Market Overview

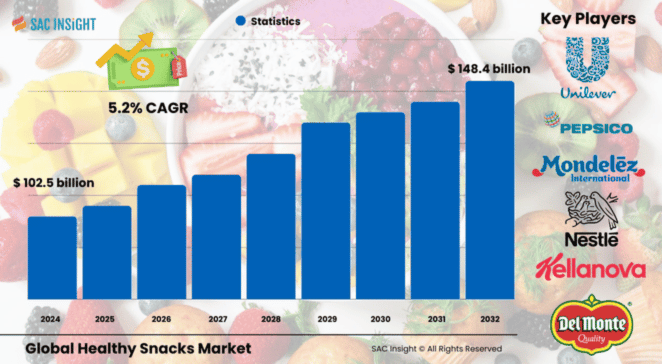

The healthy snacks market size was valued at US$ 102.53 billion in 2024 and is projected to reach approximately US$ 148.46 billion by 2032, reflecting a 5.2% CAGR during 2025-2032. First-hand industry insights reveal three powerful forces behind this market growth: a shift to on-the-go eating, rising interest in nutrient-dense ingredients, and mounting pressure on manufacturers to deliver clean-label formulations. SAC Insight's deep market evaluation also shows North America’s firm lead, while demand in Asia Pacific is accelerating as plant-based trends spread across major urban centers.

The U.S. healthy snacks market alone is expected to touch about US$ 28.12 billion by 2032, underscoring strong local momentum.

Summary of Market Trends & Drivers

Convenience now outranks traditional meal prep for many consumers, driving the popularity of single-serve bars, pouches, and multipacks. Increased awareness of obesity and diabetes is boosting purchases of low-sugar, protein-rich options, while retailers rapidly expand better-for-you shelf space to capture this swing in preferences.

Key Market Players

Well-established food groups dominate the current healthy snacks market share through deep R&D pipelines and global distribution muscle. Nestlé, Kellanova, and Unilever continue to refresh portfolios with high-protein and low-sugar launches, often backed by celebrity co-branding and functional claims that resonate with younger shoppers.

A second tier of innovators—including Danone, PepsiCo, Mondelez International, Hormel Foods, Del Monte, Select Harvest, and Monsoon Harvest—is investing heavily in superfood ingredients, plant-based proteins, and upcycled raw materials. Their agile approach pressures traditional giants to shorten product cycles and rethink packaging for sustainability.

Key Takeaways

• Market value (2024): USD$ 102.53 billion

• Projected value (2032): USD$ 148.46 billion at a 5.2% CAGR from 2025

• Fruit, nuts, and seeds remain the largest product slice, capturing 37.8% market share in 2024

• Low/no-sugar claims account for roughly 39% of global revenues

• Bags & pouches dominate packaging with about 42% share, driven by portability and shelf appeal

• Supermarkets & hypermarkets control nearly 44% of distribution, but online channels are expanding quickly

Market Dynamics

Drivers

• Rising health consciousness and demand for nutrient-dense, portion-controlled snacks

• Rapid urbanization and busier lifestyles favoring convenient, ready-to-eat formats

• Innovation in plant-based proteins, ancient grains, and functional add-ins such as probiotics

Restraints

• Higher unit prices compared with conventional snacks may limit uptake in lower-income segments

• Shelf-life and textural challenges when reducing sugar, fat, or artificial additives

• Regulatory scrutiny on health claims complicates marketing strategies

Opportunities

• Expansion of gluten-free and allergen-friendly lines to address niche dietary needs

• Upcycled ingredients and carbon-neutral packaging offering new brand stories

• Strategic acquisitions of emerging start-ups to secure innovation pipelines

Challenges

• Volatile raw material costs, especially nuts and dried fruits, squeeze margins

• Intense competition from private-label brands with aggressive pricing

• Balancing indulgence with health credentials without compromising taste

Regional Analysis

North America holds the strongest position thanks to high disposable income, proactive wellness culture, and extensive retail reach. Europe continues to value functional snacking for on-the-go nutrition, while Asia Pacific logs the fastest market growth on the back of expanding middle-class populations and rapid e-commerce uptake.

• North America – 39.1% share; protein-rich bars and low-sugar cookies thrive

• Europe – 39.75% share in 2019; consumers favor clean labels and portion-controlled packs

• Asia Pacific – Projected 6.8% CAGR to 2030; functional ingredients and gut-health claims surge

• Central & South America – Growth tied to modern retail expansion and new flavor profiles

• Middle East & Africa – Gradual adoption, driven by premium supermarket chains and online grocery

Segmentation Analysis

By Product

• Fruit, Nuts & Seeds – Core demand driver

These whole-food snacks deliver natural protein, fiber, and healthy fats, appealing to flexitarian and paleo consumers. Continuous flavor innovation, from chili-lime mango to dark-chocolate almonds, keeps the segment fresh and premium.

