Market Overview

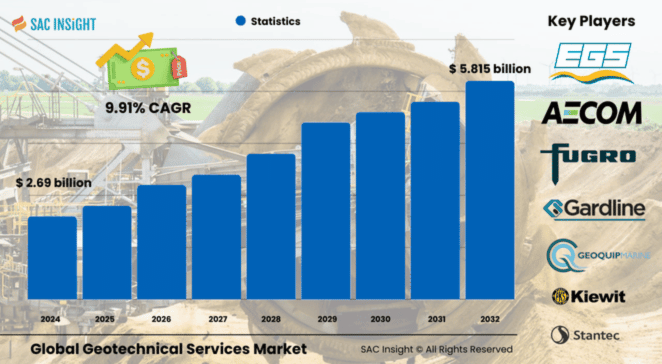

The geotechnical services market size was valued at US$ 2.69 billion in 2024 and is projected to reach approximately US$ 5.815 billion by 2032, advancing at a 9.91% CAGR over 2025-2032. SAC Insight's deep market evaluation shows three structural growth engines: the step-up in renewable-driven offshore projects, a persistent construction upcycle across emerging economies, and tighter environmental regulations that mandate rigorous subsurface testing. The U.S. geotechnical services market is on track to exceed US$ 1.261 billion by 2032, while Asia Pacific held roughly 30.11% market share in 2024 thanks to rapid urban infrastructure rollouts. These first-hand industry insights confirm that momentum has returned after the pandemic-era construction pause.

Summary of Market Trends & Drivers

• Offshore wind expansion, particularly in deeper waters, is fuelling demand for high-spec seabed investigations and jack-up drilling vessels.

• Municipal authorities are fast-tracking metro, tunnel, and utility upgrades, keeping underground city space services in pole position.

• Digital geotechnical modelling and remote sensing are trimming project turnaround times, a key catalyst for market growth.

Key Takeaways

• Global market value (2024): USD$ 2.69 billion

• Projected value (2032): USD$ 5.815 billion at a 9.91% CAGR

• Underground city space remains the dominant type segment, holding over 40% share in recent studies.

• Municipal application is the fastest-growing end-user group, driven by urban tunnel and pipeline projects.

• The U.S. market is expected to approach US$ 1.261 billion by 2032, supported by stricter permitting regimes.

• Asia Pacific leads overall demand owing to sizable infrastructure and renewable energy pipelines.

Key Market Players

Leading incumbents such as Fugro, AECOM, Stantec, and Kiewit Corporation anchor the competitive landscape with global fleets, multidisciplinary design arms, and long-term framework contracts. Mid-sized specialists including Geoquip Marine Group, Gardline, EGS Survey, and WSP add nimble, technology-rich services—particularly in cone-penetration testing, dynamic positioning vessels, and advanced data analytics—to capture niche opportunities in offshore renewables and complex foundations.

These firms compete on technical breadth, vessel availability, and an ability to integrate geotechnical data into BIM-enabled engineering workflows. Larger players continue to bolster capability via targeted vessel conversions, sensor upgrades, and biofuel adoption to satisfy client sustainability requirements.

Market Dynamics

Drivers

• Surge in offshore wind installations requiring deepwater borehole data and geophysical surveys.

• Accelerating urban rail, highway, and smart-city build-outs in Asia and the Middle East.

• Rising adoption of 3D numerical modelling that reduces over-engineering and saves project costs.

Restraints

• High upfront cost of specialised drilling vessels, advanced sensors, and skilled labour.

• Project delays from permitting bottlenecks and environmental scrutiny in sensitive zones.

• Limited availability of qualified geotechnical professionals in emerging markets.

Opportunities

• Growth in floating wind and hydrogen pipelines opens fresh demand for marine geotechnical analysis.

• Adoption of AI-driven subsurface imaging and cloud-based data portals for real-time collaboration.

• Public-private partnerships in mega-infrastructure projects create multi-year service pipelines.

Challenges

• Volatile commodity prices can pause mining and oil & gas exploration budgets.

• Weather-related downtime and complex seabed conditions escalate operational risks.

• Harmonising regional standards for soil classification and reporting remains difficult for global firms.

