Market Overview

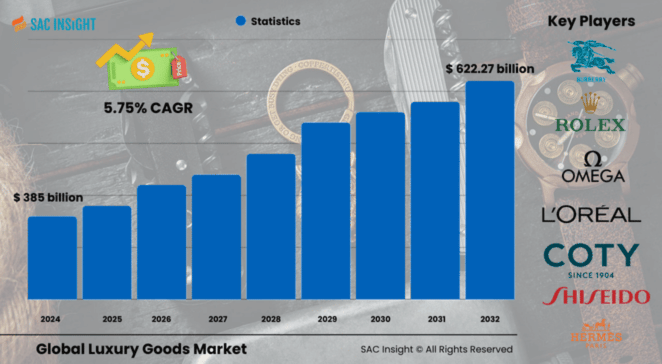

The luxury goods market size is valued at US$ 385 billion in 2024 and is projected to reach at US$ 622.27 billion by 2032, expanding at a 5.75% CAGR across the forecast period. First‑hand industry insights point to three structural tailwinds: rising disposable income in emerging economies, digital touchpoints that shorten the path to purchase, and a clear pivot toward experiential luxury. SAC Insight evaluation also shows the sector has fully rebounded from pandemic‑era disruptions, with international travel and duty‑free channels back above 2019 levels. The U.S. luxury goods market is on track to approach US$ 86.84 billion by 2032, underscoring the region’s enduring appetite for premium apparel, accessories, and beauty products.

Summary of Market Trends & Drivers

Social‑commerce, livestreaming, and influencer collaborations are turning awareness into checkout in minutes, accelerating market growth. Experiential perks—VIP events, personalization, and “drop” culture—are redefining brand loyalty and lifting average transaction values. Sustainability is no longer niche; circular services, upcycled capsules, and traceable materials are becoming core to competitive positioning.

Key Market Players

Global luxury goods market leadership is concentrated among diversified luxury conglomerates and heritage houses that control multiple iconic labels across fashion, beauty, watches, and jewelry. Household names dominate market share through relentless product refreshes, selective retail networks, and aggressive digital investment. At the same time, a fast‑growing cohort of niche designers and pre‑owned platforms is adding fresh momentum, especially among Gen Z buyers seeking uniqueness and authenticity. Innovation remains brisk: one major group recently debuted a carbon‑neutral leather collection, while another acquired a high‑end fragrance house to deepen lifestyle reach. These moves illustrate how scale players protect brand equity yet adapt quickly to shifting market trends.

Key Takeaways

• 2024 market value: ≈US$ 385 billion

• 2032 forecast: ≈US$ 622.27 billion at a 5.75% CAGR

• Asia‑Pacific commands the largest regional market share (~40%), powered by rapid wealth creation and tourism flows.

• Apparel remains the top‑grossing product line (~26% of revenue), but handbags and jewelry are the fastest climbers, each topping 7% CAGR.

• Women’s segment contributes about 60% of sales; men’s luxury is catching up with a 7% CAGR through 2032.

• Online channels already represent one‑third of global revenue and are the quickest route for new entrants.

Market Dynamics

Drivers

• Expansion of high‑net‑worth and aspirational middle‑class consumers in Asia, the Middle East, and Latin America.

• Digital storefronts, virtual try‑ons, and same‑day delivery improving access and convenience.

• Strong rebound in international travel, reviving duty‑free and flagship boutique sales.

Restraints

• Counterfeit proliferation and grey‑market leakage erode brand equity.

• Economic slowdowns can quickly defer discretionary spending, especially for first‑time buyers.

• High import tariffs in certain markets inflate retail prices and curb volume.

Opportunities

• Tech‑embedded luxury (NFC‑enabled bags, smart jewelry) offers new revenue streams and data capture.

• Circular business models—certified resale, repair services—extend product lifecycles and attract eco‑conscious shoppers.

• Personalized on‑demand manufacturing allows agile inventory and stronger customer bonds.

Challenges

• Balancing exclusivity with the scale required for sustained market growth.

