Market Overview

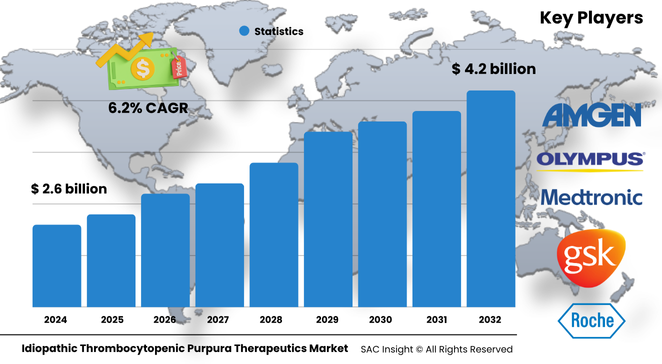

The global idiopathic thrombocytopenic purpura (ITP) therapeutics market size is valued at roughly US$ 2.67 billion in 2024 and is projected to reach about US$ 4.29 billion by 2032, expanding at an average 6.25% CAGR. First-hand industry insights highlight three growth engines: better disease recognition through molecular diagnostics, a steady pipeline of thrombopoietin receptor agonists, and rising healthcare access in high-population economies.

SAC Insight’s deep market evaluation shows the United States idiopathic thrombocytopenic purpura (ITP) therapeutics market alone could move from nearly US$ 0.8 billion in 2024 to around US$ 1.3 billion by 2032 as clinicians adopt combination regimens to cut relapse risk.

Summary of Market Trends & Drivers

• Point-of-care PCR and next-generation sequencing platforms are trimming diagnosis time, enabling earlier intervention and personalized dosing strategies.

• Strong preference for steroid-sparing agents is steering market growth toward TPO-RA and combination therapies that offer faster platelet recovery with fewer adverse effects.

• Patient-advocacy groups and rare-disease reimbursement policies are widening treatment access in Europe and Asia, supporting sustained market expansion.

Key Market Players

Industry leadership rests with a blend of biopharma innovators and diversified life-science firms. Companies such as Amgen, GSK, and F. Hoffmann-La Roche command significant market share with established brands and active life-cycle management strategies. Around them, specialty developers including Grifols, INTROMEDIC, and Shangxian Minimal Invasive are advancing pipeline assets, while device-focused players such as Medtronic and Olympus supply endoscopy and splenectomy tools that support second-line care.

Competitive dynamics increasingly revolve around accelerated clinical studies and orphan-drug incentives. Leading sponsors are pairing TPO-RA with low-dose corticosteroids in Phase III trials, pursuing fast-track designations, and signing regional marketing alliances to speed local approvals.

Key Takeaways

• Current global market size (2024): USD$ 2.67 billion

• Projected global market size (2032): USD$ 4.29 billion at a 6.25 % CAGR

• Corticosteroids remain first-line but TPO-RA show the fastest market growth as hospitals target steroid-sparing protocols

• Acute ITP dominates incidence, yet chronic cases generate the larger revenue share due to prolonged therapy needs

• North America leads in market share, while Asia-Pacific posts the highest percentage gains on the back of untapped patient pools

• Combination regimens and biosimilar IVIG formulations are reshaping treatment economics and broadening access

Market Dynamics

Drivers

• Increasing ITP prevalence linked to aging populations, viral triggers, and heightened clinical awareness

• Sustained R&D investment in novel mechanisms, including FcRn inhibitors and SYK blockers, fueling future approvals

• Favorable reimbursement under orphan-disease frameworks in the US, Japan, and EU

Restraints

• High treatment costs for biologics can limit uptake in low-income regions

• Variable patient response to existing therapies prompts frequent switching, raising overall care costs

• Potential side effects of long-term steroid use continue to challenge adherence

Opportunities

• Development of subcutaneous formulations and once-weekly dosing schedules to improve convenience

• Real-world data platforms that track platelet response and adverse events, supporting value-based pricing models

• Expanding pediatric indications and earlier-line positioning for TPO-RA in treatment guidelines

Challenges

• Supply-chain constraints for human-plasma-derived IVIG may cause periodic shortages

• Regulatory divergence on biosimilar pathways slows simultaneous multi-region launches

• Limited awareness in rural healthcare settings delays diagnosis and first treatment

Regional Analysis

North America currently dominates thanks to broad insurance coverage, active clinical-trial networks, and early adoption of TPO-RA. Europe follows closely, supported by centralized rare-disease funding and hospital tender systems that encourage brand competition. Asia-Pacific shows the fastest growth as China, India, and South Korea roll out national rare-disease lists and strengthen hematology referral centers.

