Market Overview

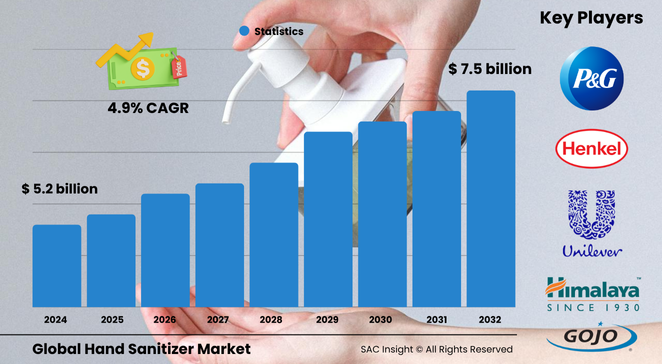

The global hand sanitizer market size is valued at roughly US$ 5.225 billion in 2024 and is projected to approach US$ 7.508 billion by 2032, expanding at an average 4.95% CAGR. First-hand industry insights highlight three structural growth engines: sustained public-health awareness, rapid product innovation with skin-friendly additives, and resilient retail distribution that keeps shelves stocked even during supply disruptions.

SAC Insight's deep market evaluation shows the U.S. hand sanitizer market alone could advance toward about US$ 1.41 billion by 2032 as healthcare, education, and hospitality settings adopt touch-free dispensers and premium foam formulas.

Summary of Market Trends & Drivers

• Skin-conditioning formulations with aloe or glycerin ease concerns over dryness, widening daily-use adoption.

• Eco-conscious shoppers drive market growth for refill pouches and PCR (post-consumer recycled) packaging, reinforcing circular-economy market trends.

• Rising e-commerce penetration, especially in Asia Pacific, shifts volume from traditional channels and supports direct-to-consumer brand launches.

Key Market Players

Global leadership is shared by consumer-health multinationals and nimble regional suppliers. Established names such as Reckitt, Procter & Gamble, Unilever, Henkel, and GOJO leverage robust supply chains, broad patent portfolios, and heavy advertising budgets to protect market share while rolling out line extensions—think moisturizing foam pumps and pocket-size sprays.

Alongside them, specialists like The Himalaya Drug Company, Vi-Jon, Best Sanitizers, Chattem, and Kutol capture niche demand through herbal actives, hospital-grade claims, or contract-manufacturing agility. Competitive dynamics increasingly revolve around fragrance innovation, sustainable packaging partnerships, and private-label production for major retailers.

Key Takeaways

• Current global market size (2024): USD$ 5.225 billion

• Projected global market size (2032): USD$ 7.508 billion at a 4.95 % CAGR

• Gel remains the largest product form, but foam posts the fastest CAGR near 7 % through 2032

• Hypermarkets & supermarkets hold the leading distribution market share, while online sales deliver the quickest uplift

• North America generates the highest revenue today; Asia Pacific records the sharpest percentage gains

• Alcohol-based products dominate, yet alcohol-free blends gain traction where skin sensitivity is a concern

Market Dynamics

Drivers

• Persistent emphasis on infection prevention in public venues, workplaces, and households

• Product diversification—portable sprays, scented gels, and child-friendly wipes—stimulates repeat purchases

• Government hygiene campaigns and healthcare procurement contracts underpin baseline demand

Restraints

• Price-based rivalry and low switching costs pressure margins for undifferentiated gels

• Soap-and-water advocacy in public health guidelines occasionally curbs volume in developed markets

• Regulatory scrutiny on alcohol content and denaturant safety can delay product approvals

Opportunities

• Biodegradable formulas and recyclable cartridges cater to sustainability mandates in corporate procurement

• Touchless dispensers integrated with IoT refill alerts create after-market service revenue

• Emerging-market urbanization expands modern retail footprints, unlocking new shelf space

Challenges

• Ethanol and isopropyl alcohol supply volatility raises input-cost risk during sudden demand spikes

• Counterfeit or substandard products erode consumer trust, requiring vigilant brand protection

• Skin-irritation claims push manufacturers to balance efficacy with dermatological performance

Regional Analysis

North America leads today on the back of entrenched healthcare protocols and premium brand preference, while Asia Pacific registers the quickest market growth as rising middle-class awareness meets broad e-commerce access. Europe maintains steady demand, buoyed by sustainability expectations and stringent workplace-safety rules.

