Market Overview

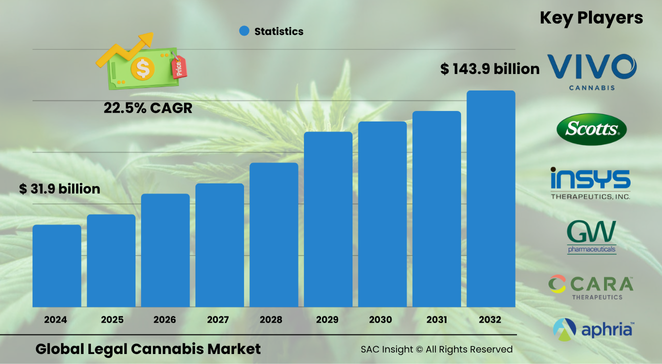

The global legal cannabis market size stands near US$ 31.9 billion in 2024 and is set to accelerate to roughly US$ 143.9 billion by 2032, advancing at an average 22.5 % CAGR. First-hand industry insights highlight three structural growth engines: rapid regulatory liberalisation, widening clinical acceptance of cannabinoid therapies, and a surge of product innovation ranging from infused beverages to pharma-grade extracts. SAC Insight’s deep market evaluation indicates the U.S. legal cannabis market alone could rise from about US$ 19 billion in 2024 to close to US$ 87 billion by 2032 as adult-use programmes expand and prescription uptake climbs.

Summary of Market Trends & Drivers

• Edibles, drinks, and wellness formats are diversifying the product mix and attracting new consumer segments.

• Precision indoor farming and advanced extraction boost quality, consistency, and margins, reinforcing market growth.

• Governments increasingly treat cannabis taxes as a fiscal lever, encouraging transparent supply chains and squeezing illicit trade.

Key Market Players

Global leadership rests with a mix of multistate operators and science-driven specialists. Companies such as Canopy Growth, Curaleaf, Tilray, Cronos, Aurora Cannabis, GW Pharmaceuticals, and Green Thumb Industries command sizeable market share through extensive cultivation assets, branded retail networks, and robust R&D pipelines. Their strategies revolve around portfolio expansion, cross-border acquisitions, and pharmaceutical partnerships that fast-track novel dosage forms.

Competitive dynamics are intensifying as new entrants chase niche opportunities in hemp-based wellness and high-potency concentrates. Established players counter by integrating vertically—from genetics through distribution—while investing in safety testing and clinical trials to cement credibility with physicians and regulators.

Key Takeaways

• Current global legal cannabis market size (2024): USD$ 31.9 billion

• Projected global market size (2032): USD$ 143.9 billion at a 22.5 % CAGR

• The U.S. market could top US$ 87 billion by 2032, underpinning North America’s leadership

• Marijuana accounts for over 75 % of revenue, while CBD captures nearly two-thirds of derivative sales

• Medical use generates more than 70 % of current demand, but recreational channels show the fastest trajectory

• Asia is the quickest-growing region as clinical trials and hemp exports gain policy support

Market Dynamics

Drivers

• Ongoing decriminalisation and tax-driven legalisation across North America, Europe, and parts of Latin America

• Expanding evidence base for chronic-pain, epilepsy, and oncology support propelling physician endorsements

• Venture and public-market funding that accelerates capacity build-outs and branded consumer launches

Restraints

• Patchwork regulations and federal-state conflicts complicate interstate commerce and capital access

• Supply-glut cycles in mature markets compress prices and pressure small growers

• Persistent stigma inhibits physician prescribing in conservative jurisdictions

Opportunities

• Pharmaceutical-grade cannabinoids for neurology, mental-health, and sleep disorders

• Functional beverages, pet-care lines, and cosmeceuticals broadening addressable consumer bases

• Technology-enabled seed-to-sale tracking and ESG-aligned cultivation unlocking institutional investment

Challenges

• Complex licensing and quality-control compliance raise barriers for emerging nations

• Banking and payment restrictions elevate operating costs and limit retail reach

• Rising energy demands of indoor grows clash with sustainability targets, prompting calls for greener practices

Regional Analysis

North America commands roughly two-thirds of global revenue thanks to extensive adult-use markets, strong disposable income, and well-established supply networks. Europe follows as Germany, the Netherlands, and Spain advance medical programmes, while Asia-Pacific registers the steepest CAGR on the back of Thailand’s liberal framework and Japan’s ageing-population demand for CBD therapies.

