Market Overview

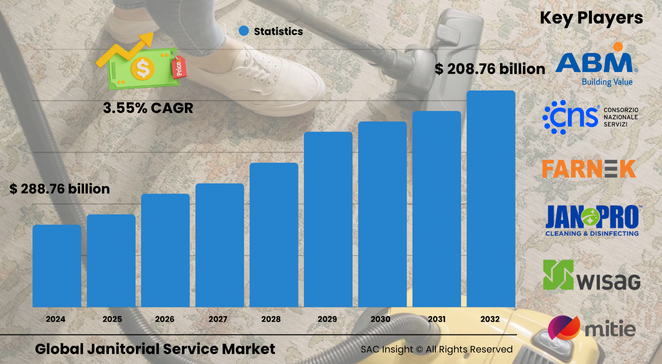

The global janitorial service market size was valued at about US$ 288.76 billion in 2024 and is projected to approach roughly US$ 208.76 billion by 2032, advancing at an average 3.55% CAGR over the forecast period. SAC Insight's first-hand industry insights reveal that tighter hygiene regulations, rising outsourcing of non-core functions, and a pivot toward green cleaning solutions are the primary engines of market growth. SAC Insight's deep market evaluation indicates the United States alone could expand from nearly US$ 91.24 billion in 2024 to around US$ 118.40 billion by 2032 as commercial real-estate pipelines, healthcare facilities, and hospitality chains widen their reliance on professional cleaning vendors.

Summary of Market Trends & Drivers

• Heightened post-pandemic emphasis on indoor air quality and infection control is lifting service frequency requirements across healthcare, education, and retail properties.

• Rapid market growth in green, low-toxicity chemicals and energy-efficient equipment is reshaping procurement criteria and strengthening providers’ ESG credentials.

• Advanced scheduling apps, IoT-enabled sensors, and robotic floor scrubbers are trimming labor hours and improving proof-of-service, supporting a data-driven market analysis culture.

Key Market Players

Large integrated vendors and specialist franchises dominate market share through broad service portfolios and national footprints. ABM Industries, ServiceMaster, ISS A/S, Aramark, Mitie Group, Jani-King, Jan-Pro, and AEON Delight anchor the competitive landscape. These firms invest heavily in technician training, digital quality audits, and eco-label consumables to meet rising client benchmarks.

Meanwhile, agile regional providers—Farnek Services, WISAG, CNS Consorzio Nazionale Servizi, and numerous niche operators—compete on localized response times and bespoke packages. Strategic moves range from facility-wide bundled contracts that fuse security, waste, and janitorial work, to M&A aimed at bolstering coverage in data-center cleaning, biohazard remediation, and high-rise window care.

Key Takeaways

• Current global janitorial service market size (2024): about US$ 288.76 billion

• Forecast global market size (2032): roughly US$ 208.76 billion at a 3.55 % CAGR

• U.S. market share exceeds 30 % and is on track for US$ 118.40 billion by 2032

• Commercial facilities account for close to nine-tenths of revenue; residential is the fastest-growing slice

• Standard cleaning remains the core service line, while exterior window cleaning posts the highest projected CAGR

• Market trends favor low-carbon cleaning agents, smart sensors that log room-by-room completions, and outcome-based pricing agreements

Market Dynamics

Drivers

• Outsourcing surge as corporations streamline overhead and focus on core activities

• Regulatory pressure in healthcare, food service, and hospitality mandates verifiable sanitation metrics

• Expanding hotel pipelines, co-working hubs, and logistics centers boost recurring demand

Restraints

• Perceived loss of direct control over frontline staff can slow contract awards

• Fragmented vendor base complicates multi-site standardization for large enterprises

Opportunities

• Premium eco-friendly service tiers attract sustainability-focused tenants and asset managers

• Robotics and IoT tools unlock labor savings and differentiated service guarantees

Challenges

• Wage inflation and high staff turnover strain profit margins in labor-intensive segments

• Variable real-estate cycles expose providers to occupancy downturns and contract renegotiations

Regional Analysis

North America leads on revenue thanks to stringent workplace-wellness programs, advanced cleaning technology uptake, and a dense roster of office and healthcare facilities. Europe follows, propelled by strict environmental standards and steady outsourcing in the U.K., Germany, and France. Asia Pacific posts the fastest percentage gains as urbanization and commercial construction accelerate in China, India, and Southeast Asia.

