Market Overview

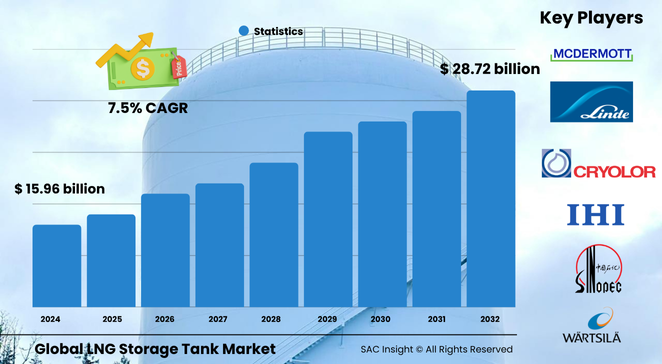

The global LNG storage tank market size sits at roughly US$ 15.96 billion in 2024 and is on track to reach about US$ 28.72 billion by 2032, translating to a steady 7.5% CAGR. SAC Insight industry insights point to three clear growth engines: surging LNG trade as a lower-carbon bridge fuel, rising adoption of LNG-powered ships and heavy-duty vehicles, and rapid build-out of floating storage and regasification units. SAC Insight's deep market evaluation also shows the United States LNG storage tank market poised for solid double-digit gains as Gulf Coast export terminals expand second-wave liquefaction trains to meet Asian spot demand.

Summary of Market Trends & Drivers

• Self-supporting cryogenic designs are moving into mainstream projects because they combine proven safety records with faster installation, trimming project schedules by months.

• Steel—and, increasingly, high-manganese and 9 % nickel grades—dominates tank fabrication, while aluminum alloys carve out a niche in small-scale, mobile applications.

• Market analysis highlights tougher IMO sulphur limits, national decarbonization targets, and energy-security agendas as the core forces underpinning LNG storage tank market growth through 2032.

Key Market Players

Global leadership rests with a mix of diversified EPC majors and cryogenic-specialist manufacturers. Companies such as Linde, McDermott, Chart Industries, Wärtsilä, and IHI Corporation supply large-scale membrane and full-containment tanks for onshore terminals. Meanwhile, CIMC Enric, Air Water, and several Turkish and Indian fabricators compete aggressively in small-scale and modular segments. Their strategies revolve around in-house alloy development, vertical integration of insulation systems, and regional joint ventures that shorten lead times.

Key Takeaways

• Current global LNG storage tank market size (2024): US$ 15.96 billion

• Projected global market size (2032): US$ 28.72 billion at a 7.5 % CAGR

• Self-supporting tanks command nearly 68 % market share owing to robust structural integrity and easy retrofits

• Steel accounts for about two-thirds of material demand; high-manganese alloys lower cost by up to 30 % versus 9 % nickel grades

• Transportation & logistics is the fastest-growing end-use as LNG bunkering and trucking networks scale

• Asia-Pacific leads market growth, underpinned by China’s and India’s aggressive regasification build-outs

Market Dynamics

Drivers

• Expanding global LNG trade volumes, supported by over 480 million t annual liquefaction capacity and a pipeline of new FSRUs

• Tightening maritime sulphur and carbon rules pushing shipowners toward LNG propulsion, lifting demand for onboard and quay-side storage

• First-cost advantages of high-manganese and duplex steels unlocking new project economics

Restraints

• Volatile raw-material prices—particularly nickel—compress EPC margins and complicate bid strategies

• High upfront capital for full-containment tanks can deter smaller developers and delay final investment decisions

Opportunities

• Modular, prefabricated tank kits for remote mining and island grids enable quick deployment of micro-LNG solutions

• Integration with renewable-powered microgrids offers incremental revenue streams through peak-shaving and seasonal storage

Challenges

• Stricter methane-leak regulations raise compliance costs and require advanced monitoring technologies

• Local content policies in emerging markets create qualification hurdles for foreign suppliers

Regional Analysis

Asia-Pacific remains the centre of gravity for market growth thanks to rapid urbanization, coal-to-gas switching, and sustained policy support for energy diversification. North America follows closely as export infrastructure expands and new Gulf Coast trains demand large tank farms.

