Market Overview

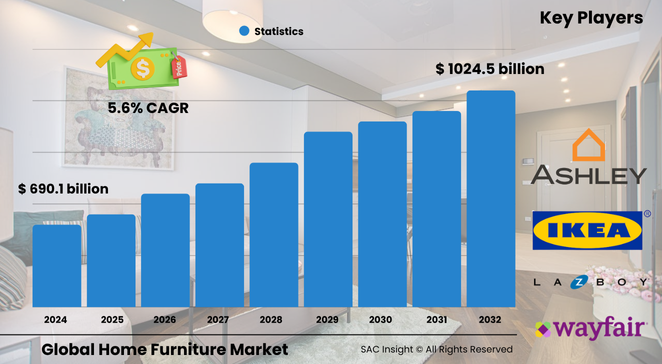

The global home furniture market size is valued at roughly US$ 690.10 billion in 2024 and is projected to hover near US$ 1024.5 billion by 2032, translating to an average 5.645% CAGR for the 2025-2032 forecast window. First-hand industry insights show three forces shaping market growth: surging residential construction, heightened demand for responsibly sourced materials, and a step-change in e-commerce logistics that shortens delivery lead times from weeks to days.

SAC Insight’s deep market evaluation indicates the United States home furniture market alone could approach one-quarter of global market share by 2032 as single- and two-person households accelerate purchases of compact, multi-purpose furnishings.

Summary of Market Trends & Drivers

• Ready-to-assemble designs and modular storage systems answer the twin pressures of shrinking living spaces and mobile lifestyles.

• Eco-friendly, formaldehyde-free products built from recycled wood, bamboo, or rattan are moving from niche to mainstream as consumers link indoor air quality with wellbeing.

• Online-first retailers refine virtual showrooms with AR tools, allowing shoppers to visualise scale and colour in situ, a proven driver of basket size and repeat orders.

Key Market Players

Global leadership rests with a blend of mass-market titans and design-driven regional specialists. Companies such as Ikea, Ashley Furniture Industries, La-Z-Boy, Bernhardt, and Godrej Interio anchor the sector through sprawling catalogues, vertically integrated supply chains, and omnichannel storefronts. Their ability to balance cost efficiency with design refreshes every six months keeps traffic high online and in store.

Competitive dynamics tighten as mid-tier brands embrace digital marketplaces and partner with local artisans for limited-edition runs. These collaborations emphasise sustainable sourcing, short production batches, and quick-ship programmes, eroding the historical advantage of the largest manufacturers while giving consumers more differentiated options.

Key Takeaways

• Current global market size (2024): USD$ 690.10 billion.

• Forecast global market size (2032): nearly USD$ 1024.5 billion at a 5.645 % average CAGR.

• Living-room seating and tables account for the largest revenue slice, driven by high ticket prices and frequent style refreshes.

• Wooden furniture retains the highest market share thanks to durability and aesthetic flexibility, while metal-framed pieces post the fastest incremental gains.

• Asia Pacific records the quickest market growth as urban middle-class households upgrade from basic to premium designs.

• Online retail is on course to surpass specialty stores as the leading distribution channel before 2030.

Market Dynamics

Drivers

• Rising disposable income and rapid urbanisation in emerging economies fuel spending on stylish, space-saving designs.

• E-commerce innovations—free returns, white-glove delivery, and real-time inventory—reduce purchase friction and widen geographic reach.

• Smart-furniture integrations such as wireless charging pads and voice-controlled lighting enhance perceived value.

Restraints

• Volatile raw-material costs for wood, foam, and metals compress margins, deterring aggressive price reductions.

• High freight rates and container shortages lengthen lead times, challenging just-in-time inventory strategies.

Opportunities

• Circular-economy programmes—refurbishment, subscription rentals, and trade-in credits—open new revenue streams and appeal to eco-conscious buyers.

• Augmented-reality shopping applications can raise conversion rates by easing colour-matching and fit decisions.

Challenges

• Second-hand marketplaces gain traction among value-oriented consumers, limiting unit sales of entry-level ranges.

