Market Overview

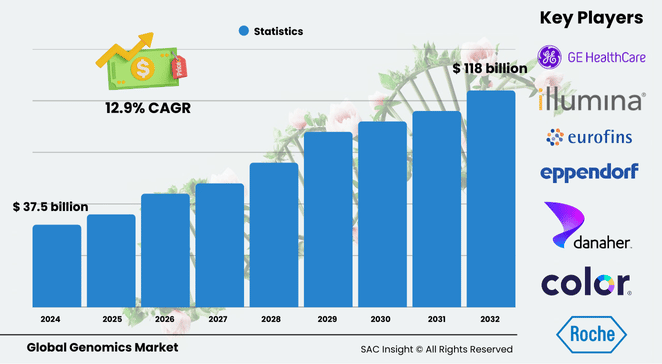

The global genomics market size is valued at approximately US$ 37.5 billion in 2024 and is projected to reach about US$ 118 billion by 2032, reflecting a healthy 12.95% CAGR. First-hand industry insights highlight three structural drivers underpinning this market growth: surging demand for precision medicine and gene therapies, rapid cost reductions in next-generation sequencing (NGS), and expanding clinical adoption of comprehensive genomic profiling.

SAC Insight's deep market evaluation shows North America continues to command the largest market share, while Asia Pacific is registering the fastest market growth as national genome projects scale up. In the U.S., the genomics market is expected to top roughly US$ 50 billion by 2032 as large health systems move toward routine whole-genome sequencing for oncology and rare-disease diagnostics.

Summary of Market Trends & Drivers

• Sequencing costs below US$ 200 per genome and turnkey benchtop sequencers are accelerating decentralized testing in hospitals and specialty labs.

• AI-driven variant interpretation and cloud bioinformatics platforms are shortening analysis cycles, turning raw data into actionable insights for clinicians.

• Public-private genome initiatives—such as Genome Asia 100K and All of Us—are enlarging reference databases and nurturing personalized-medicine pipelines.

Key Market Players

Industry competition pivots around innovation speed, reagent economics, and informatics ecosystems. Leading instrument makers and service providers include Illumina, Thermo Fisher Scientific, Danaher, F. Hoffmann-La Roche, QIAGEN, Agilent Technologies, Revvity, PacBio, Oxford Nanopore, Bio-Rad Laboratories, and Eurofins Scientific. These companies reinforce their positions through continuous platform refreshes, strategic M&A, and partnerships that bundle long-read sequencing, cloud analysis, and minimal-residual-disease tools into integrated offerings. Meanwhile, data-centric firms such as 10x Genomics, Foundation Medicine, and Fabric Genomics focus on single-cell workflows, oncology decision support, and real-time clinical reporting, pushing the competitive tempo toward end-to-end clinical solutions.

Key Takeaways

• Market value (2024): USD$ 37.5 billion

• Projected value (2032): USD$ 118 billion at a 12.95% CAGR

• North America holds about 42% of global revenue; Asia Pacific is the fastest-growing region.

• Functional genomics commands the largest application slice at roughly one-third of revenue.

• Sequencing technologies lead the technology stack, with long-read workflows gaining momentum in rare-disease research.

• Oncology remains the dominant diagnostic application, driven by comprehensive genomic profiling and liquid biopsy adoption.

Market Dynamics

Drivers

• Declining sequencing costs and expanding reimbursement for genomic tests are propelling routine clinical use.

• Rising prevalence of cancer and inherited disorders fuels demand for high-resolution genomic diagnostics.

• Growth of consumer genomics and direct-to-consumer testing widens data pools for research and drug discovery.

Restraints

• High capital expenditure for advanced sequencers and the bioinformatics infrastructure needed for large-scale data analysis.

• Fragmented data-privacy regulations complicate cross-border sharing of genomic datasets.

• Limited bioinformatics talent pools create workflow bottlenecks in many emerging markets.

Opportunities

• Precision-medicine programs in cardiology, neurology, and immunology open new clinical revenue streams beyond oncology.

• Long-read sequencing combined with epigenetic mapping promises deeper insight into structural variants and rare diseases.

• Partnering with pharma on companion-diagnostic development offers high-margin service opportunities for labs.

Challenges

• Managing terabyte-scale data volumes requires sustained investment in high-performance computing and secure cloud storage.

• Complex intellectual-property landscapes around CRISPR and novel gene-editing tools may slow commercialization.

• Ensuring equitable access to genomic testing in low- and middle-income countries remains a public-health hurdle.

Regional Analysis

North America retains leadership thanks to sizable R&D budgets, favorable reimbursement policies, and a robust biopharma pipeline. Europe follows with strong regulatory support for population-health genomics, while Asia Pacific enjoys double-digit gains on the back of national genome projects and expanding precision-oncology programs.

