Market Overview

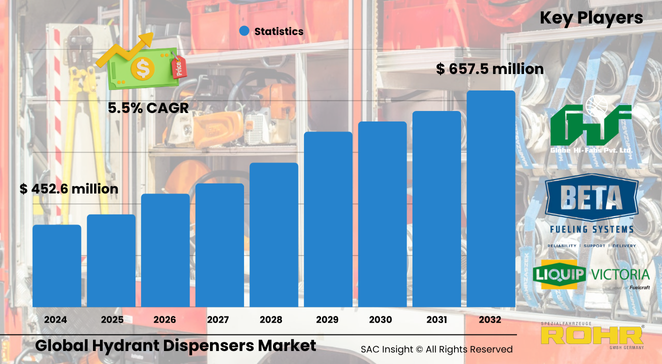

The global hydrant dispensers market size is valued at about US$ 452.6 million in 2024 and is projected to approach US$ 657.56 million by 2032, advancing at a 5.5% CAGR. First-hand industry insights indicate that rising passenger numbers, quicker aircraft turnaround targets, and stricter safety protocols are the major engines of market growth.

SAC Insight’s deep market evaluation shows the U.S. alone could climb from roughly US$ 120 million in 2024 to just over US$ 185 million by 2032 as the country’s busy hubs and large military fleet prioritise fast, low-spill refuelling infrastructure.

Summary of Market Trends & Drivers

Automation-ready dispenser designs, wider adoption of electric propulsion, and airport carbon-reduction mandates are converging to reshape market trends. Airlines and ground-handling firms are replacing fuel trucks with fixed hydrant networks to slash logistics costs, while high-traffic airports in Asia and the Middle East are specifying medium-flow (450–850 GPM) units to serve the latest narrow- and wide-body fleets without bottlenecks.

Key Market Players

Leading manufacturers include BETA Fueling Systems, Garsite Progress, Globe Hi-Fabs, Holmwood Group, Weihai Guangtai, Westmor Industries, and KAR-KUNZ. These companies combine modular chassis, fail-safe control systems, and smart flow meters to boost reliability while meeting evolving emission norms. Strategic moves such as airline fleet-service contracts, local assembly partnerships, and targeted acquisitions of electric-drive technology specialists are helping incumbents widen their market share and defend margins against niche newcomers.

European suppliers focus on all-electric, zero-spill units for airports with strict environmental targets, while Asia-Pacific firms emphasise cost-optimised, high-throughput carts for rapidly expanding regional airports. Across the board, data-rich telematics and predictive-maintenance packages are becoming decisive differentiators.

Key Takeaways

• Current global market size (2024): USD$ 452.6 million

• Forecast global market size (2032): USD$ 657.56 million at a 5.5 % CAGR

• Medium-flow (450–850 GPM) dispensers already account for more than 35 % of revenue and are the fastest-growing band

• Electric-powered units could secure an additional USD$ 7.5 million absolute opportunity through 2032 as airports chase net-zero targets

• Towable configurations hold the highest market share today, but self-propelled trucks are gaining as wide-body operations expand

• Asia-Pacific is set to deliver the quickest regional market growth thanks to aggressive airport-infrastructure spending in China and India

Market Dynamics

Drivers

• Continuous airport expansion programmes and larger aircraft fleets elevate demand for high-capacity hydrant systems

• Cost savings and safety gains versus fuel-truck operations motivate rapid dispenser adoption

• Government push for lower-carbon ground support equipment accelerates electric-drive conversions

Restraints

• High up-front capital outlay for advanced metering and automation can deter price-sensitive operators

• Diesel-engine emission regulations raise compliance costs for legacy fleets

• Supply-chain delays for speciality valves and sensors lengthen build times

Opportunities

• Smart dispensers with IoT diagnostics unlock new service-contract revenue for OEMs

• Hydrogen-ready and SAF-compatible components open a niche but growing segment

• Refurbishment programmes for older hydrant systems present attractive mid-life upgrade markets

Challenges

• Volatile aviation traffic—especially during economic downturns—can stall order pipelines

• Limited skilled technicians for complex electronic control systems increase downtime risk

• Space constraints at legacy airports hinder deployment of additional hydrant pits

Regional Analysis

Asia-Pacific leads market growth as governments invest billions in new runways and terminal capacity, while North America remains the largest revenue base on the back of dense flight schedules and substantial military procurement. Europe follows closely, driven by stringent environmental rules and fleet modernisation in key hubs.

