Market Overview

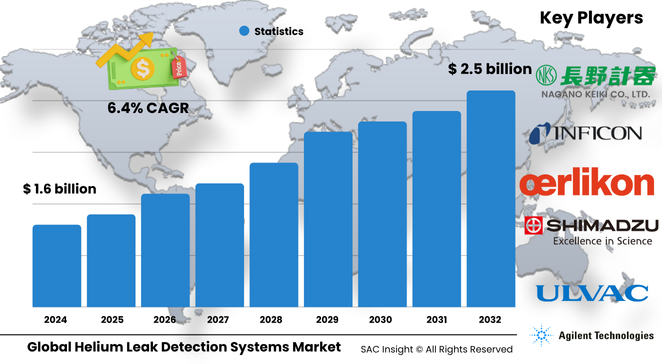

The global helium leak detection systems market size is valued at about US$ 1.64 billion in 2024 and is on track to approach roughly US$ 2.56 billion by 2032, reflecting a healthy 6.45% CAGR. First-hand industry insights show sustained demand from high-precision industries, tight global quality mandates, and rising automation across robotic production lines.

SAC Insight's deep market evaluation highlights the United States helium leak detection systems market is advancing toward nearly US$ 350 million by 2032 as automotive electrification and aerospace re-shoring accelerate stringent leak-test requirements.

Summary of Market Trends & Drivers

• Single-chamber systems with rapid 48-second cycle times are replacing legacy multi-step setups, lifting throughput in battery, fuel-cell, and refrigeration plants.

• Vacuum and sniffer technologies are integrating smart sensors and AI-driven analytics that flag micro-leaks before they trigger scrap or warranty claims, anchoring steady market growth.

• Heightened environmental and energy-efficiency regulations are pushing manufacturers to verify tight seals in HVAC and power-generation equipment, expanding the customer base beyond traditional aerospace users.

Key Market Players

Industry leadership rests with a mix of instrumentation specialists and diversified vacuum-technology firms. Companies such as Inficon, Agilent, Pfeiffer Vacuum, Leybold, and ULVAC compete on sensitivity, cycle speed, and ease of calibration, while LACO Technologies and Cincinnati Test Systems focus on modular, application-specific rigs for automotive, medical, and HVAC lines. Competitive dynamics revolve around software-enabled diagnostics, portable form factors, and service networks that guarantee 24-hour parts availability.

Key Takeaways

• Current global market size (2024): USD$ 1.64 billion

• Projected global market size (2032): USD$ 2.56 billion at a 6.45 % CAGR

• Top five suppliers command roughly 23 % market share in a still-fragmented field

• Single-chamber platforms headline product demand and could reach about USD$ 0.95 billion by 2032

• Automotive applications account for roughly 21 % of revenue and are projected to expand at a 6.5 % CAGR

• The U.S. market is set to exceed USD$ 350 million by 2032 on the back of electrified-vehicle battery production hubs

Market Dynamics

Drivers

• Strict global quality-control frameworks in automotive, aerospace, and medical device manufacturing

• Rising helium detector adoption over dye-penetrant or bubble testing owing to superior sensitivity and operator-independent results

• Rapid automation and robotics installations in Asia encouraging inline, high-throughput leak testers

Restraints

• High capital and ongoing helium supply costs weigh on adoption among small and mid-sized enterprises

• Growing interest in lower-cost hydrogen forming-gas detectors in non-critical sniffing applications

Opportunities

• Software upgrades that convert legacy detectors into connected, IoT-ready quality-assurance nodes

• Emerging demand from green-hydrogen electrolyzer and fuel-cell stack production lines

Challenges

• Tight global helium supply and price volatility can inflate testing expenses and create procurement uncertainty

• Need for skilled technicians to calibrate and maintain high-vacuum systems, particularly in developing markets

Regional Analysis

Asia Pacific leads current unit shipments thanks to surging electronics, battery, and HVAC investments across China, Japan, and South Korea, while North America delivers the highest average selling price on premium aerospace and defense projects. Europe follows with a robust automotive and pharmaceutical footprint and an entrenched culture of preventative maintenance.