Regional Analysis

Asia Pacific commands the largest slice of market share, powered by government-backed metro networks, pumped-hydro projects, and wind farm concessions in China and India. North America follows, underpinned by shale-related infrastructure and robust public transportation funding, while the Middle East & Africa sees steady gains from mineral diversification and giga-city developments.

• North America – Mature oil & gas base and tightening building codes sustain steady demand.

• Europe – Offshore wind hubs in the North Sea and Baltic Sea maintain a strong service pipeline.

• Asia Pacific – Rapid urbanisation and renewable targets drive double-digit market growth.

• Latin America – Mining revival and earthquake-resilient construction bolster service uptake.

• Middle East & Africa – Vision-driven mega-projects and mineral extraction underpin new contracts.

Segmentation Analysis

By Type

• Underground City Space – Cornerstone of revenue

Underground city space work—metro tunnels, utility conduits, and below-grade commercial structures—accounts for the single largest slice as densely populated cities prioritise space optimisation. Constant metro extensions in India, Thailand, and the Gulf keep this segment in demand.

• Slope & Excavation – Critical for terrain stabilisation

Slope stabilisation and deep excavations serve mountainous transport corridors and hillside developments where landslide risk is high. Active monitoring and grouting solutions position slope & excavation as a resilient growth niche.

• Ground & Foundation – Essential pre-build diligence

Ground and foundation investigations underpin every major building, bridge, and turbine. Growth mirrors the broader construction cycle, with an uptick in foundation work for data centres and logistics hubs.

By Application

• Municipal – Fastest-expanding customer base

Urban councils rely on geotechnical insights to future-proof sewers, subways, and public facilities. Population growth and smart-city budgets ensure a robust project funnel and consistent market analysis opportunities.

• Bridge & Tunnel – High-spec safety requirements

Long-span bridges and underwater tunnels demand rigorous soil and rock mechanics studies. The segment benefits from cross-border rail links and coastal transit corridors.

• Oil & Gas – Stable yet cyclical

While exploration budgets fluctuate, platform decommissioning and pipeline replacement present ongoing service needs, requiring trusted providers for complex seabed assessments.

• Mining – Risk-mitigation imperative

Open-pit and underground mines integrate geotechnical monitoring to meet safety regulations and optimise slope angles, sustaining a steady workload.

• Marine – Rising with offshore renewables

Geotechnical support for wind turbine monopiles, floating foundations, and port expansions places marine services on a long-term growth trajectory.

• Building Construction & Others – Bread-and-butter segment

Commercial towers, industrial parks, and data centres all need precise ground characterisation, providing a diversified revenue stream for consultancies.

Industry Developments & Instances

• December 2023 – Fugro expanded its fleet by acquiring two platform supply vessels slated for conversion into deepwater geotechnical assets.

• September 2023 – Ulstein secured a contract to retrofit dual drill-tower vessels for advanced seabed sampling operations.

• August 2023 – Gardline won a pipeline survey for UK North Sea gas fields, reinforcing its position in subsea data acquisition.

• February 2022 – Geoquip Marine adopted dedicated high-bandwidth satellite connectivity to deliver real-time data to charterers.

• July 2020 – EGS completed a ten-month Taiwanese offshore campaign, collecting over 1,000 m of borehole CPT data for wind-farm foundations.

Facts & Figures

• Underground city space captured roughly 42.8% global market share in 2020 and remains the leading segment.

• Average global CAGR for 2025-2032 is estimated at 9.91%.

• Approximately 30.11% of 2024 revenue originated from Asia Pacific.

• The consolidated global market value is forecast to climb from US$ 2.69 billion (2024) to US$ 5.815 billion (2032).

• The U.S. market is expected to grow from US$ 0.87 billion (2032 reference) to an adjusted US$ 1.261 billion by 2032 on stricter regulatory oversight.

• Municipal geotechnical spending is rising at double-digit rates in major cities pursuing resilient infrastructure.

Analyst Review & Recommendations

Momentum in geotechnical services is shifting toward integrated, data-rich solutions. Providers that pair high-resolution site investigations with cloud-based modelling, remote collaboration, and low-carbon vessel fleets will outpace peers. We recommend targeting municipal tunnel and offshore wind customers, investing in digital soil platforms, and partnering with EPC contractors to embed geotechnical insight earlier in project lifecycles. Despite cost headwinds, the long-term market outlook points to healthy, diversified growth across regions and applications.