• North America – Largest revenue pool, hospital and hospitality uptake strong

• Europe – High product diversity, eco-packaging momentum

• Asia Pacific – Fastest CAGR, digital retail acceleration, rising urban hygiene standards

• Latin America – Government hygiene drives in schools and transit hubs boost volume

• Middle East & Africa – Tourism recovery and healthcare infrastructure upgrades support gradual expansion

Segmentation Analysis

By Product Form

• Gel – Familiar format, widest market reach.

Gel sanitizers command the dominant share thanks to easy spreadability, clear usage cues, and abundant retail brands.

• Foam – Premium feel, fastest growth.

Light, quick-dry foams appeal to workplaces seeking spill-free application and skin-soothing additives, fueling a robust CAGR.

• Liquid – Institutional favorite, cost-effective.

Bulk liquid refills serve hospitals and factories where dispenser systems minimize per-use cost and waste.

• Spray – Convenience led, on-the-go.

Fine-mist sprays fit pockets and travel kits, gaining traction among commuters and frequent flyers.

• Wipes – Dual-surface utility.

Pre-moistened wipes sanitize both hands and small objects, making them popular in childcare and foodservice.

• Others – Novel formats.

Sticks, powders, and waterless soaps target niche users seeking fragrance-free or ultra-compact options.

By Type

• Alcohol-Based – Gold-standard efficacy.

Formulas with 60–95 % alcohol remain the primary defence against pathogens, endorsed by healthcare authorities worldwide.

• Alcohol-Free – Skin-gentle alternative.

Benzalkonium chloride and plant-derived actives satisfy users worried about dryness or flammability, carving out a steady niche.

By Distribution Channel

• Hypermarket & Supermarket – Broad visibility.

Mass merchandising drives impulse buys during weekly shopping trips, keeping this channel on top.

• Pharmacy & Drugstore – Trust factor.

Professional advice and curated assortments make pharmacies a preferred outlet for premium and therapeutic lines.

• Convenience Store – Immediate need fill.

Small packs at checkout lanes capture on-the-go shoppers, lifting unit velocity.

• Online – Fastest CAGR.

Subscription refills and influencer-led launches propel sustained digital-channel market growth across regions.

• Others – Specialty & institutional supply.

B2B wholesalers and cash-and-carry formats serve schools, offices, and government agencies at scale.

By End-User

• Hospitals – Critical baseline demand.

Stringent infection-control protocols lock in continuous bulk purchasing for patient wards and surgical units.

• Schools – Education-driven hygiene.

Hand-sanitizer stations in corridors and classrooms support attendance and reinforce healthy habits.

• Restaurants – Food-safety compliance.

Front-of-house dispensers and kitchen refills reduce cross-contamination, improving customer reassurance.

• Household – Everyday convenience.

Rising awareness converts seasonal buyers to daily users, especially during flu seasons.

• Others – Transportation, corporate, military.

Airports, offices, and defence facilities integrate sanitizers into routine safety procedures to protect workforce readiness.

Industry Developments & Instances

• March 2022 – A leading brand unveiled plant-based moisturizing foam lines delivering 99.99 % germ kill with essential-oil fragrance.

• May 2021 – A sustainability-focused start-up released refillable aluminium bottles with concentrated sanitizer drops, cutting plastic use by 80 %.

• January 2021 – A provincial government funded a domestic plastics-injection plant to secure local bottle supply and shorten lead times.

• April 2020 – Multiple distilleries retooled to produce sanitizer, easing early-pandemic shortages and expanding regional capacity.

• March 2020 – Major FMCG players pivoted R&D facilities to ramp up private-label output, meeting surging retail demand.

Facts & Figures

• Gel products accounted for roughly 46 % of global revenue in 2023.

• Foam products are on track to post about 7 % CAGR through 2032.

• Hypermarkets & supermarkets generated nearly 38 % of 2023 sales value.

• Online channel turnover rose over 800 % in early 2020 and still outpaces other outlets.

• Alcohol-based formulas hold roughly three-quarters of total market share today.

Analyst Review & Recommendations

Market analysis points to a decisive shift from crisis-driven stockpiling to steady, routine consumption. Brands that couple dermatologist-approved ingredients with refill-friendly packaging stand to outpace average market growth. Investment in smart dispensers and localized bulk production can cushion supply shocks and differentiate on sustainability metrics. Firms should also monitor evolving alcohol-content regulations and nurture e-commerce fulfilment partnerships to secure long-term share gains while maintaining consumer trust in product efficacy and safety.