Market Overview

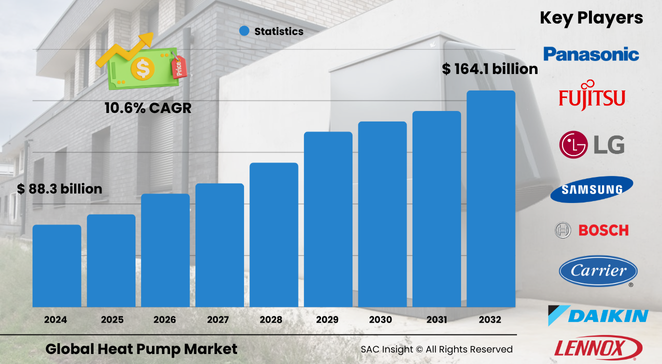

The global heat pump market size is valued at roughly US$ 88.3 billion in 2024 and is projected to surge to about US$ 164.12 billion by 2032, registering an average 10.65% CAGR over the 2025-2032 forecast period. First-hand industry insights show three clear growth engines: aggressive electrification policies in buildings, rapid performance gains in cold-climate models, and mounting corporate demand for low-carbon HVAC retrofits.

SAC Insight’s deep market evaluation indicates the United States global heat pump market alone could leap from US$ 18.66 billion in 2024 to nearly US$ 38.27 billion by 2032 as federal tax credits and state rebates accelerate residential conversions.

Summary of Market Trends & Drivers

Momentum is shifting from fossil-fuel furnaces toward inverter-driven air-to-water systems that deliver both heating and cooling with 65 %-plus seasonal efficiency gains. Smart home integration, remote diagnostics, and refrigerants with ultra-low global-warming potential are redefining market trends and shortening replacement cycles. Simultaneously, stringent building codes across Europe and Asia mandate higher coefficients of performance, pushing manufacturers to upgrade compressors, variable-speed fans, and hybrid configurations that pair heat pumps with existing boilers for peak-load coverage.

Key Market Players

Global leadership rests with a blend of diversified HVAC giants and agile regional challengers. Firms such as Carrier, Daikin, Mitsubishi Electric, and Panasonic command extensive portfolios spanning air-source minisplits to large-tonnage industrial units, supported by robust service networks and aggressive R&D in eco-friendly refrigerants. Their strategy centers on vertically integrated production, digital twins for performance optimization, and partnerships with utilities to bundle equipment rebates with demand-response programs.

Alongside these incumbents, innovators like Midea, LG Electronics, Bosch, and Johnson Controls capture fast-growing segments through modular designs, cold-climate scroll compressors, and plug-and-play hydronic kits. Many are co-developing hybrid or PVT (photovoltaic-thermal) solutions with solar integrators, creating differentiated offerings that address net-zero building mandates and energy-storage goals.

Key Takeaways

• Current global market valuation (2024): about USD$ 88.3 billion

• Projected global market valuation (2032): around USD$ 164.12 billion at a 10.65 % CAGR

• U.S. market share dominates North America, forecast to near USD$ 38.27 billion by 2032

• Air-source units account for more than 80 % of 2024 shipments; geothermal shows the fastest percentage gains where ground loops are feasible

• Residential retrofits remain the primary revenue stream, but industrial waste-heat recovery applications are emerging as a high-margin niche

• Smart, cloud-connected controllers and ultra-low-GWP refrigerants are reshaping competitive positioning

Market Dynamics

Drivers

• Decarbonization targets and carbon-pricing schemes boost demand for electricity-based heating and cooling.

• Rising electricity from renewables lowers operating costs, reinforcing the market growth narrative.

• Enhanced rebates under programs such as the U.S. Inflation Reduction Act cut payback periods below five years for many homeowners.

Restraints

• High upfront installation costs, especially for geothermal loops and hybrid systems, deter budget-constrained consumers.

• Performance degradation in extreme sub-zero climates requires larger auxiliary heaters, raising lifecycle costs.

• Skilled-installer shortages slow project timelines in several high-demand regions.

Opportunities

• Rapid urban redevelopment in Asia-Pacific opens large contracts for centralized air-to-water heat pumps in high-rise complexes.

• Integration with rooftop solar and behind-the-meter batteries positions heat pumps as flexible grid assets.

• Growing corporate net-zero commitments spur demand for industrial heat pumps capable of delivering process heat up to 160 °C.

Challenges

• Supply-chain volatility for compressors, electronic expansion valves, and rare-earth magnets affects delivery schedules.

• Evolving F-gas regulations add design complexity and certification costs as manufacturers shift to R290 or R744 refrigerants.

• Competition from high-efficiency gas boilers in regions with low natural-gas prices pressures margins.