• North America – Robust export expansion and brownfield tank replacements

• Europe – Accelerated FSRU deployments to offset pipeline gas shortfalls

• Asia-Pacific – Highest CAGR, driven by China, India, South Korea, and Southeast Asia

• Middle East & Africa – LNG hubs in Oman, Qatar, and the UAE targeting bunkering and re-export

• Latin America – Niche growth via small-scale LNG for off-grid power and industrial users

Segmentation Analysis

By Type

• Self-Supporting – Workhorse design, dominant share.

Self-supporting (independent) tanks rely on a primary barrier that is structurally capable of holding cryogenic LNG without hull support, lowering complexity and easing inspection, which keeps them the preferred choice for onshore terminals and LNG carriers.

• Non-Self-Supporting – Niche but strategic.

These membrane-type or prismatic tanks integrate with the carrier hull or concrete shell, saving weight and enabling higher volumetric efficiency—ideal for large-capacity newbuilds where yard expertise is available.

By Material

• Steel – Core demand engine.

Austenitic and duplex steels offer excellent cryogenic toughness, corrosion resistance, and global fabrication capacity, anchoring around two-thirds of total material use.

• 9 % Nickel Steel – High-performance segment.

Its superior strength permits thinner walls and larger diameters, appealing for mega-projects despite cost premiums tied to nickel volatility.

• Aluminum Alloy – Lightweight alternative.

Favoured for ISO containers and trailer tanks, aluminum’s low density simplifies road and rail logistics, though insulation requirements limit scale.

• Others – High-manganese and composite linings.

Emerging alloys cut cost and CO2 footprint, while composite wraps enhance structural redundancy and slosh resistance.

By End-Use

• Energy & Power – Foundation market.

Utilities rely on peak-shaving LNG storage to backstop intermittent renewables and manage seasonal demand swings.

• Industrial – Steady uptake.

Process industries adopt captive LNG tanks to hedge fuel supply and curb emissions from boilers and kilns.

• Transportation & Logistics – Fastest-growing slice.

Bunkering barges, truck refuelling depots, and rail tenders integrate medium-scale tanks to serve expanding LNG mobility fleets, driving multi-year order pipelines.

Industry Developments & Instances

• May 2024 – A leading EPC contractor secured EPC scope for a 165 000 m³ full-containment tank in Oman’s low-carbon LNG hub.

• November 2023 – A Chinese state energy major inaugurated the world’s largest 270 000 m³ tank, adding 165 million m³ of storage capacity at its Qingdao terminal.

• July 2022 – A landmark Taiwanese import project kicked off construction of twin 180 000 m³ tanks to secure regional gas supply.

• September 2021 – A Finnish technology provider unveiled a modular LNG carrier concept featuring flexible multi-fuel tanks to future-proof against decarbonization pathways.

• September 2019 – An innovative in-line tank connection system entered service, simplifying shipboard LNG system installation by eliminating bulky deckhouses.

Facts & Figures

• Self-supporting designs captured roughly 68 % of revenue in 2023.

• Steel commanded nearly 66 % of material market share last year.

• International LNG trade climbed above 401 million t in 2023, up 2.1 % year-on-year.

• Global regasification capacity topped 217 million t per year in Japan alone.

• High-manganese alloy can cut tank fabrication cost by around 30 % versus traditional 9 % nickel steel.

Analyst Review & Recommendations

The LNG storage tank market is entering a disciplined expansion phase marked by modular construction, alloy innovation, and tighter emissions oversight. Suppliers that pair competitive steel chemistries with integrated insulation and smart-monitoring packages will capture outsized share. Developers should lock in multi-year metal hedges, pre-qualify regional fabricators to meet local content rules, and design tanks with methane-leak detection baked in to stay ahead of evolving ESG benchmarks.