• North America – Largest revenue base, robust clinical research and insurance reimbursement

• Europe – Rising R&D collaboration and centralized procurement improve market penetration

• Asia-Pacific – Quickest CAGR as expanding middle-class populations seek advanced care

• Latin America – Gradual uptake hindered by budget constraints but aided by public-sector tenders

• Middle East & Africa – Opportunistic growth through medical-tourism hubs and specialty centers

Segmentation Analysis

By Disease Type

• Acute ITP – High incidence, quick resolution.

Acute episodes, mostly in children, account for the majority of new diagnoses each year. Management focuses on short-term platelet support and watchful waiting, keeping drug exposure limited.

• Chronic ITP – Revenue powerhouse.

Relapsing or persistent cases drive prolonged therapy needs, favoring TPO-RA and periodic IVIG infusions. Intensified monitoring and personalized dose adjustments sustain recurring revenue.

• Others – Secondary and drug-induced variants.

These niche categories often overlap with autoimmune disorders, requiring cross-specialty care and off-label biologic use.

By Product

• Corticosteroids – First-line mainstay.

Low acquisition cost and rapid response keep steroids as the initial choice, though taper strategies are increasingly favored to curb adverse effects.

Steroid courses typically last four to six weeks; emerging algorithms advocate early switch to steroid-sparing agents when relapse risk is high.

• IVIG – Rapid platelet boost.

Hospital protocols rely on IVIG for emergency bleeding control or peri-operative preparation, supporting steady demand despite premium pricing.

Single-dose infusions offer quick but transient platelet elevation, making IVIG a complementary rather than long-term solution.

• Anti-D Immunoglobulins – Niche for Rh-positive patients.

Used mainly in select adult populations, demand fluctuates with Rh distribution and availability of alternative agents.

• TPO-RA – Fastest-growing class.

Eltrombopag, romiplostim, and newer small-molecule agonists are gaining preference for chronic ITP due to durable platelet response and oral or weekly dosing formats.

Clinical data show response rates above 70 %, positioning the class as the cornerstone of second-line therapy.

• Others – Emerging biologics and biosimilars.

Pipeline molecules targeting FcRn, BTK, and SYK aim to provide steroid-free, durable control; biosimilar IVIG and rituximab promise cost relief for health systems.

Industry Developments & Instances

• December 2022 – A major biopharma acquired a rare-disease specialist, adding a next-generation TPO-RA and expanding its hematology portfolio.

• August 2021 – An oral TPO-RA gained pediatric approval in the US, marking the first expansion of the class into children with chronic ITP.

• April 2021 – A biosimilar rituximab secured FDA clearance for adult ITP, introducing price competition in B-cell-targeted therapy.

• July 2020 – A leading immunology firm launched eltrombopag across key EU markets under fast-track designation, accelerating access via centralized procurement.

Facts & Figures

• Corticosteroids still initiate roughly 60 % of global first-line treatments despite rising steroid-sparing protocols.

• Real-world registries show TPO-RA achieve platelet response in more than 70 % of chronic ITP cases after 12 weeks.

• Chronic ITP accounts for about 55 % of total market revenue owing to longer treatment duration.

• Hospital IVIG usage peaks in North America, representing nearly 45 % of global IVIG sales for ITP.

• Average time from diagnosis to second-line therapy is shortening, now sitting below eight months in high-income countries.

Analyst Review & Recommendations

Market analysis underscores a decisive shift toward personalized, steroid-sparing care pathways. Manufacturers that blend patient-friendly dosing, robust safety data, and value-based contracting will outpace average market growth. Investors should monitor late-stage FcRn and SYK inhibitors for potential class disruptors, while payers can leverage real-world evidence to refine treatment algorithms and contain costs.?? engagement with patient groups and diagnostic-lab networks will remain essential to accelerate earlier diagnosis and maximize market growth potential.