• North America – Largest market share; focus on reducing turnaround times at mega-hubs and on military readiness

• Europe – Steady upgrades to all-electric ground support equipment and SAF-compatible infrastructure

• Asia-Pacific – Fastest CAGR; new greenfield airports in China, India, and Southeast Asia dominate order books

• Middle East & Africa – Growth tied to hub expansion in the Gulf and regional airline fleet upgrades

• Latin America – Moderate uptake as modernisation projects resume after pandemic-related delays

Segmentation Analysis

By Mass Flow Rate

• Less than 450 GPM – Light-duty support for regional jets.

Designed for commuter and narrow-runway operations, these compact carts prioritise manoeuvrability over volume, keeping service costs low for small airports.

• 450–850 GPM – Core mid-range, fastest-growing share.

This segment balances speed and cost, matching the refuelling needs of most single-aisle and mid-haul aircraft; rising domestic traffic worldwide is pushing demand sharply higher.

• 850–1050 GPM – Heavy-duty for long-haul giants.

Wide-body fleets rely on these high-flow dispensers to cut gate time; procurement spikes coincide with intercontinental route additions and hub-capacity upgrades.

By Configuration

• Towable – Workhorse of ground support fleets.

Airports favour towable carts for flexible apron deployment and lower maintenance, sustaining the segment’s leading revenue position.

• Self-Propelled – Gaining ground in busy hubs.

Built-in traction motors allow rapid repositioning between gates, making self-propelled units the choice for high-density international terminals.

By Propulsion

• IC Engine – Dominant today but plateauing.

Diesel-powered models underpin most installed fleets; stricter emission caps, however, are curbing fresh demand.

• Electric – Small base, high upside.

Battery-electric dispensers eliminate on-site emissions and qualify for green-airport incentives, driving double-digit annual shipments.

By Fuel Type

• Jet Fuel – Over 90 % share.

Commercial and military jet operations set the pace, demanding leak-free, high-accuracy metering to control costs.

• Avgas – Niche but stable.

General-aviation fields and flight-training schools sustain avgas-compatible dispenser orders, mainly in North America and Europe.

By Application

• Commercial Airports – Primary revenue engine.

Airline route growth and aggressive slot-utilisation targets make fast, safe refuelling non-negotiable, locking in steady dispenser demand.

• Military Airports – Strategic procurement cycles.

Large defence budgets and frequent sortie rates ensure recurring orders for ruggedised, easy-maintain units capable of austere-field operation.

Industry Developments & Instances

• March 2022 – A leading Thai aviation-fuel consortium partnered with an EU dispenser maker to co-develop hydrogen-ready electric units for a net-zero refuelling roadmap.

• September 2024 – A North American OEM launched a telematics-enabled self-propelled model that predicts valve wear, cutting unscheduled maintenance by 20 %.

• June 2025 – Major Gulf hub awarded a multi-year service contract covering 100-plus medium-flow carts, bundling parts, training, and software updates into a fixed-fee agreement.

Facts & Figures

• Towable units still account for roughly 60 % of annual shipments worldwide.

• Electric dispensers can trim apron CO2 emissions by up to 35 % compared with diesel equivalents.

• A single 850 GPM dispenser can reduce wide-body turnaround by nearly six minutes, saving an airline about USD$ 5,000 per daily aircraft utilisation cycle.

• Asia-Pacific airports added more than 120 new hydrant pits in 2024 alone.

• Predictive-maintenance software adoption across installed fleets climbed from 8 % in 2022 to 18 % in 2024 and is on track to exceed 30 % by 2027.

Analyst Review & Recommendations

Our market analysis confirms a decisive pivot toward smarter, cleaner, and faster hydrant dispensers. Suppliers that integrate battery-electric drivetrains, real-time flow analytics, and modular upgrade paths will outpace average market growth. Airports should prioritise mid-flow electric carts with cloud-based diagnostics to compress gate times and align with net-zero targets, while OEMs should expand service-bundle offerings to lock in recurring revenue and deepen customer loyalty.