• North America – Largest revenue contributor; hospital-based NGS adoption fuels steady market analysis momentum.

• Europe – Strong public funding and biobank networks underpin sustained market growth.

• Asia Pacific – Fastest-growing region as China, Japan, India, and Australia ramp up clinical genomics infrastructure.

• Latin America – Gradual uptake driven by private lab expansion and regional cancer initiatives.

• Middle East & Africa – Early-stage market, with genomics hubs emerging in the Gulf and South Africa.

Segmentation Analysis

By Technology

• Sequencing – Cornerstone of the market, capturing the highest revenue share

Widespread use of short- and long-read NGS in diagnostics and research keeps sequencing at the center of market trends. Benchtop systems now enable same-day in-house sequencing for oncology panels and infectious-disease surveillance.

• PCR – Critical for targeted variant detection and sample prep

Despite the rise of NGS, PCR remains indispensable for quick validation of specific mutations, pathogen load monitoring, and expression analysis, especially in low-resource labs.

• Flow Cytometry & Microarrays – Established tools with niche clinical roles

These technologies support gene-expression profiling, immunophenotyping, and high-throughput screening where sequencing is not cost-effective.

• In Situ Hybridization & Gene Editing – Specialized methods gaining clinical interest

ISH helps pathologists visualize gene amplification in tissue sections, while CRISPR-based diagnostics usher in rapid, point-of-care mutation detection.

By Application

• Functional Genomics – Largest application segment at 32% share

Researchers leverage knock-out/knock-down screens and single-cell RNA-seq to decode phenotype-genotype links, guiding novel drug targets.

• Epigenomics – Fast-growing area for cancer detection and aging research

Bisulfite sequencing and chromatin-accessibility assays uncover methylation signatures that aid early cancer screening and prognostics.

• Pathway Analysis – Increasingly vital for next-generation therapeutics

Mapping disease pathways helps identify druggable nodes and predict combination-therapy responses, attracting pharma collaborations.

• Biomarker Discovery & Others – Diverse applications in rare-disease and metabolic-disorder research

Comprehensive omics integration accelerates biomarker pipelines, supporting companion diagnostics and stratified-medicine trials.

By Deliverable

• Products (Instruments/Systems/Software; Consumables & Reagents) – Two-thirds of total spend

Continuous platform updates and reagent subscription models drive recurring revenue and lock-in laboratory workflows.

• Services (NGS-based, Core Genomics, Biomarker Translation, Computational) – Growing double digits

Laboratories and biopharma increasingly outsource sequencing, data analytics, and bioinformatics to specialist service providers to focus on core R&D.

By End-Use

• Pharmaceutical & Biotechnology Companies – Leading spenders on multi-omics drug-discovery programs

Extensive investment in genomics accelerates target validation and patient stratification for clinical trials.

• Hospitals & Clinics – Fastest clinical-adoption curve

Comprehensive genomic profiling is moving from research to routine care, particularly in oncology and neonatal intensive-care units.

• Academic & Government Institutes, Clinical Research Organizations, and Others – Steady demand for large population studies and translational research

Industry Developments & Instances

• May 2024 – Oxford Nanopore and Twist Bioscience rolled out a long-read pharmacogenomics beta program for star-allele calling in a single workflow.

• May 2024 – Fabric Genomics partnered with DNAnexus and Oxford Nanopore to deploy neonatal genomic labs in U.S. pediatric ICUs.

• September 2023 – PacBio teamed with Hamilton, Integra, Revvity, and Tecan to automate sample prep on Revio sequencers.

• January 2023 – Agilent acquired Avida Biomed to bolster NGS target-enrichment workflows for oncology research.

• April 2022 – QIAGEN launched a biomedical knowledge base to power AI-ready data-science applications in biotech.

Facts & Figures

• Functional genomics commanded 32.1% of global revenue in 2023.

• North America captured roughly 42.65% market share last year, with the U.S. contributing the majority.

• Sequencing technologies accounted for more than 40% of overall technology revenue in 2023.

• Over 52 million human genomes are expected to be studied by 2025, up from fewer than 10 million in 2020.

• AI-enabled variant-interpretation platforms cut analysis time by up to 60%, slashing laboratory turnaround to under 24 hours.

• Oncology generates nearly half of all clinical-sequencing demand, propelled by comprehensive genomic profiling and minimal-residual-disease testing.

Analyst Review & Recommendations

Market analysis indicates genomics is transitioning from high-throughput research to everyday clinical practice. To capture market growth, vendors should bundle sequencing platforms with easy-to-use bioinformatics, pursue pharma partnerships for companion-diagnostic co-development, and invest in long-read plus epigenetic capabilities that resolve structural and regulatory variants. Stakeholders bringing down per-sample costs while safeguarding data privacy will gain sustainable competitive advantage as precision medicine moves to the population scale.