Market Overview

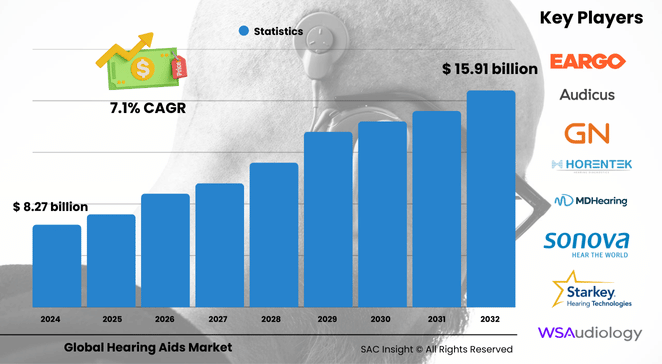

The global hearing aids market size was valued at roughly US$ 8.27 billion in 2024 and is projected to reach about US$ 15.91 billion by 2032, advancing at a 7.1% CAGR during 2025-2032. This steady market growth is powered by three structural forces: a rapidly aging global population, wider screening programs that catch hearing loss earlier, and sustained product innovation—particularly AI-driven digital devices that deliver a more natural listening experience.

SAC Insight industry insights highlight robust demand recovery after pandemic disruptions; procedure volumes now exceed 2019 levels, and unserved need remains large. In the U.S., where an estimated 15% of adults live with some degree of hearing loss, the market is set to surpass US$ 4 billion by 2032 as over-the-counter (OTC) policy changes widen access.

Market Trends & Drivers

• AI-enabled sound processing, Bluetooth streaming, and smartphone-based remote fitting are redefining user expectations, pulling digital devices to the foreground.

• Rising awareness campaigns in developing economies, coupled with healthcare privatization, are expanding the addressable base faster than previously forecast.

• Retail chains and e-pharmacies are reshaping the buying journey, making price and feature comparison easier for consumers and squeezing margins for traditional clinics.

Key Market Players

Global leadership rests with diversified specialists recognized for deep R&D pipelines and broad geographic footprints. Firms such as Sonova, GN Store Nord, WS Audiology, Starkey, and Demant collectively hold the lion’s share of market revenue by continually refreshing portfolios with micro-RIC, rechargeable, and app-connected models. Mid-tier innovators—including Eargo, Audicus, and a growing cohort of Asian manufacturers—are carving out space through direct-to-consumer channels, competitive pricing, and niche form factors that appeal to tech-savvy users. Consolidation remains brisk; strategic acquisitions of startups with acoustic-lens or AI-software expertise help incumbents cut time-to-market and extend their market share into emerging segments like hearables and smart eyewear.

Key Takeaways

• Current market value (2024): USD$ 8.27 billion

• Projected value (2032): USD$ 15.91 billion at a 7.1% CAGR

• Europe retains the largest regional market share at roughly 38%, while Asia-Pacific posts the fastest gains.

• Behind-the-ear devices command about 40% of 2024 revenue, but canal aids record the highest unit growth.

• Digital technology makes up more than 90% of unit sales, driven by better programmability and wireless streaming.

Market Dynamics

Drivers

• Growing geriatric population and longer life expectancy worldwide

• Continuous product upgrades: AI algorithms, rechargeable batteries, and discreet form factors

• Government-backed early screening and OTC pathways boosting adoption

Restraints

• High upfront device costs and limited reimbursement in several countries

• Persistent social stigma surrounding visible hearing aids, especially among younger adults

Opportunities

• Rapid urbanization and expanding middle class in Asia-Pacific create room for mid-priced smart devices

• Tele-audiology platforms cut follow-up costs and open white-space in remote regions

Challenges

• Shortage of trained audiologists in low-income markets limits fitting capacity

• Price competition from consumer electronics brands entering hearables blurs regulatory boundaries

Regional Analysis

Europe leads the global market thanks to strong public reimbursement, high screening rates, and a mature distribution network. Asia-Pacific, however, is the clear engine of future market growth: large geriatric cohorts in China and Japan, rising disposable incomes across Southeast Asia, and local manufacturing partnerships all point to double-digit gains through 2032.

