Market Overview

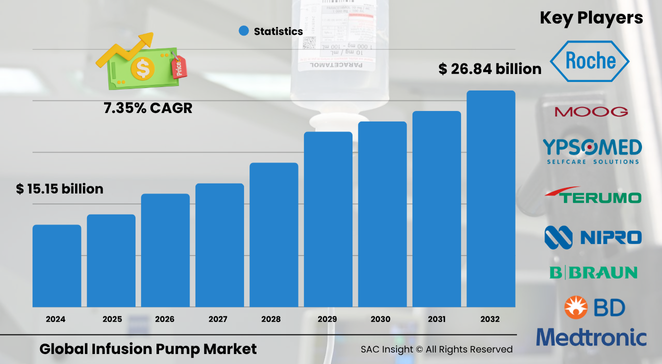

The global infusion pump market size is valued at about US$ 15.15 billion in 2024 and is projected to reach roughly US$ 26.84 billion by 2032, reflecting a steady 7.35% CAGR over 2025-2032. SAC Insight's first-hand industry insights highlight three forces behind this market growth: rapid adoption of home-based infusion therapy, continuous device miniaturization with smart connectivity, and the surging burden of chronic illnesses that demand precise, round-the-clock drug delivery. Deep market analysis indicates North America captures nearly 38 % market share today, while the U.S. infusion pump sub-market is on course to break the US$ 10 billion mark by 2032 as payers push for cost-effective outpatient care.

Summary of Market Trends & Drivers

• Smart pumps equipped with wireless drug libraries and dose-error reduction software are becoming the default specification for new hospital installations.

• Demand for ambulatory and wearable devices is climbing as diabetes and oncology patients opt for home care to avoid recurrent hospital stays.

• Emerging markets are investing in basic volumetric and syringe pumps as health-system upgrades expand surgical capacity and intensive-care beds.

Key Market Players

Global leadership rests with a handful of diversified medical-technology companies. Firms such as Medtronic, Baxter, Becton Dickinson, Fresenius Kabi, and B. Braun supply broad device portfolios, accessories, and integrated IT platforms. Their market strategies focus on iterative safety upgrades, cloud connectivity, and targeted acquisitions to widen therapy coverage. Mid-tier specialists—including Insulet, ICU Medical, Smiths Medical, and Terumo—differentiate through niche innovations such as tubeless insulin pumps, dual-channel oncology systems, and long-wear infusion sets, intensifying competitive dynamics.

Key Takeaways

• Current global infusion pump market size (2024): US$ 15.15 billion

• Projected global market size (2032): US$ 26.84 billion at a 7.35 % CAGR

• Devices command the bulk of revenue, while accessories & consumables generate recurring margins

• Insulin pumps lead type-based market share and will stay the fastest-growing segment through 2032

• Ambulatory care settings represent the highest end-user growth rate as site-of-care shifts out of hospitals

• North America maintains revenue leadership; Asia Pacific shows the quickest percentage gains

Market Dynamics

Drivers

• Rising prevalence of diabetes, cancer, and cardiovascular disease increases long-term infusion therapy demand

• Shift toward outpatient and home care to cut hospital costs fuels uptake of portable and wearable pumps

• Continuous software upgrades and cloud integration improve safety, compliance, and data visibility for clinicians

Restraints

• High recall frequency linked to design or software faults erodes brand trust and adds compliance costs

• Capital-budget constraints in low-income regions slow replacement of aging, manually controlled pumps

Opportunities

• Untapped demand in emerging economies where surgical volumes and critical-care capacity are expanding rapidly

• Integration of infusion pumps with electronic health records and closed-loop medication management systems

• Development of extended-wear insulin and oncology pumps that reduce line changes and increases patient comfort

Challenges

• Interoperability gaps between smart pumps and hospital IT networks limit full automation benefits

• Persistent medication-error risk despite safety software highlights need for easier user interfaces and training

Regional Analysis

North America holds the largest revenue base owing to advanced acute-care infrastructure, strong reimbursement for home infusion, and early adoption of smart devices. Europe follows with high chronic-disease prevalence and rigorous safety standards driving replacement cycles. Asia Pacific, anchored by China and India, records the fastest market growth as healthcare spending and surgical procedures surge. Latin America and the Middle East & Africa are at an earlier adoption stage but benefit from multinational vendor expansion and rising private-sector hospitals.

