Market Overview

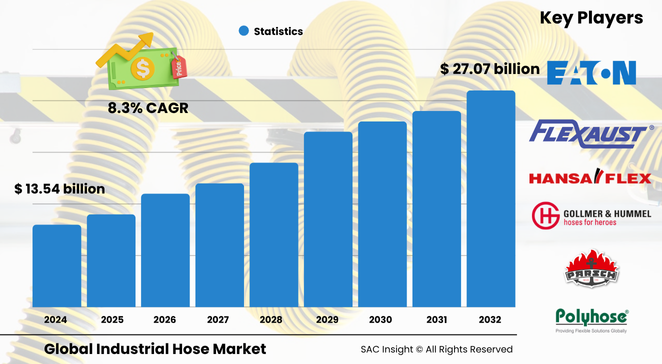

The global industrial hose market size stands at roughly US$ 13.54 billion in 2023 and is set to almost double to about US$ 27.07 billion by 2032, advancing at an average 8.3% CAGR. SAC Insight's first-hand industry insights confirm three persistent growth engines: robust infrastructure spending, proliferating process-automation projects that need high-performance fluid transfer, and a steady rebound in oil, gas, and mining activity. SAC Insight's deep market evaluation shows the United States industrial hose market could move from a current US$ 14.25 billion in 2024 to around US$ 26.36 billion by 2032 as non-residential construction and shale production lift demand for reinforced rubber and PVC assemblies.

Summary of Market Trends & Drivers

Tighter safety regulations are pushing buyers toward hoses with higher burst ratings and traceable materials, while supply-chain managers favor modular end-fittings that cut downtime. At the same time, market analysis highlights rising preference for lightweight PVC lines in agriculture and food-grade operations, and for conductive rubber in EV battery cooling systems—trends that collectively underpin healthy market growth.

Key Market Players

Leading participants include Eaton, Gates, HANSA-FLEX, Flexaust, Polyhose, AEROFLEX, Gollmer & Hummel, PARSCH, and JinYuan Rubber Manufacturing. These companies shape competitive dynamics through continuous material innovation—think nitrile blends for biofuel compatibility—and by expanding localized assembly centers that shorten lead times for custom lengths.

Competitive moves revolve around product launches and strategic acquisitions. Recent examples range from Gates rolling out ProV hydraulic lines tailored to heavy equipment, to Kurt Manufacturing absorbing Bellatex Industries to widen its specialty polyurethane portfolio. Regional distributors are also being folded into global networks, giving larger brands direct access to aftermarket revenue.

Key Takeaways

• Current global market size (2023): USD$ 13.54 billion

• Projected global market size (2032): USD$ 27.07 billion at an 8.3 % CAGR

• U.S. market share remains the single largest, reaching an estimated USD$ 26.36 billion by 2032

• Rubber commands roughly 39 % material market share thanks to superior flexibility and heat tolerance

• Construction & infrastructure applications account for nearly one-fifth of global revenue, driven by concrete-placement and dewatering lines

• Ongoing market trends include quick-coupling systems, RFID-enabled asset tracking, and hose-in-hose designs for leak containment

Market Dynamics

Drivers

• Expanding civil-infrastructure budgets worldwide boost demand for concrete, grout, and water-delivery hoses

• Accelerating vehicle electrification raises the need for high-temperature, chemical-resistant cooling lines around batteries and power electronics

• Process-safety standards in chemicals and pharmaceuticals mandate certified, traceable hose assemblies, lifting premium product penetration

Restraints

• Volatile prices for synthetic rubber, PVC, and stainless-steel reinforcement wire can squeeze manufacturer margins and raise end-user costs

• Shortage of skilled technicians for proper hose routing, crimping, and inspection increases failure risk and adoption hesitancy

Opportunities

• Growth in renewable-diesel and bio-ethanol plants opens new demand for hoses resistant to aggressive, oxygenated fuels

• Smart factories adopting predictive-maintenance platforms will integrate sensor-equipped hoses, unlocking aftermarket analytics revenue

Challenges

• Limited differentiation among general-purpose hose lines pressures suppliers to innovate or compete on price

• Rising debris density on construction sites accelerates abrasion and drives higher warranty claims unless tougher covers are adopted

Regional Analysis

Asia-Pacific leads global demand, supported by large-scale infrastructure roll-outs in China, India, and Southeast Asia. North America follows, underpinned by shale gas, non-residential building, and mining expansion, while Europe’s growth is tied to pharmaceutical and specialty-chemical projects targeting stricter emission norms.

