Market Overview

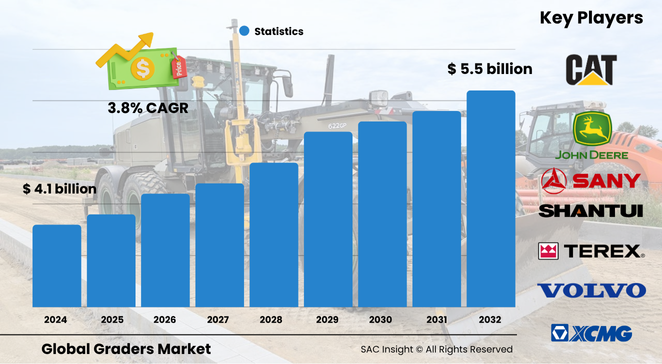

The global graders market size is estimated at US$ 4.18 billion in 2024 and is set to climb US$ 5.58 billion by 2032, reflecting an average 3.8% CAGR over the 2025-2032 forecast window. First-hand industry insights reveal three main engines of market growth: accelerated infrastructure spending in emerging economies, rapid uptake of GPS-enabled grade-control systems that cut rework, and steady fleet renewal in snow-prone regions.

SAC Insight’s deep market evaluation shows the United States alone advancing from nearly US$ 697 million in 2024 to around US$ 945 million by 2032 as federal road, rail, and agriculture programs prioritise site-levelling efficiency.

Summary of Market Trends & Drivers

• Contractors are shifting from manual staking to smart graders that integrate telematics, boosting productivity and lowering total project cost.

• Heightened environmental standards are nudging OEMs toward hybrid drivetrains and low-rolling-resistance tyres, reshaping product design.

• Rental demand is rising in North America and Europe as small builders opt for short-term access to high-spec equipment without heavy capital outlay.

Key Market Players

Caterpillar and Komatsu lead global market share with broad model ranges, factory retrofit automation, and dense service networks that minimise downtime. Close behind, John Deere, Volvo CE, and CNH’s Case brand compete aggressively on fuel efficiency and operator-comfort upgrades. Chinese and Indian manufacturers such as XCMG, SANY, and Mahindra are scaling export capacity, leveraging cost-competitive articulated frames and targeting Africa, Latin America, and Southeast Asia.

Competitive dynamics increasingly centre on digital services. Leading OEMs bundle over-the-air software updates, predictive-maintenance dashboards, and pay-per-use analytics that lock in aftermarket revenue while giving contractors actionable machine-health data.

Key Takeaways

• Current global market size (2024) – USD$ 4.18 billion

• Forecast global market size (2032) – USD$ 5.58 billion at 3.85 % CAGR

• ICE units retain roughly 98 % propulsion market share but electric prototypes are entering airport and urban projects

• Above-200 HP graders command about 60 % of 2032 revenue as large-scale mining and highway contracts favour higher blade pull

• Asia Pacific captured 44 % market share in 2023 and remains the fastest-growing region on the back of mega rail-and-road corridors

• Smart grade-control packages can cut finish-grading time by up to 30 %, a decisive market trend driving premium adoption

Market Dynamics

Drivers

• Continuous government funding for roads, airports, and smart-city corridors fuels grader demand.

• Integration of GNSS, LiDAR, and telematics elevates grading accuracy, shortening project schedules and trimming fuel burn.

• Cold-region municipalities rely on graders for snow removal, supporting stable replacement cycles.

Restraints

• High upfront cost of smart and high-horsepower models strains budgets of small contractors.

• Availability of versatile alternatives such as skid-steer loaders with blade attachments diverts some entry-level demand.

Opportunities

• Electrified drivetrains paired with battery-swap stations open doors in zero-emission job sites.

• Subscription-based software that links machine control with BIM platforms offers recurring revenue for OEMs.

Challenges

• Skilled-operator shortages raise training costs and slow adoption of advanced features.

• Volatile steel and microchip prices create margin pressure across the supply chain.

Regional Analysis

Asia Pacific dominates graders market share thanks to aggressive highway expansion in China, India, and Southeast Asia, plus sustained mining investment in Australia. North America holds a solid second position, buoyed by road maintenance and snow management, while Europe sees moderate growth driven by urban redevelopment and rental penetration.