• North America – Largest market; tax revenues and job creation sustain bipartisan support

• Europe – Rapidly formalising medical supply chains and pilot recreational schemes

• Asia-Pacific – Fastest growth; hemp cultivation and senior-care demand driving uptake

• Latin America & Caribbean – Export-oriented hemp and low-cost cultivation hubs emerging

• Middle East & Africa – Early-stage, with pockets of medical adoption and industrial hemp trials

Segmentation Analysis

By Source

• Marijuana – Main revenue engine, buoyed by adult-use rollouts.

Marijuana dominates because high-THC flowers and oils remain the preferred format for both therapeutic and recreational users. Large-scale greenhouses and brand-driven retail secure consistent supply and consumer loyalty.

• Hemp – Smaller base, fastest legal adoption.

Hemp benefits from lenient regulations and versatile applications, spanning dietary supplements to textile fibre. Low-THC thresholds ease cross-border trade, encouraging farmers in Asia and South America to enter the market.

By Derivatives

• Cannabidiol (CBD) – Broad wellness appeal, leading share.

CBD’s non-intoxicating profile and mounting clinical data underpin its popularity in anxiety, sleep, and skincare products, making it the cornerstone of mainstream retail penetration.

• Tetrahydrocannabinol (THC) – Potent therapeutic and recreational driver.

THC retains strong demand for pain management and relaxation, with nano-emulsified beverages and vaporisable concentrates elevating bioavailability and convenience.

By Distribution Channel

• Recreational Stores – Experience-driven retail hubs.

Modern dispensaries emphasise curated product walls and personalised education, locking in repeat traffic as stigma fades.

• Pharmacies – Trusted access point for medical patients.

Pharmacies leverage existing cold-chain and counselling infrastructure to dispense doctor-prescribed formulations, boosting adherence and data collection.

• Online Stores – Convenience catalyst.

E-commerce platforms pair doorstep delivery with age verification, widening reach in regions that allow direct-to-consumer shipping.

• Others – Clubs, vending, and social lounges.

Innovative models such as cannabis cafés and membership collectives cater to community experiences and micro-dosing trends.

By End User

• Medical Use – Core demand bedrock.

Chronic-pain, oncology-related nausea, and neurological conditions drive steady prescriptions, supported by insurance pilots and hospital trials.

• Recreational Use – Fastest-growing slice.

Youthful demographics and premium branding propel flower, vape, and edible sales where adult-use is permitted, converting illicit consumption into taxable revenue.

• Industrial Use – Nascent but promising.

Hemp fibre and hurd enter bioplastics, construction, and automotive composites, providing a sustainable alternative to petrochemical feedstocks.

Industry Developments & Instances

• May 2023 – A U.S. juice chain launched CBD-infused wellness shots nationwide.

• April 2023 – A Canadian giant introduced grape and orange cannabis sodas to capture beverage share.

• August 2022 – Leading multistate operator doubled its cultivation footprint through two strategic acquisitions.

• December 2021 – European authorities cleared the first full-spectrum cannabis extract for epilepsy treatment.

• October 2020 – Ecuador initiated commercial cannabis licensing to stimulate post-pandemic economic recovery.

Facts & Figures

• Adult-use markets generate over 55 % of global sales despite fewer legal jurisdictions.

• Colorado collects more than US$ 20 million in monthly cannabis tax revenue, while California exceeds US$ 50 million.

• Hemp acreage expanded by roughly 30 % worldwide between 2021 and 2024.

• Average retail flower prices in mature U.S. states fell 14 % year on year as cultivation efficiency improved.

• Clinical-trial registrations involving cannabinoids climbed 22 % in 2024, signalling robust R&D momentum.

Analyst Review & Recommendations

The market analysis shows legal cannabis transitioning from a novelty sector to a regulated consumer-health staple. Operators that integrate precision cultivation, pharma-grade quality controls, and data-rich consumer insights will capture disproportionate market share. Investing in energy-efficient grow technologies, diversifying into low-THC wellness formats, and lobbying for banking reform will mitigate volatility and position stakeholders for sustained expansion through 2032.