Market Overview

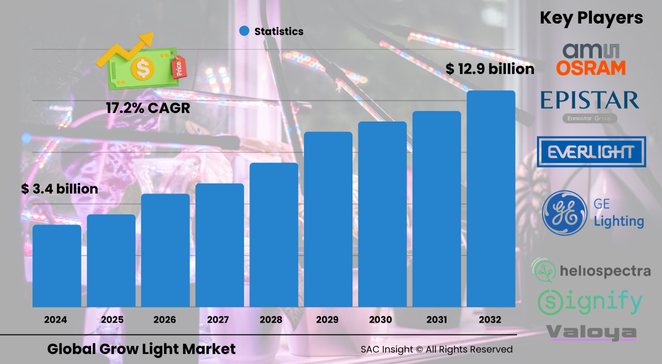

The global grow light market size stands near US$ 3.4 billion in 2024 and is on track to hit roughly US$ 12.9 billion by 2032, expanding at a brisk 17.2 % CAGR. First-hand industry insights highlight three growth engines: surging demand for controlled-environment agriculture, steady LED price declines that improve return on investment, and widening government incentives for energy-efficient food systems.

SAC Insight's deep market evaluation suggests the U.S. segment alone could move from about US$ 1.1 billion in 2024 to almost US$ 3.9 billion by 2032 as vertical farms, cannabis facilities, and high-tech greenhouses scale nationwide.

Summary of Market Trends & Drivers

• LED systems now claim the largest grow light market share thanks to higher photon efficacy, tunable spectra, and falling capital costs.

• Vertical farming and urban gardening are shifting market trends toward space-efficient, stacked installations that demand low-heat, high-intensity fixtures.

• Solid government support for food security and sustainability—rebates, tax credits, and R&D grants—continues to accelerate market growth.

Key Market Players

Leading vendors combine optoelectronic expertise with horticultural know-how. Global lighting majors supply high-output LED engines, while horticulture specialists refine optics, wireless dimming, and crop-specific recipes. The competitive field increasingly revolves around spectrum tailoring, long-term warranty packages, and partnerships with automation providers delivering turnkey farms.

Regional powerhouses in Europe and Asia focus on broad white and hybrid fixtures for greenhouse retrofits, whereas North American companies emphasize broadband LED bars for cannabis and leafy-green stacks. Consistent product launches and strategic alliances illustrate an active race to capture high-margin vertical farm deals.

Key Takeaways

• Current global market size (2024): USD$ 3.4 billion

• Projected market size (2032): USD$ 12.9 billion at a 17.2 % CAGR

• U.S. market poised to nearly quadruple, supported by legalized cannabis and food-localization efforts

• LED technology commands the dominant market share, but HID retains a cost-sensitive niche

• Vertical farming represents the fastest-growing application, outpacing traditional greenhouses

• Automation-ready fixtures and data-driven spectrum control are defining future market analysis and purchasing decisions

Market Dynamics

Drivers

• Rapid LED cost decline improves payback periods for commercial farms.

• Urbanization and shrinking arable land push investment toward indoor cultivation solutions.

• National sustainability goals favor energy-efficient solid-state lighting.

Restraints

• High upfront cost relative to legacy HPS fixtures remains a hurdle for small growers.

• Lack of universal testing standards complicates fixture comparison and procurement.

• Skilled-labor shortages in controlled-environment agriculture can slow project deployment.

Opportunities

• Spectrum-tunable LEDs enable crop-specific recipes that boost yield and nutritional quality.

• Integration with IoT platforms allows real-time monitoring, driving service revenues for OEMs.

• Government rebate programs can unlock retrofits across conventional greenhouses.

Challenges

• Energy costs remain volatile, pressuring operators to optimize light-hour strategies.

• Heat management in dense vertical stacks demands robust thermal design.

• Counterfeit low-quality fixtures risk damaging crop outcomes and eroding buyer confidence.

