Market Overview

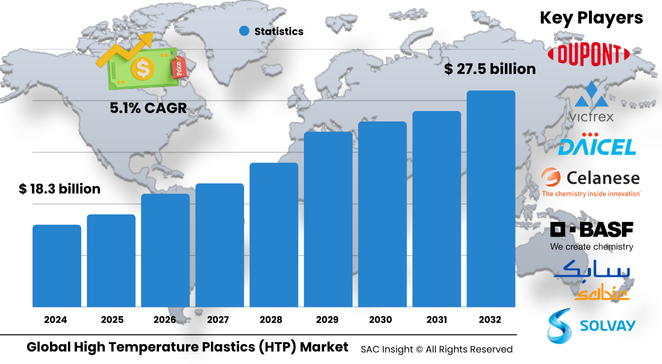

The global high temperature plastics market size is valued at about US$ 18.34 billion in 2024 and is projected to reach roughly US$ 27.52 billion by 2032, reflecting a healthy 5.15% CAGR. First-hand industry insights reveal that demand for lighter, corrosion-proof parts in electric vehicles, aircraft, and miniaturized electronics is the prime engine of market growth.

SAC Insight's deep market evaluation shows the United States high temperature plastics market alone could advance from nearly US$ 4.6 billion in 2024 to approximately US$ 6.90 billion by 2032 as domestic OEMs accelerate polymer substitution programs.

Summary of Market Trends & Drivers

• Mass-adoption of e-mobility, autonomous driving electronics, and battery systems is tilting specifications toward polymers that remain stable above 250 °C.

• Continuous advances in compounding, nanofillers, and additive manufacturing are raising mechanical strength while trimming part-cost, widening the material’s design window.

• Sustainability pressures are triggering market analysis of bio-based or fully recyclable HTP grades, opening fresh niches for innovators.

Key Market Players

Sector leadership rests with a blend of diversified chemical majors and focused engineering-polymer specialists. Companies such as Solvay, BASF, DuPont, Celanese, SABIC, Victrex, Arkema, Toray, and Ensinger anchor large-volume production, captive compounding, and multi-regional supply chains. Their competitive playbook centers on new resin chemistries—think low-warpage fluoropolymers or fast-cycle PPS compounds—paired with technical-service teams that co-design parts with Tier 1s.

Alongside the majors, agile mid-size firms including Polyplastics, DIC, Kureha, and Lion Idemitsu are carving out share through niche expertise in high-performance polyamides, polyketones, and liquid crystal polymers. Most leading players are doubling down on capacity in Asia while pushing closed-loop recycling pilots to meet customer carbon targets.

Key Takeaways

• Current global market size (2024): USD$ 18.34 billion

• Projected global market size (2032): USD$ 27.52 billion at a 5.15 percent CAGR

• Electronics & electrical applications command the largest market share at just over one-third of revenue and are set to top USD$ 8.5 billion by 2032

• Fluoropolymers are the single biggest product type, slated to deliver an incremental USD$ 4.7 billion opportunity through 2032

• The U.S. market is forecast to reach around USD$ 6.90 billion by 2032 on the back of robust aerospace, EV, and semiconductor investments

• R&D is pivoting toward recyclable, low-friction, and self-healing HTP grades as end users tighten sustainability criteria

Market Dynamics

Drivers

• Weight-reduction programs in automotive and aerospace shift metal parts to high-temperature plastics, improving fuel economy and battery range.

• Market trends favor miniaturized, high-wattage electronics that need polymers with superior dielectric strength and continuous-use temperatures above 200 °C.

• Regulatory push for lower emissions motivates OEMs to replace lubricated metal components with dry-running, low-maintenance HTP equivalents.

Restraints

• Volatile prices for specialty monomers and high-purity additives inflate formulation costs and squeeze smaller processors.

• Technical molding challenges—high melt viscosity, shrinkage control, and tool wear—limit adoption among converters lacking advanced equipment.

Opportunities

• Hydrogen fuel-cell, geothermal, and oil-tooling segments present untapped demand for materials that hold mechanical integrity at 300 °C+ and in corrosive chemistries.

• Additive manufacturing of HTPs enables low-volume, high-complexity parts, opening premium revenue streams for service bureaus.

Challenges

• Ensuring consistent global supply while meeting tighter sustainability metrics pushes manufacturers to invest in closed-loop recycling and renewable feedstocks.

• Rising space-debris regulations in LEO satellites demand polymers that burn up completely on re-entry, prompting new compliance hurdles.