• Navigating diverse regulatory frameworks on sustainability claims and data privacy.

• Recruiting and retaining skilled artisans amid an aging craft workforce.

Regional Analysis

The luxury goods market in Asia‑Pacific is the undisputed growth engine thanks to rising billionaire counts, digital fluency, and aggressive retail roll‑outs in China, India, and Southeast Asia. North America follows, buoyed by robust e‑commerce adoption and a flourishing pre‑owned ecosystem, while Europe leverages tourism recovery and heritage craftsmanship to stay competitive.

• Asia‑Pacific: Wealth boom, flagship expansion, digital‑first consumers

• North America: Strong online penetration, experiential retail concepts

• Europe: Tourism rebound, craftsmanship heritage, sustainability leadership

• Middle East & Africa: Luxury malls and airport hubs drive steady uptake

• Latin America: Growing urban elites and duty‑free corridors spur demand

Segmentation Analysis

By Product

• Apparel – Style driver, widest assortment.

Apparel captures the largest slice of revenue as designers refresh collections multiple times a year, tapping into fast‑changing fashion cycles and capsule drops.

• Handbags – Status symbol, 7 %+ CAGR.

Limited‑edition bags and emerging artisanal labels cater to consumers seeking individuality and investment pieces, pushing this segment ahead of the market average.

• Watches & Jewelry – Timeless value, tech infusion.

Smart complications, recycled metals, and gender‑neutral designs keep watches and jewelry relevant to new demographics while preserving heirloom appeal.

• Perfumes & Cosmetics – Entry gateway, 6 %+ CAGR.

Smaller ticket sizes make beauty an accessible entry point; immersive pop‑ups and customizable scents sustain momentum.

• Footwear & Others – Sneaker culture, lifestyle crossovers.

Luxury sneakers and athleisure collaborations blur lines between streetwear and haute couture, attracting younger buyers.

By End‑user

• Women – 60 % share, style‑driven.

Financial independence and social‑media influence fuel frequent wardrobe updates and premium skincare adoption.

• Men – 7 % CAGR, rising grooming focus.

Relaxed tailoring, statement timepieces, and luxury streetwear widen the men’s basket beyond traditional suits and leather goods.

By Distribution Channel

• Offline – Flagships & duty‑free theatre.

High‑touch service, exclusive launches, and architectural showpieces reinforce brand storytelling and justify premium pricing.

• Online – Fastest‑growing, one‑third of sales.

Direct‑to‑consumer sites and curated marketplaces extend reach, enable data‑driven personalization, and smooth cross‑border purchases.

Industry Developments & Instances

• Jan 2024: A leading maison released its fourth upcycled denim and patchwork bag line, underscoring circular ambitions.

• Sep 2023: A top watch‑and‑jewelry group unveiled a dedicated beauty division to diversify revenue.

• Jun 2023: A French conglomerate bought a heritage fragrance brand, signaling renewed interest in niche perfumery.

• Mar 2023: Luxury innovation lab launched NFC‑embedded jewelry, merging tech with tradition.

Facts & Figures

• Roughly 70 % of luxury consumers under 35 say social media directly influences purchase decisions.

• Experiential programs can raise average customer spend by 30 % compared with standard retail.

• Pre‑owned luxury is expanding at >10 % CAGR, outpacing the primary market.

• Sustainability‑labeled products now represent one in five luxury items sold online.

• Airport duty‑free stores account for ≈8 % of global luxury revenue post‑pandemic, up two points from 2019.

Analyst Review & Recommendations

Our market analysis indicates that luxury brands thriving today pair heritage craftsmanship with digital agility. To capture forthcoming market growth, incumbents should double down on data‑driven personalization, invest in circular initiatives that resonate with eco‑minded consumers, and maintain tight control over omnichannel pricing to protect brand equity. New entrants can carve niches in tech‑enhanced accessories and experiential services where barriers to entry remain lower. Overall, sustained mid‑single‑digit expansion looks achievable through 2032, provided players balance exclusivity with innovation and operational transparency.