Market Overview

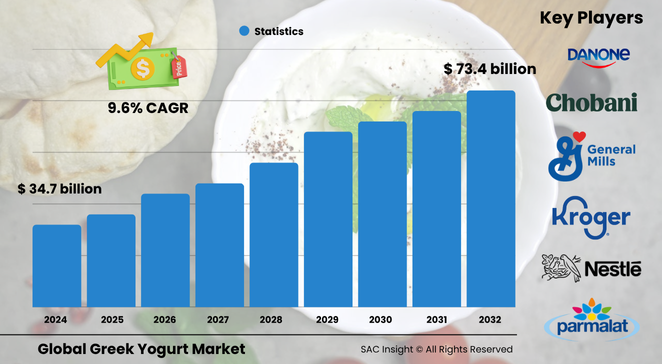

The global greek yogurt market size was valued at about US$ 34.75 billion in 2024 and is on track to reach roughly US$ 73.46 billion by 2032, reflecting an average 9.65 % CAGR. First-hand industry insights highlight three powerful engines behind this market growth: rising demand for high-protein snacks, expanding clean-label preferences, and the convenience of single-serve formats for busy urban consumers.

SAC Insight market analysis shows the United States Greek yogurt market alone could capture close to 40 % market share, with sales likely to approach US$ 29.4 billion by 2032 as fitness-focused eating habits spread across mainstream grocery aisles.

Summary of Market Trends & Drivers

• High-protein, low-sugar positioning is moving Greek yogurt from a breakfast staple to an all-day snack or meal component, a shift reinforced by growing interest in weight-management and muscle-building diets.

• Clean-label and organic market trends are spurring launches that spotlight short ingredient lists, live cultures, and lactose-free or plant-based alternatives.

• Online grocery adoption is accelerating premium product discovery, discounts, and subscription models, expanding reach beyond traditional retail shelves.

Key Market Players

Leading suppliers include Chobani, Danone, Fage International, Nestlé, General Mills, Parmalat, The Kroger Co., Horizon Organic, The Hain Celestial Group, and Stonyfield Farm. These companies set the competitive tempo through rapid flavor innovation, strategic celebrity partnerships, and the roll-out of plant-based or lactose-free lines that bring new consumers into the category. Challenger brands focus on niche propositions—such as locally sourced milk or probiotic-rich recipes—while private labels leverage supermarket footprints to deliver value-priced options and chip away at branded shelf space.

Key Takeaways

• Global market size (2024): USD$ 34.75 billion

• Projected market size (2032): USD$ 73.46 billion at a 9.65 % CAGR

• The U.S. could reach about USD$ 29.4 billion by 2032, maintaining the largest national market share

• Strawberry remains the top-selling flavor, but peach and limited-edition seasonal blends post the fastest unit gains

• Supermarkets dominate distribution, yet online sales record double-digit annual market growth as health-conscious shoppers value doorstep delivery

• Spoonable formats account for roughly three-quarters of revenue, while drinkable lines find traction among on-the-go consumers and fitness enthusiasts

Market Dynamics

Drivers

• Rapid adoption of protein-rich diets and the popularity of Mediterranean-style eating patterns

• Continuous flavor experimentation, from indulgent dessert profiles to savory dips, expanding use occasions

• E-commerce platforms promoting direct-to-consumer bundles, healthy-snack subscriptions, and personalized recommendations

Restraints

• Premium pricing versus conventional yogurt can deter price-sensitive shoppers in emerging economies

• Digestive discomfort in lactose-intolerant consumers when products are not clearly labeled or formulated accordingly

• Shelf-life limitations in fresh dairy logistics challenge small retailers and distant export markets

Opportunities

• Organic and lactose-free recipes broaden the addressable audience among wellness-centric and sensitive consumers

• Plant-based Greek-style offerings made from almond, coconut, or oat bases capture flexitarian and vegan demand

• Partnerships with fitness apps and sports influencers position Greek yogurt as an essential recovery food

Challenges

• Volatile milk prices compress margins and complicate long-term contract planning

• Intensifying competition from high-protein alternatives such as skyr, kefir, or protein shakes requires constant differentiation

• Sustainability expectations push brands to redesign plastic packaging and invest in recyclable or bio-based materials

Regional Analysis

Europe currently leads global revenue thanks to entrenched yogurt culture, strong supermarket penetration, and high awareness of gut-health benefits. North America follows closely, propelled by aggressive product launches and promotional campaigns that link Greek yogurt to active lifestyles. Asia-Pacific, while smaller today, posts the fastest percentage gains as rising middle-class incomes and online grocery platforms make premium dairy more accessible.