• North America – Solid replacement cycle, strong construction and energy activity

• Europe – Demand fueled by EV manufacturing, chemical processing, and strict safety codes

• Asia-Pacific – Largest market share, driven by megaprojects, rapid industrialization, and agriculture modernization

• Middle East & Africa – Steady oil & gas pipeline builds and water-transfer projects

• Latin America – Mining and agribusiness investments spur lightweight, abrasion-resistant hose uptake

Segmentation Analysis

By Material

• Rubber – Core revenue driver, excelling in flexibility and high-pressure endurance.

Natural, nitrile, and EPDM blends dominate oil, steam, and coolant handling thanks to heat resistance and long burst life.

• PVC – Cost-effective, lightweight option ideal for agriculture, air, and mild-chemical duties.

UV-stable grades and food-contact formulations extend use into dairy wash-down and beverage transfer.

• Silicone – Premium niche for ultrapure processes and extreme temperatures.

Pharma and biotech facilities value its non-reactive nature and clean-in-place compatibility.

• Teflon – High-end solution for aggressive chemicals and high-temperature hydraulics.

Expanded PTFE liners paired with stainless braids meet stringent aerospace and semiconductor specifications.

• Others (Polyurethane, UPE, composite fabrics) – Specialty choices balancing cut resistance and flexibility.

Polyurethane covers thrive in wood-chip and grain handling where abrasion is severe.

By Media Type

• Water – Largest volume segment.

Dewatering, irrigation, and utility hoses benefit from easy coupling systems and ozone-resistant compounds.

• Oil & Fuel – High-value segment requiring nitrile and conductive liners.

New biofuel blends push suppliers to validate compatibility and prevent permeation.

• Air & Gas – Compressed-air lines and breathing-air hoses favor light PVC or hybrid constructions to cut operator fatigue.

• Hot Water & Steam – EPDM and silicone linings withstand thermal cycling in wash-down and sterilization tasks.

• Food & Beverage, Chemical – Demand for FDA, EU, and 3-A compliant materials grows alongside craft-brew and specialty-chem markets.

By Industry

• Construction & Infrastructure – Dominant share, roughly 19 %.

Concrete-placement, grout injection, and dust suppression rely on rugged, kink-resistant assemblies to keep job sites on schedule.

• Automotive – Hose demand shifts toward electric-vehicle battery cooling and lightweight air-intake lines, diversifying revenue streams.

• Oil & Gas – Upstream and downstream operations need durable transfer hoses for drilling mud, refined fuels, and LNG loading arms.

• Pharmaceuticals – Sterile transfer of APIs and solvents fuels uptake of silicone and PTFE lines with quick-clamp ends.

• Food & Beverages – Growth stems from craft brewing, dairy expansion, and plant-based protein production requiring odor-neutral hoses.

• Water & Wastewater Treatment, Mining, Agriculture, Others – These segments value abrasion resistance, long reels, and easy field repair to minimize outages.

Industry Developments & Instances

• April 2023 – Kurt Manufacturing acquired Bellatex Industries, broadening its polyurethane and specialty-hose offering

• January 2022 – Gates launched ProV hydraulic series targeting multi-industry mobile equipment

• February 2020 – NORRES added Swedish distributor Jarl Elmgren, expanding direct market access in Scandinavia

• April 2020 – Continental engineered PVC medical hoses for Italian ventilator production during pandemic surges

Facts & Figures

• Rubber captured about 39 % global material market share in 2023

• Asia-Pacific accounted for roughly 37 % of total revenue in 2023

• Average service life extension from RFID-tracked preventive maintenance exceeds 15 % compared with reactive replacement

• Lightweight PVC lines can reduce manual-handling effort by up to 30 % versus comparable rubber hoses

• Integrated hose-in-hose spill-containment designs are growing at more than 10 % annually in chemical transfer applications

Analyst Review & Recommendations

Market growth over the next decade hinges on material innovation and service support. Suppliers that marry tougher, lighter compounds with digital tracking and on-site assembly stand to outpace peers. We recommend prioritizing modular crimp systems, investing in polyurethane-liner R&D for biofuel compatibility, and expanding technician-training programs to close skills gaps and reduce warranty exposure.