• North America – Largest share; tech-enabled quality control and LEED-linked cleaning contracts dominate

• Europe – Strong focus on ESG compliance and partnership models with integrated facility-management providers

• Asia Pacific – Quickest CAGR, driven by booming office builds, retail expansion, and data-center growth

• Latin America – Growing tourism investments and public-infrastructure upgrades spur demand

• Middle East & Africa – Hospitality and healthcare projects underpin steady market growth

Segmentation Analysis

By Type

• Standard Cleaning – Core revenue generator, broadest client base.

Routine dusting, restroom sanitation, and floor care form the backbone of service portfolios, ensuring predictable workloads and high contract renewal rates.

• Damage Restoration Cleaning – Niche but margin-rich.

Specialized teams tackle flood, fire, and biohazard events, leveraging certification and quick response to secure premium pricing and emergency-service retainers.

• Exterior Window Cleaning – Fastest-growing, image-critical.

High-rise façade cleaning enhances property appeal and daylight penetration; advances in water-fed poles and rope-access techniques reduce safety risks and downtime.

• Floor Care Services – Resilient demand across retail and healthcare.

Strip-and-wax, burnishing, and advanced coating treatments protect flooring investments and meet slip-resistance standards.

• Others – Carpet extraction, pressure washing, and specialty disinfection.

Add-on offerings help vendors deepen wallet share and smooth seasonal revenue swings.

By Application

• Commercial – Dominant market share, nearly 90 %.

Corporate offices, hospitals, shopping centers, and educational campuses prize third-party cleaning for compliance, brand image, and employee well-being, driving multi-year, multi-site contracts.

• Residential – Rapidly expanding, especially among high-net-worth households and senior residents.

Time-poor consumers seek deep-clean packages and recurring maid services; app-based booking platforms ease on-demand scheduling and foster market growth.

Industry Developments & Instances

• March 2024 – ABM Industries secured a multi-year contract to provide housekeeping and event staff across a 1.3 million sq ft U.S. ballpark, integrating mobile task verification.

• March 2024 – ServiceMaster Clean adopted a cloud-based operations platform to automate work-order dispatch and real-time KPI reporting for franchisees.

• January 2024 – ISS A/S extended a five-year integrated-services agreement with a leading Nordic bank, bundling cleaning, energy management, and staff amenities across 500+ branches.

• February 2022 – Mitie Group launched a hygiene center of excellence showcasing robotics and UV-C disinfection pilots for healthcare clients.

• August 2022 – Diversified Maintenance acquired Millers Cleaning Services to deepen penetration in U.S. Mid-Atlantic healthcare and manufacturing verticals.

Facts & Figures

• Approximately 65 % of K-12 schools and 90 % of hospitals mop floors daily or more, reinforcing recurring janitorial spend.

• Green cleaning products represent over 20 % of total chemical purchases by large corporate buyers and are rising two percentage points annually.

• Adoption of autonomous floor scrubbers can cut repetitive labor hours by up to 25 % in big-box retail settings.

• Franchise networks account for roughly 10 % of global market revenue yet grow nearly 1.5 times faster than independent firms.

• Investments in LEED-certified buildings paired with regular janitorial upkeep can deliver lifecycle savings exceeding USD$ 18 billion, according to facility-management audits.

Analyst Review & Recommendations

Market analysis underscores a decisive shift toward data-verified outcomes and sustainability positioning. Providers that blend skilled labor with IoT sensors, robotics, and certified green consumables will capture outsize market share while reducing cost-to-serve. We recommend vendors focus on technician retention programs, expand restoration and high-rise window specialties to lift margins, and invest in digital client portals that translate cleaning logs into actionable indoor-health metrics. The sector’s resilience to economic cycles and rising ESG scrutiny positions janitorial service as a dependable, innovation-ready arena through 2032.