Regional Analysis

Europe currently leads global revenue thanks to widespread greenhouse modernization and stringent sustainability mandates, yet Asia Pacific shows the fastest percentage gains as densely populated nations bet on vertical farms to bolster food security.

• North America – High adoption in cannabis and leafy green segments; strong rebate landscape.

• Europe – Largest market share; retrofit boom in Netherlands, Spain, and Nordic countries.

• Asia Pacific – Highest CAGR; urban farms in Japan, Singapore, and China drive volume.

• Latin America – Gradual uptake in premium flower cultivation and export-oriented produce.

• Middle East & Africa – Niche but rising; desert agriculture projects leverage efficient LED arrays.

Segmentation Analysis

By Technology

• LED – Efficiency leader and market growth engine.

LED fixtures deliver superior µmol J-1 efficacy, long lifespans, and spectrum tunability, making them the preferred choice for vertical farms, cannabis, and premium produce.

• HID – Cost-effective workhorse.

High-pressure sodium and metal-halide lamps retain traction in large greenhouses needing broad light coverage at low capital cost, despite higher energy draw.

• Fluorescent & Others – Seedling specialists.

Compact fluorescents and emerging plasma or induction lamps serve propagation rooms and hobby setups where gentle light and minimal heat are paramount.

By Installation Type

• New Installations – Setting the pace.

Purpose-built vertical farms and high-tech greenhouses opt for full-LED layouts with integrated controls, driving the bulk of fixture shipments.

• Retrofit Installations – Efficiency upgrade wave.

Existing HID-equipped houses switch to LED bars or hybrids to cut power bills and maintain competitive yields, supported by utility rebates.

By Spectrum

• Full-Spectrum – All-stage performance.

Balanced white and enriched spectra support photosynthesis from seed to bloom, simplifying lighting strategies for mixed-crop facilities.

• Partial Spectrum – Targeted efficiency.

Red-blue blends or far-red-boosted recipes maximize energy-to-biomass conversion during specific phases, popular in cost-sensitive vertical stacks.

By Application

• Indoor Farming – Core demand driver.

Closely controlled environments rely entirely on artificial light, underpinning steady fixture orders for herbs, microgreens, and exotics.

• Vertical Farming – Fastest-growing slice.

Stacked layers paired with low-profile LEDs squeeze high output into city footprints, delivering pesticide-free greens year-round.

• Commercial Greenhouse – Large-scale supplement.

Grow lights extend daylight in winter and improve uniformity, especially for tomatoes, peppers, and ornamentals in temperate zones.

• Turf and Landscaping & Others – Niche uses.

Stadium turf regeneration and research labs apply high-intensity LEDs for rapid plant recovery and experimental trials.

Industry Developments & Instances

• May 2024 – A leading horticultural supplier unveiled a 1 500 W LED array achieving 3.7 µmol J-1 to cut fixture count in vine-crop trellises.

• February 2024 – A modular grid-lighting line added cannabis-tuned spectra and 120-480 V flexibility, easing large-facility retrofits.

• June 2023 – A European vertical-farm developer partnered with a lighting firm to co-design data-driven, remote-managed LED solutions.

• July 2022 – Major venture funding backed an American greenhouse operator expanding acreage with fully networked LED systems.

Facts & Figures

• Average LED fixture efficacy now exceeds 3.4 µmol J-1, up from 2.2 µmol J-1 five years ago.

• Vertical farming can reduce water use by up to 95 % versus field production.

• Europe captured roughly 36 % of global market revenue in 2024.

• U.S. cannabis facilities accounted for nearly 45 % of North American grow light demand last year.

• New installations represented about 58 % of global fixture shipments in 2024, with retrofit projects making up the balance.

Analyst Review & Recommendations

The grow light market analysis points to a decisive shift toward smart, spectrum-tunable LED systems that integrate seamlessly with climate controls and data dashboards. Suppliers that combine high-efficacy diodes with robust warranty support and agronomic consulting will command premium margins. Operators should prioritize fixtures offering modular optics and wireless dimming to future-proof facilities against crop-mix changes and energy-pricing swings.