• North America – Focused on infrastructure renewal, snow removal, and precision agriculture

• Europe – Rental-heavy market emphasising low-emission equipment and telematics compliance

• Asia Pacific – Largest and fastest-growing, propelled by smart-city and mining megaprojects

• Latin America – Steady demand from commodity-linked road networks and public-private partnerships

• Middle East & Africa – Growth tied to desert rail corridors, airport hubs, and mineral extraction

Segmentation Analysis

By Propulsion

• Internal Combustion Engine – Workhorse option, dominant share.

ICE graders deliver the torque and refuelling convenience needed for heavy-duty, remote operations, keeping them the mainstay across highway and mining applications.

• Electric – Emerging niche, zero tail-pipe emissions.

Pilot fleets in urban infrastructure and airport maintenance demonstrate lower noise and simplified maintenance, hinting at wider uptake as battery density improves.

By Frame

• Articulated – High manoeuvrability and 64 % market share.

Their centre-pivot design lets operators grade tight corners and uneven terrain, essential for urban jobsites and haul-road upkeep.

• Rigid – Favoured for straight-line stability.

Heavy rigid frames excel on long, uniform passes such as runway construction or pipeline corridors where minimal articulation is required.

By Blade Class

• Large Motor Graders – Preferred for highways and open-pit mining.

Wider blades and greater weight speed up bulk earthmoving, reducing passes and fuel per cubic metre moved.

• Medium Motor Graders – Versatile mid-range choice.

They fit most municipal budgets and handle both road maintenance and site prep without oversizing.

• Small Motor Graders – Compact solution for landscaping or alleyways.

Light footprint limits ground pressure, making them ideal for turf care, sidewalks, and inner-city lanes.

By Base Power

• Up to 200 HP – Cost-effective for light civil work.

Municipalities and agriculture fleets choose these models for gravel road smoothing and drainage ditch shaping.

• Above 200 HP – Productivity booster for large projects.

Higher horsepower delivers faster cycle times and deeper cuts on demanding haul roads, airports, and dams.

By Application

• Construction – Core demand engine accounting for the bulk of revenue.

From base-course preparation to final surfacing, graders ensure level foundations that extend pavement life and reduce asphalt bleed.

• Mining – Essential for haul-road maintenance.

Well-maintained grades cut truck tyre wear and fuel, directly impacting mine operating costs.

• Agriculture – Growing slice tied to land-levelling for irrigation efficiency.

Precision-level fields boost crop yields and water savings, supporting adoption in emerging agri-projects.

• Snow Removal – Seasonal but vital application in cold climates.

Adjustable mouldboards clear compacted ice, keeping transport arteries open.

• Land Grading & Levelling – Landscaping, sports fields, and industrial pads.

Contractors rely on fine-grade accuracy to meet strict drainage and surface-flatness specs.

Industry Developments & Instances

• July 2024 – CASE rolled out D-Series graders with low-profile cabs and all-around glazing that improve operator sight-lines and ease transport height limits.

• January 2024 – Komatsu launched the GD955-7 in North America, targeting 100-ton-truck haul-road construction with integrated steering and load-sensing hydraulics.

• February 2022 – MacLean unveiled the rugged GR5 underground grader for ramp upkeep, shipping first units to African mines.

• May 2022 – Mahindra introduced the RoadMaster G75 Smart for cost-conscious emerging markets, blending a fuel-efficient engine with a precision laser kit.

• June 2022 – Goodyear debuted its GP-3E tyre range for graders and loaders, promising longer tread life and lower rolling resistance.

• 2021 – John Deere upgraded GP-Series graders with Auto-Shift PLUS and remote SmartGrade support to slash idle time and enhance machine control.

Facts & Figures

• ICE propulsion commanded about 98 % of shipments in 2023.

• Asia Pacific accounted for roughly 44 % market share in 2023.

• Smart-enabled graders can reduce material over-cut by up to 15 %.

• Above-200 HP models are projected to top USD$ 3.3 billion by 2032.

• Articulated frames held more than 64 % share in 2023, reflecting demand for nimble maneuvering.

Analyst Review & Recommendations

Market analysis indicates a clear pivot toward digitally enabled, high-horsepower graders that shorten project timelines and lower lifecycle costs. Contractors should prioritise models offering factory-integrated grade-control and remote diagnostics to future-proof fleets. OEMs that pair electrification roadmaps with subscription-based software and robust operator-training programs are best positioned to capture outsized market growth through 2032.