• North America – High adoption of premium digital devices; policy shift toward OTC aids widens consumer pool

• Europe – 38% market share; ageing population, universal healthcare coverage, and early intervention programs drive demand

• Asia-Pacific – Fastest CAGR; increasing product launches, strategic partnerships, and growing medical tourism

• Latin America – Gradual uptake aided by improving private insurance coverage and mid-tier device pricing

• Middle East & Africa – Early-stage but expanding, supported by urban hospital investments and awareness campaigns

Segmentation Analysis

By Product Type

• Behind-the-Ear (BTE) – Robust, versatile design, holds the largest revenue share BTE devices offer strong amplification, easy cleaning, and Bluetooth connectivity, making them popular among children and adults who need high power and reliability.

• Receiver-in-the-Ear (RIE) – Slim profile with natural sound pickup RIE models place the speaker in the ear canal, improving high-frequency clarity and comfort for mild to severe losses; their aesthetic appeal supports rapid uptake.

• In-the-Ear (ITE) – Custom shell for moderate hearing loss Custom-molded ITE units sit entirely within the outer ear, balancing discretion with battery life and straightforward handling for seniors.

• Canal Hearing Aids – Fastest-growing category due to invisibility Completely-in-canal (CIC) and invisible-in-canal (IIC) styles address cosmetic concerns and reduce wind noise, attracting younger adults who previously avoided aids.

By Technology

• Digital – Over 90% share, core engine of market growth Digital platforms allow precise frequency shaping, multi-environment presets, and smartphone streaming, which substantially improves user satisfaction and repeat purchase rates.

• Analog – Niche segment serving value-oriented users Simple, uniform amplification and lower price points keep analog devices relevant for select markets, but upgrades to digital continue to erode share.

By Sales Channel

• Retail Stores (Company-Owned and Independent) – 71% of revenue Established clinics and chain retailers offer in-person testing, same-day fitting, and after-sales support, maintaining customer loyalty despite rising online offerings.

• E-Pharmacy – High-growth, convenience-driven model Online channels provide virtual screening questionnaires, transparent pricing, and home delivery, expanding reach to tech-savvy buyers and rural areas.

• Others – Hospital audiology departments and ENT practices Specialist centres cater to complex cases requiring implant candidacy evaluation or medical management.

By Type of Hearing Loss

• Sensorineural – Dominant segment Age-related degeneration and noise exposure make sensorineural loss the most common, sustaining demand for both BTE and RIE devices.

• Conductive – Smaller share, typically managed via surgery or bone-anchored aids Chronic ear infections and congenital malformations spur use of bone conduction solutions for patients unresponsive to traditional devices.

By Patient Type

• Adults – Core user base Occupational noise exposure and lifestyle-related loss in mid-life adults create a steady pipeline of new users and upgrade demand every four to five years.

• Pediatrics – Smaller but critical segment Early intervention in children improves language development; mini-BTE devices with tamper-proof features cater specifically to this group.

Industry Developments & Instances

• October 2023 – Launch of a next-generation RIC family featuring LE Audio connectivity, enabling clearer group conversations.

• March 2023 – Introduction of a premium CIC device with adaptive feedback suppression and rechargeable lithium battery.

• March 2022 – Acquisition of a leading consumer audio division to accelerate convergence of hearing health and lifestyle wearables.

• September 2022 – Roll-out of an AI-assisted fitting platform that automatically fine-tunes devices via smartphone in under five minutes.

Facts & Figures

• Digital technology accounts for more than 93% of total unit sales.

• Europe recorded about 196 million people with hearing impairment in 2021, projected to reach 236 million by 2050.

• Behind-the-ear devices generated roughly 40% of 2024 revenue.

• Retail outlets capture 71% of global sales, while e-pharmacy channels grow at double the market average.

• Average replacement cycle is 4–5 years, driving steady refresh demand.

Analyst Review & Recommendations

SAC Insight's deep market analysis confirms that the hearing aids landscape is shifting toward consumer-centric, connected solutions. Companies that integrate AI-powered sound processing, remote support, and lifestyle form factors will outpace peers. To capture market share in fast-growing Asia-Pacific, incumbents should expand mid-tier product lines and strengthen distributor training. Meanwhile, investment in tele-audiology and OTC channels will be critical for sustaining growth in mature markets where price transparency and convenience increasingly guide purchasing decisions.