• North America – Robust demand from health-conscious consumers; frequent limited-edition launches keep shelves dynamic

• Europe – Mature yogurt culture, with Germany and the UK driving premiumization and private-label expansion

• Asia-Pacific – Highest CAGR, powered by urbanization, e-commerce growth, and probiotic awareness in China and India

• Latin America – Gradual adoption, with Brazil showing steady uptake of drinkable lines for on-the-go nutrition

• Middle East & Africa – Niche but rising interest, especially among expatriate populations seeking protein-dense alternatives

Segmentation Analysis

By Flavor

• Strawberry – Widest appeal, commanding the largest revenue slice.

Strawberry’s familiar sweetness aligns with clean-label expectations when real fruit or puree is highlighted, making it the go-to flavor for family tubs and kids’ packs.

• Peach – Fastest-growing segment on a smaller base.

Peach offers a delicate, naturally sweet profile that pairs well with honey and granola, encouraging trial among consumers seeking subtler taste notes.

• Vanilla, Blueberry, Others – Essential for variety.

Classic vanilla supports parfaits and baking, blueberry satisfies antioxidant marketing claims, while exotic blends like coconut-lime or salted-caramel keep the category fresh.

By Product Type

• Spoonable Greek Yogurt – Core demand engine.

Spoonable formats dominate because their thick, creamy texture supports breakfast bowls, dessert swaps, and savory dips, appealing across age groups.

• Drinkable Greek Yogurt – Convenience-driven niche.

High-protein smoothies and ready-to-drink bottles target gym-goers and commuters who want portable nutrition without the mess of a spoon.

By Package Type

• Cups & Tubs – Mainstay for single-serve and multi-serve.

Easy stacking, visible fruit layers, and peel-back lids reinforce freshness cues and portion control.

• Bottles – Growth lever for drinkables.

Resealable tops and slim profiles fit car cup holders and backpacks, boosting impulse buys at convenience outlets.

• Other Formats – Pouches and split-cup combinations.

Kid-friendly squeeze pouches and granola-topper cups create new snacking occasions.

By Distribution Channel

• Supermarkets – Largest share thanks to aisle visibility and promotions.

In-store sampling, bundled granola deals, and loyalty-card discounts stimulate trial and repeat purchases.

• Convenience Stores – Impulse and grab-and-go sales.

Chilled endcaps near checkouts position Greek yogurt as an upgraded alternative to chocolate bars or sugary drinks.

• Online – Highest CAGR as consumers appreciate doorstep delivery.

Brand websites and e-commerce giants offer flavor variety, subscription savings, and nutrition education that deepen customer engagement.

• Others – Specialty and club stores extend reach.

Natural-food retailers spotlight organic and lactose-free options, while warehouse clubs push bulk packs for families.

By Nature

• Conventional – Mass-market backbone with competitive pricing.

Scale efficiencies keep unit costs down, sustaining supermarket promotions and broad household adoption.

• Organic – Premium tier growing above category average.

Consumers seeking chemical-free dairy and animal-welfare assurances pay a price premium, supporting higher margins and brand storytelling.

Industry Developments & Instances

• October 2024 – A major brand debuted high-protein Greek yogurt cups (20 g protein) and drinks (up to 30 g) with no added sugar, expanding lactose-free options nationwide.

• September 2024 – A leading natural-foods group rolled out seasonal Greek yogurt flavors alongside better-for-you snack bars in U.S. mass retailers.

• July 2023 – A frozen-dessert pioneer introduced Greek frozen yogurt pints featuring indulgent mix-ins while maintaining the core protein profile.

• January 2025 – A U.S. dip manufacturer launched Jalapeño Ranch Greek yogurt spreads in key supermarket chains, underscoring savory application momentum.

• February 2024 – A Canadian plant-based label unveiled pea-protein Greek-style yogurt, marking the country’s first large-scale dairy-free entry in the segment.

Facts & Figures

• Spoonable formats account for roughly 75 % of global revenue.

• Strawberry flavor captured an estimated 33.7 % market share in 2024.

• Online sales of Greek yogurt are growing at more than 15 % annually.

• Europe represented about 30.7 % of global sales in 2024.

• Organic offerings already contribute close to 45 % of incremental category growth.

• Drinkable Greek yogurt volumes have risen by nearly 12 % year on year in North America.

• Plant-based Greek-style launches doubled between 2022 and 2024.

• Average protein content sits around 10 g per 100 g serving, roughly double that of conventional yogurt.

Analyst Review & Recommendations

Greek yogurt’s thick texture, high protein, and clean-label halo give it staying power far beyond a passing wellness fad. Brands that pair authentic taste with transparent sourcing, expand lactose-free and plant-based lines, and use digital channels to personalize nutrition stories are poised to outpace average market growth. Investment in recyclable packaging and value-added savory applications will further differentiate top performers as the category matures through 2032.