• Bakery – Emerging better-for-you indulgence

Whole-grain biscuits, high-fiber muffins, and protein-fortified cookies satisfy cravings without excessive sugar. The category benefits from “power ingredient” blends such as quinoa, flax, and chia for added functionality.

• Frozen & Refrigerated – Smaller but rising

Greek-yogurt bites, smoothie pops, and protein-rich chilled bars cater to consumers seeking fresh, minimally processed options with short ingredient lists, though logistics remain a cost consideration.

• Savory – Seasoned vegetable crisps and roasted legumes

Lower-fat, air-popped techniques produce crunchy textures that compete with traditional chips, encouraging repeat purchase among health-minded snackers.

• Bars & Confectionery – Protein and functional inclusions

Portability and balanced macros propel growth, especially among fitness enthusiasts emphasizing convenient recovery snacks.

• Dairy & Others – Functional yogurts and cheese snacks

High-protein skyr cups and dehydrated cheese crisps meet the demand for clean satiating products with minimal processing.

By Claim

• Low/No Sugar – Leading share at 39%

Demand stems from diabetes prevention efforts and weight-management goals. Manufacturers achieve sweetness with natural alternatives such as monk fruit and allulose, maintaining taste without blood sugar spikes.

• Gluten-Free – Fastest-growing at 7.5% CAGR (2025-2030)

Fueled by celiac awareness and general digestive health trends, brands reformulate with alternative flours like buckwheat and chickpea.

• Low/No Fat – Popular for cardiovascular health

Advances in baking technology allow crunchy textures with reduced oil content, improving label appeal without sacrificing satisfaction.

• Others – High protein, organic, non-GMO

Specialty claims provide market differentiation and command premium pricing among discerning shoppers.

By Packaging

• Bags & Pouches – Dominant at 42.3%

Lightweight, resealable, and cost-efficient, these packs support impulse buys and meal replacement occasions.

• Boxes – Family-size convenience

Often used for multipack bars and baked bites catering to pantry stocking and school-lunch occasions.

• Cans – Growing 6.4% CAGR

Airtight, lightproof containers extend shelf life for nut mixes and sparkling fruit beverages while projecting a premium feel.

• Jars & Others – Glass and compostable formats

Appeal to eco-conscious buyers who prioritize reusability or plastic reduction.

By Distribution Channel

• Supermarkets & Hypermarkets – 43.9% share

One-stop formats showcase broad assortments and frequent promotions that sway mainstream shoppers.

• Convenience Stores – Snack-time impulse

Success depends on smaller pack sizes and strategic placement near checkout counters.

• Online – Rapidly scaling

Mobile-app grocery purchases already claim nearly 40% of digital shoppers, offering brands direct-to-consumer data insights.

• Others – Specialty stores, gyms, and workplace vending

Targeted channels help niche brands reach diet-specific consumers and capitalize on wellness trends.

Industry Developments & Instances

• September 2023 – A high-protein dairy brand launched an eleven-SKU snack line delivering 15-25 g protein per serving without added sugars.

• September 2023 – A limited-edition bar with customizable wrappers debuted through an influencer partnership, blending experiential marketing with clean ingredients.

• August 2023 – A frozen-treat producer rolled out sparkling mini cans of fruit juice and water, each under 6 g of sugar.

• June 2023 – A multinational completed the acquisition of a better-for-you frozen dessert label to bolster its premium snacking portfolio.

• November 2023 – A streamer-turned-entrepreneur introduced gluten-free cookie assortments, signaling fresh competition from digital native brands.

Facts & Figures

• Consumers replace an average of four weekly meals with snacks; 79% actively seek healthier choices.

• Fruit, nuts, and seeds command roughly 37.8% product market share thanks to whole-food positioning.

• Supermarkets & hypermarkets operate over 80,000 outlets worldwide, maintaining the largest distribution footprint.

• Bags & pouches packaging captured about 42% of healthy snack sales in 2023.

• North America’s healthy snacks penetration stands at nearly 39% of global revenues.

Analyst Review & Recommendations

This market analysis confirms steady, broad-based expansion anchored in wellness trends and portable formats. Brands that combine credible health claims with great taste and sustainable packaging will outpace slower-moving peers. Strategic priorities include deeper engagement with online shoppers, investment in functional ingredient R&D, and agile supply chains to manage raw-material volatility. Overall, healthy snacks remain a resilient category with room for premium positioning and inclusive reformulations that cater to diverse dietary needs.