Regional Analysis

North America leads market share thanks to deep aerospace and semiconductor ecosystems, while East Asia posts the fastest percentage gains as China, South Korea, and Japan expand EV battery and 5G infrastructure. Europe follows closely, buoyed by strict CO2 rules that favor lightweighting and electrified powertrains.

• North America – Largest revenue base; strong defense and EV battery pipelines

• Europe – Rapid growth fueled by stringent emissions standards and medical-device innovation

• East Asia – Quickest CAGR as local champions localize advanced polymer supply

• South Asia & Pacific – Emerging aerospace offsets slower automotive uptake

• Middle East & Africa – Niche demand in petrochemicals and heat-exchanger applications

• Latin America – Steady growth tied to expanding electronics assembly and oilfield tooling

Segmentation Analysis

By Product Type

• Fluoropolymers – Benchmark heat and chemical resistance.

Fluoropolymers dominate because they sustain service above 260 °C and shrug off aggressive solvents, making them the default in wafer-fab fixtures and fuel-cell seals.

• Polyamides & High-Performance Polyamides – Fastest-growing engineering workhorses.

Improved glass-fiber grades and lower moisture uptake allow these materials to replace die-cast alloys in under-bonnet EV components without costly tooling changes.

• Polyketones – Emerging for hydrocarbon barrier parts.

They combine PPS-like temperature capability with low gas permeability, attracting interest for hydrogen tanks and fuel lines.

• Polysulfones – Preferred for medical sterilization.

Excellent steam-cycling endurance positions polysulfones in reusable surgical instruments and dialysis modules that must withstand repeated autoclave.

• Polyphenylene Sulfide – Cost-competitive high-temperature resin.

PPS offers dimensional stability and flame retardance for connectors and motor slots, delivering high volumes at moderate price points.

• Liquid Crystal Polymers – Go-to for micro-precision.

Ultra-low warpage and high flow enable thin-wall connectors and antenna arrays in 5G smartphones.

By End-Use

• Electronics & Electrical – Core demand engine.

Miniaturization and higher power density in servers, ADAS modules, and 800 V inverters keep electrical grades in the lead.

• Automobiles – Rapid EV-centred adoption.

Battery enclosures, power-electronics housings, and turbo-charger parts drive strong volume, offsetting slower ICE platforms.

• Aerospace – High-margin specialty market.

Lightweight cabin brackets, wire insulation, and bleed-air ducts rely on HTPs to trim weight and simplify maintenance schedules.

• Chemical / Industrial – Resilient process equipment.

Pump housings, filter plates, and heat-exchanger components benefit from non-corrosive, high-temperature performance.

• Medical – Small but rising share.

Biocompatible, sterilizable polymers enter surgical tools and implantable devices for long-term patient safety.

• Other End-Uses – 3D-printing, energy, and oilfield tools.

Extreme service requirements and rapid prototyping make HTPs attractive across niche segments.

By Processing Method

• Injection Molding – Dominant volume route.

High-speed, multi-cavity tools cut cycle times, expanding automotive and E&E throughput.

• Extrusion – Key for films, pipes, and wire coatings.

Continuous processes deliver uniform tubing and high-frequency cables.

• Compression Molding & Casting – Large, thick-wall parts.

Preferred for composite aircraft panels and industrial pump bodies.

• Thermoforming – Low-volume, quick-turn panels.

Used in medical tray systems and specialty housings.

Industry Developments & Instances

• December 2024 – BASF started a new high-temperature thermoplastics unit in Yeosu, South Korea to meet rising Asian electronics demand.

• November 2024 – DuPont unveiled a polyimide family for aerospace ducting rated to 315 °C continuous use.

• October 2024 – Celanese introduced PPS grades with faster crystallization for EV motor stators, cutting molding cycle by up to 20 percent.

• June 2024 – A leading Japanese processor piloted closed-loop recycling of glass-reinforced PA 46 for laptop hinges.

Facts & Figures

• Electronics & electrical accounted for 34.1 percent of market revenue in 2025.

• Fluoropolymers are projected to hit roughly USD$ 10.7 billion by 2032.

• Average raw-material cost volatility reached 7 percent in 2024, pressuring converter margins.

• Replacing steel oil-pump gears with HTPs can cut component mass by up to 60 percent while maintaining strength.

• Electric vehicle content of HTPs rose 12 percent year-on-year between 2023 and 2024.

Analyst Review & Recommendations

High temperature plastics continue to edge out metals wherever weight, corrosion, and thermal limits intersect. To capture outsized market growth, suppliers should prioritize fast-cycle, recyclable grades and partner with Tier 1s on part design to ease processing hurdles. Downstream players are advised to lock in dual sourcing and invest in molding expertise to navigate resin-price swings and ensure consistent quality as volumes climb toward 2032.