Regional Analysis

Europe currently leads global heat pump adoption thanks to aggressive emission-reduction mandates and dense installer networks, while Asia-Pacific delivers the quickest shipment growth on the back of massive residential construction and energy-security goals. North America follows closely as federal incentives widen.

• North America – Large retrofit market, strong policy support, rapid cold-climate technology uptake

• Europe – Highest penetration rate, stringent energy-performance directives, mature rebate schemes

• Asia-Pacific – Fastest CAGR, driven by China, Japan, and South Korea; India emerging on soaring cooling demand

• Latin America – Growing middle-class adoption, rising electricity prices encourage switchovers

• Middle East & Africa – Early but promising interest in hybrid water-source units paired with large solar arrays

Segmentation Analysis

By Technology

• Air Source – Mass-market workhorse, commanding over 80 % market share.

Air-to-air and air-to-water units score with easy installation, declining compressor costs, and smart controls that optimize defrost cycles, making them the first choice for residential upgrades.

• Water Source – Highest efficiency in stable-temperature environments.

Ideal for properties near lakes or rivers, these systems post COPs above 5, appealing to premium hospitality and district-energy projects focused on long-term savings.

• Geothermal – Smaller volume, superior performance.

Ground-source loops leverage constant subsurface temperatures, slashing annual energy bills but require upfront drilling investments, limiting uptake to new builds or high-end retrofits.

• Hybrid – Dual-fuel flexibility, rising interest.

Combining heat pumps with condensing gas boilers delivers comfort during extreme cold and unlocks fuel-switching incentives, popular in northern Europe.

• PVT – Emerging niche, integrated renewable package.

Photovoltaic-thermal collectors feed electricity and low-grade heat into the pump, boosting self-consumption rates and meeting zero-energy-building criteria.

By Capacity

• Up to 10 kW – Core residential segment, fastest-growing.

Compact inverter models suit apartments and small houses, driven by online retail and DIY-friendly kits.

• 10-20 kW – Versatile mid-range for small commercial sites.

Schools, restaurants, and swimming pools favor this class for balanced performance, low noise, and hydraulic flexibility.

• 20-50 kW and Above – Industrial and multi-family demand engine.

These high-capacity units serve district heating, warehouses, and process-heat recovery, where economies of scale offset installation complexity.

By Application

• Residential – Main revenue anchor.

Urban electrification mandates and smart-home platforms that show real-time savings keep household adoption high.

• Commercial – Strong upgrade cycle.

Office retrofits and hospitality chains pursue ESG scores, installing variable-refrigerant-flow (VRF) heat pump systems to cut operating costs.

• Industrial – Early-stage but high-value.

Chemical and food processors retrofit compressors capable of reaching process-heat temperatures, capturing waste heat that previously vented to atmosphere.

By Operation Type

• Electric – Dominant mode at 86 % share.

Inverter-driven scrolls and twin-rotary designs optimize seasonality, while grid-interactive features enable demand response.

• Hybrid – Growing at double-digit rates.

Dual-fuel logic controllers switch between gas and electric, ensuring comfort and minimizing carbon intensity during grid peaks.

Industry Developments & Instances

• November 2023 – Daikin launched R32-based high-temperature VRV 5 systems up to 56 kW to meet low-GWP mandates.

• November 2023 – LG opened an Alaska cold-climate R&D center under the CAHR consortium to refine sub-zero performance.

• September 2023 – Fujitsu partnered with Sensibo to integrate cloud analytics into minisplit and heat pump controls across Australia and New Zealand.

• March 2023 – Mitsubishi Electric unveiled propane (R290) air-source units capable of 75 °C domestic hot water for retrofit boilers in Europe.

• January 2023 – Johnson Controls acquired Hybrid Energy AS to expand high-temperature industrial heat pump offerings.

Facts & Figures

• Over 3.8 million air-source heat pumps were shipped in Europe during 2024, a 37 % jump year on year.

• Cold-climate models deliver up to 20 % higher seasonal COPs after inverter firmware updates introduced in 2023.

• Smart-thermostat integration cuts annual energy bills by an additional 8-10 % versus standalone units.

• Ground-source systems can reduce greenhouse-gas emissions by roughly 70 % compared with oil boilers over a 15-year lifecycle.

• R290 refrigerant units feature a GWP of just 3, aligning with pending F-gas phase-down thresholds.

Analyst Review & Recommendations

Market analysis underscores a decisive pivot from single-function HVAC toward integrated, grid-interactive heat pumps. Suppliers that combine ultra-low-GWP refrigerants with cloud analytics and flexible financing will capture outsized market growth. Stakeholders should prioritize installer training, streamline permitting for geothermal loops, and forge alliances with solar and battery providers to deliver turnkey decarbonization packages that resonate with policy goals and consumer expectations.