• Counterfeit listings on grey-market platforms erode brand equity and demand constant monitoring.

Regional Analysis

North America commands the largest market share, underpinned by high per-capita spending and a mature omni-retail ecosystem. Asia Pacific, led by China and India, is the fastest-growing region as young urban consumers furnish first homes and embrace online flash-sale events.

• North America – Stable replacement demand, strong DIY culture supports RTA sales.

• Europe – Sustainability regulations accelerate adoption of low-VOC finishes and FSC-certified timber.

• Asia Pacific – Rapid urban housing starts and mobile-first shopping habits drive double-digit e-commerce gains.

• Latin America – Rising condominium developments lift demand for modular kitchen and storage units.

• Middle East & Africa – Premium furniture imports grow alongside expanding luxury residential projects.

Segmentation Analysis

By Product

• Living Room and Dining Room Furniture – Largest revenue generator.

High-value sofas, coffee tables, and entertainment units carry premium margins as consumers see these areas as the home’s showcase.

Demand remains resilient even in slower housing cycles because refresh cycles average five to seven years.

• Bedroom Furniture – Steady core demand.

Beds and mattresses post consistent market growth as wellness-oriented buyers upgrade to ergonomic designs and hybrid foam technologies.

Sleep-focused marketing and “mattress-in-a-box” fulfilment keep the category competitive.

• Kitchen Furniture – Space-efficient favourite.

Rising apartment living boosts demand for compact islands and fold-down breakfast bars.

Manufacturers bundle installation services to capture value beyond the product sale.

• Lamps and Lighting – Design accent.

Statement lighting doubles as decor, pushing retailers to expand style options and smart-bulb compatibility.

The category benefits from frequent trend cycles that encourage mix-and-match purchases.

• Plastic and Other Furniture – Budget and outdoor niche.

Weather-resistant resin sets dominate balconies and gardens where affordability and easy cleaning matter most.

Colour-fast additives and recycled plastics extend product life and sustainability credentials.

By Distribution Channel

• Specialty Stores – Curated experience.

Showrooms emphasise touch-and-feel, personalised design advice, and financing plans, sustaining loyalty despite higher price points.

• Supermarkets/Hypermarkets – Impulse value.

Flat-pack essentials and seasonal patio sets succeed in these high-traffic venues where price and convenience intersect.

• Online Retail Stores – Fastest-expanding route.

Virtual room planners, user reviews, and same-week delivery widen addressable markets beyond metropolitan cores.

• Other Channels – Rentals and club stores.

Furniture-as-a-service appeals to mobile professionals needing flexible, short-term solutions.

Industry Developments & Instances

• April 2023 – A leading global brand opened a 357 sq m flagship showroom in Phnom Penh, expanding Southeast Asian footprint.

• November 2022 – A major Indian player announced plans to add one hundred brick-and-mortar stores annually for four years to deepen national coverage.

• August 2021 – A North American manufacturer launched a fourth production facility in Mexico, aiming to double output within four years.

• July 2021 – A recliner specialist invested over USD$ 30 million to modernise its Missouri plant, shortening lead times for custom orders.

Facts & Figures

• Living-room furniture captures more than 30 % of total revenue owing to higher average selling prices.

• Wooden pieces command roughly 45 % market share, while metal and glass collectively account for 20 %.

• Online channels contributed close to 18 % of global sales in 2024 and are on track to cross 25 % by 2028.

• Beds and mattresses surpassed USD$ 43 billion in revenue in 2023 and continue growing at about 5.9 % annually.

• Formaldehyde-free product searches jumped 171 % year-on-year on a major e-commerce platform, signalling rising health awareness.

Analyst Review & Recommendations

Market analysis highlights a steady yet competitive landscape where design refresh speed, supply-chain agility, and sustainability credentials differentiate winners. Brands should accelerate circular-economy pilots and invest in AR shopping to improve customer confidence and reduce return rates. Vertical integration of last-mile delivery and installation services will further enhance market share as consumers prioritise convenience over pure price.