• North America – High spending per system; aerospace refurbishments and EV battery plants underpin demand

• Europe – Stringent CE and pharma GMP standards sustain steady replacement cycles

• Asia Pacific – Fastest market growth driven by electronics, robotics, and expanding HVAC exports

• Latin America – Gradual uptake tied to automotive component clusters in Mexico and Brazil

• Middle East & Africa – Niche power-generation and LNG projects create sporadic but high-value orders

Segmentation Analysis

By Technology

• Vacuum – Benchmark for high sensitivity.

Vacuum systems surround the part in an evacuated chamber, inject helium, and detect partial-pressure rise; they dominate critical applications such as aerospace fuel tanks and EV battery modules.

• Sniffer – Cost-effective for field service.

Lightweight handheld probes trace helium escaping from assembled products, popular in HVAC, refrigeration, and routine maintenance tasks where a full chamber is impractical.

• Other Processes – Mass-spectrometry hybrids.

Specialized methods, including spray-wand and accumulation techniques, serve lab-scale research and ultra-clean semiconductor lines that require sub-10-9 mbar-l/s resolution.

By Application

• Aerospace – Mission-critical sealing.

Leak integrity of fuel, hydraulic, and life-support systems drives steady detector upgrades across MRO shops and new aircraft production.

• Automotive – Battery and powertrain surge.

EV battery packs, e-compressors, and ADAS sensors demand tight seals, pushing automakers to shift from water-bath tests to helium chambers for faster takt times.

• Medical – Zero-fault tolerance.

Pacemakers, surgical tools, and implantable devices rely on helium detection to meet FDA and ISO 11607 packaging rules.

• HVAC – Energy-efficiency pressure.

Heat-pump and VRF manufacturers adopt sniffer stations to meet refrigerant-leak limits and secure eco-label certifications.

• Power Generation and Others – Safety assurance.

Gas turbines, nuclear steam generators, and LNG valves require periodic helium checks to avoid costly downtime and emissions fines.

By Component

• Hardware – Core revenue engine.

Detectors, turbomolecular pumps, and calibrated leaks form 70 % of spend, with miniaturized spectrometers gaining ground in portable models.

Hardware upgrades that cut helium consumption by recycling tracer gas are now standard on flagship systems.

• Software – Analytics tailwind.

Real-time dashboards, remote calibration alerts, and SPC integration raise throughput and slash scrap; subscription models create sticky recurring revenue.

• Services – Lifecycle support.

Preventive maintenance, on-site training, and rapid spares logistics keep uptime above 98 %, especially in 24/7 automotive lines.

By End-User

• Manufacturing – Dominant adopter.

Inline test rigs validate every part off the line, supporting zero-defect mandates across automotive, electronics, and HVAC.

• Laboratories – Precision research.

Materials science and semiconductor fabs rely on helium mass-spectrometry benches for ultra-low leak thresholds.

• Research Institutes and Others – Niche demand.

Particle accelerators, cryogenic equipment, and space-science projects require customized helium detection modules configured for extreme-vacuum environments.

Industry Developments & Instances

• 2024 – A leading vacuum-technology firm introduced an AI-enabled single-chamber detector capable of adaptive test-time optimization, cutting helium usage by 15 %.

• 2023 – An automotive OEM partnered with a regional integrator to retrofit ten battery-pack lines with closed-loop helium recovery, slashing tracer gas costs by 40 %.

• 2023 – Portable sniffer units with Bluetooth data export entered field service kits for global HVAC contractors, enabling cloud-based leak history tracking.

• 2022 – Pharmaceutical packagers adopted GMP-compliant helium integrity testers ahead of stricter sterility guidelines, driving a spike in laboratory-grade system orders.

Facts & Figures

• Single-chamber platforms already account for roughly 49 % of global revenue.

• Vacuum-based systems achieve leak-rate detection down to 1 × 10-10 mbar-l/s.

• Average helium consumption per test cell fell by about 12 % between 2020 and 2024 due to gas-recovery upgrades.

• Automotive battery-pack lines now specify cycle times under 50 seconds, a 30 % improvement over 2019 standards.

• Portable sniffer detectors weigh as little as 1.8 kg, enhancing technician mobility in field inspections.

Analyst Review & Recommendations

Market analysis underscores a decisive pivot toward smarter, leaner leak-testing setups that marry hardware precision with cloud analytics. Suppliers that lower helium dependence through recovery circuits and predictive software will capture outsized market share. Manufacturers should budget early for operator training and helium supply contracts while exploring hybrid hydrogen solutions for non-critical checks to contain costs and secure uninterrupted quality assurance.