers seeking originality over standardization.

By Type

• Business Hotels – Secure, tech-forward spaces for executives

These properties integrate discrete check-in, in-suite work zones, and hybrid meeting technology, capturing roughly one-third of luxury room revenue.

• Airport Hotels – Convenience-driven transit hubs

Premium airport properties blend fast check-out, soundproof rooms, and spa amenities, catering to time-sensitive travellers and airline crews.

• Holiday Hotels – Leisure-focused city or beach stays

Located in tourism hot spots, they combine destination-led experiences with family-friendly offerings, anchoring the off-season demand curve.

• Resorts & Spa – Immersive wellness and destination retreat

High ADRs stem from all-inclusive wellness programming, signature treatments, and secluded settings that encourage extended stays and repeat visits.

By Booking Mode

• Direct Booking – Personalized offers and loyalty perks

Luxury brands use proprietary apps and CRM engines to push curated upgrades, driving higher spend per guest while lowering commission outflow.

• Travel Agents – High-touch itinerary curation

Specialist agents remain influential for multi-leg luxury journeys, securing guaranteed suites and VIP access.

• Online Travel Agencies – Convenience and bundled packages

OTAs widen reach to aspirational travellers by displaying transparent comparisons and loyalty-linked benefits, especially for international trips.

By Room Type

• Luxury – Top-tier suites with bespoke butler service

Ultra-high daily rates derive from exclusive amenities, private transfers, and curated cultural access.

• Upper-Upscale – High design and premium facilities at slightly lower price points

These rooms balance cost with elevated comfort, attracting corporate travellers and young affluents.

• Upscale – Accessible luxury with key premium touch-points

Strategically priced to capture wider demand without compromising core brand standards.

Industry Developments & Instances

• January 2025 – A landmark beachfront resort opened in Aruba, introducing the island's first rooftop fine-dining concept and private gaming lounge.

• January 2025 – A leading Asian brand confirmed a 106-key eco-luxury resort in Puerto Rico, featuring plunge-pool villas and a championship golf course for a 2028 debut.

• December 2024 – An international group announced fifty new luxury and lifestyle hotels by 2025 after acquiring an acclaimed boutique portfolio.

• September 2022 – A major U.S. operator acquired a European upscale brand, adding forty properties and 6,000 rooms to its growing footprint.

• March 2022 – A global hospitality firm launched an ultra-luxury property in São Paulo, blending cultural venues with garden towers and branded residences.

Facts & Figures

• 1.6 million luxury rooms in 2023 are forecast to climb to 1.9 million by 2030.

• Average stay in luxury resorts rose to 7.6 nights in 2023 as travellers combined leisure with wellness.

• Chain hotels captured 65% of market revenue in 2024, while independent properties are accelerating at 8% annual growth.

• Direct booking accounted for 42% of premium room revenue in 2024, reflecting guests' preference for tailor-made packages.

• Investment yields exceeded 6% in 2022, prompting sovereign funds to deploy more than US$ 2.8 billion into marquee brands.

Analyst Review & Recommendations

SAC Insight's deep market evaluation underscores a clear pivot from hardware-centric luxury to experience-centric value. Brands that weave authentic local narratives, measurable sustainability, and friction-free digital journeys into their core proposition will out-perform peers. Investors should prioritize adaptive-reuse assets in gateway cities and eco-integrated resorts in high-growth leisure corridors, while operators must double down on talent retention and data security to safeguard guest trust and sustain premium pricing.