• North America – Leadership sustained by technology upgrades and large chronic-disease population

• Europe – Robust replacement demand and supportive regulatory frameworks

• Asia Pacific – Highest CAGR, propelled by rising disposable income and expanding hospital networks

• Latin America – Gradual uptake of ambulatory pumps as private insurers promote home care

• Middle East & Africa – Nascent market, but critical-care investments create future demand

Segmentation Analysis

By Type

• Insulin Pumps – Fastest-growing, patient-centric.

Insulin pumps dominate value share as continuous subcutaneous insulin infusion becomes standard for type 1 diabetes management, reducing multiple daily injections and improving glycemic control.

• Volumetric Pumps – Workhorse of acute care.

These machines deliver high-volume fluids during surgery and critical care, ensuring precise high-flow rates vital for anesthesia and hydration therapies.

• Syringe Pumps – Precision for low-flow drugs.

Ideal for neonatal and intensive-care units where micro-dosing of potent drugs is essential to avoid adverse events.

• Enteral Pumps – Nutritional support niche.

Used to deliver enteral nutrition to patients unable to swallow, with anti-free-flow features safeguarding against accidental bolus feeding.

• Elastomeric & Implantable Pumps – Specialty infusions.

Offer continuous analgesia or chemotherapy without external power, giving patients mobility in ambulatory settings.

• Patient-Controlled Analgesia Pumps – On-demand pain relief.

Allow postoperative patients to self-administer analgesics within safe dose limits, enhancing satisfaction and recovery times.

By Application

• Diabetes – Core demand engine.

Rising diabetes incidence and preference for wearable insulin delivery keep this segment at the forefront of market growth.

• Oncology – Continuous chemotherapy delivery.

Portable infusion pumps enable outpatient cancer care, cutting inpatient costs and improving quality of life.

• Pain Management – Post-op and chronic care.

High surgery volumes and increasing emphasis on patient-controlled relief drive steady uptake.

• Others – Pediatrics, hematology, gastroenterology.

Specialized therapies such as TPN and blood component delivery add incremental volume to device demand.

By End User

• Hospitals – Largest revenue contributor.

High procurement budgets, complex case mix, and trained staff maintain hospitals as the primary installation base.

• Ambulatory Care Settings – Fastest-rising.

Surgical center expansion and payer incentives to shorten hospital stays spur strong pump installations in ASCs.

• Home Care Settings – Growing site-of-care shift.

Long-term therapies and smart, user-friendly devices support rapid adoption among chronic-disease patients.

• Specialty Clinics – Targeted usage.

Oncology and pain clinics rely on compact pumps to deliver outpatient regimens efficiently.

Industry Developments & Instances

• August 2023 – ICU Medical received clearance for its Plum Duo dual-line infusion pump featuring LifeShield safety software.

• November 2022 – Medtronic introduced the Extended Infusion Set, doubling wear time to seven days for insulin delivery.

• April 2022 – Fresenius Kabi won an innovative-technology contract for its Ivenix Infusion System, easing U.S. hospital purchasing.

• January 2022 – ICU Medical finalized the acquisition of Smiths Medical, adding syringe and ambulatory pumps to its portfolio.

• March 2022 – Regulatory approval for a wireless Agilia Connect Infusion System advanced networked drug delivery in U.S. hospitals.

Facts & Figures

• Smart pumps now account for over 65 % of new hospital pump purchases worldwide.

• Ambulatory devices are posting double-digit shipment growth, outpacing traditional large-volume pumps.

• Insulin pump penetration among type 1 diabetes patients in the U.S. has surpassed 45 % and continues to rise.

• Average recall events linked to infusion pumps have fallen by roughly 12 % since 2020 due to stricter design validation.

• Portable chemotherapy pumps can cut inpatient oncology costs by up to 30 % while maintaining treatment efficacy.

Analyst Review & Recommendations

Market analysis confirms a decisive shift toward connected, patient-friendly infusion systems that lower total therapy costs and improve safety. Vendors that pair hardware innovation with robust dose-error reduction software and seamless EHR interoperability will capture outsized market share. We recommend investing in extended-wear sets and cloud-based analytics, strengthening service networks in fast-growing Asia Pacific markets, and partnering with home-infusion providers to cement long-term recurring revenue streams.