Market Overview

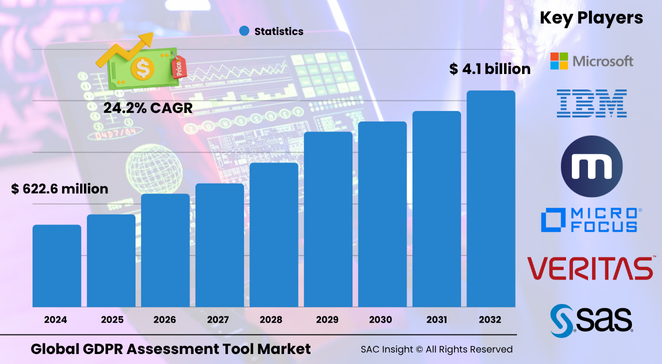

The global GDPR assessment tools market size was about US$ 622.6 million in 2024 and is expected to surge to roughly US$ 4.17 billion by 2032, advancing at a robust 24.25% CAGR. SAC Insaight's first-hand industry insights reveal three growth engines: soaring penalties for non-compliance, a sharp rise in cross-border data transfers, and the rapid adoption of AI-powered compliance automation.

SAC Insight's deep market evaluation indicates the U.S. GDPR assessment tools market alone could approach US$ 1.1 billion by 2032 as enterprises prioritize reputational risk management.

Summary of Market Trends & Drivers

• Cloud-native, API-ready platforms dominate new purchases, reflecting a shift from checklist audits to continuous monitoring.

• AI and machine-learning engines now flag potential breaches in real time, shortening incident-response cycles and driving market growth.

• Mid-sized firms increasingly bundle GDPR assessment with wider privacy frameworks, fuelling demand for integrated, multi-regulation toolsets.

Key Market Players

Leading providers include Microsoft, IBM, Mimecast, Softcat, Commvault, SAS Institute, Websense, Veritas Technologies, AlienVault, OneTrust, and Micro Focus. These companies combine deep security portfolios with regional partners to deliver scalable privacy solutions. Product roadmaps focus on low-code dashboards, automated data-mapping, and pre-built reporting templates that satisfy data-protection authorities on day one.

Competitive dynamics pivot around ecosystem breadth and time-to-audit. Vendors that pair self-service portals with expert advisory teams win higher market share, while alliances with niche European consultancies help global brands navigate localized requirements.

Key Takeaways

• Current global market size (2024): USD$ 622.6 million

• Projected global market size (2032): USD$ 4.17 billion at a 24.25 % CAGR

• Cloud-based deployments already command about 65 % market share and are the fastest-growing segment

• Large enterprises generate roughly 70 % of current revenue; SMEs show the quickest uptake through SaaS models

• Europe leads adoption, yet Asia Pacific posts the highest year-on-year growth at 12 % as new privacy laws emerge

• AI-driven data-mapping and automated DPIA modules are the top technology market trends shaping procurement decisions

Market Dynamics

Drivers

• Escalating fines—up to 4 % of global turnover—push boards to approve bigger compliance budgets

• Continuous digitalization balloons personal-data volumes, making automated risk detection indispensable

• Rising consumer privacy awareness boosts demand for transparent consent management

Restraints

• High upfront integration costs deter some SMEs from full-featured platforms

• Fragmented global regulations create upgrade cycles that overwhelm resource-strained IT teams

Opportunities

• Privacy-by-design consulting and managed compliance services open recurring-revenue streams

• Third-party risk scoring modules extend tool relevance beyond internal data flows

Challenges

• Constant regulatory updates risk making legacy tool licenses obsolete within short cycles

• Shortage of in-house privacy talent slows implementation and value realization

Regional Analysis

Europe remains the reference market due to stringent enforcement and mature data-protection cultures, while North America follows closely as breach headlines spur investment. Asia Pacific shows the quickest CAGR, powered by new laws in India, Japan, and Australia and rapid cloud migration across SMEs.

• Europe – Largest revenue base, strict enforcement drives tool penetration

• North America – High breach incidents and litigation risk sustain spend

• Asia Pacific – Fastest growth on expanding privacy regulations and digital commerce

• Latin America – Gradual uptake as Brazil’s LGPD sets precedent

• Middle East & Africa – Early-stage adoption, led by financial hubs seeking global trust

Segmentation Analysis

By Deployment

• On-Premises – Legacy critical-data control.

Enterprises in heavily regulated sectors retain on-premises stacks to meet internal security mandates, yet the segment’s overall share is easing as SaaS security certifications mature.

• Cloud-Based – Scalability and automated updates.

Subscription models bundle continuous patching, multi-regulation templates, and API integrations, making cloud the preferred choice for rapid roll-outs and lower total cost of ownership.

By Service

• Consulting – Strategy first.

Specialist advisers set baselines, map data flows, and craft remediation roadmaps, positioning vendors as long-term partners rather than software resellers.

• Training – Culture catalyst.

Interactive modules and micro-learning keep staff alert to phishing and consent pitfalls, reducing human-error incidents that trigger fines.

• Implementation & Integration – Fast-track compliance.

Pre-built connectors with CRM, ERP, and data-lake platforms cut deployment time from months to weeks, a decisive factor for growth-stage firms.

• Support & Maintenance – Continuous assurance.

Round-the-clock monitoring and periodic audit updates safeguard against creeping non-compliance as business processes evolve.

By Tool

• Privacy Impact Assessment – Core diagnostic.

Automates risk scoring and recommends safeguards before new processing activities go live.

• Data Inventory & Mapping Automation – Single source of truth.

Discovers, classifies, and tags personal data across structured and unstructured repositories, forming the backbone of any market analysis.

• Readiness & Accountability – Executive dashboards.

Tracks policy maturity, assigns owners, and generates evidence packs for regulators.

• Incident & Breach Management – Rapid containment.

Orchestrates response playbooks, logs actions, and prepares breach notifications within statutory windows.

• Subject Access Rights Portal – Self-service transparency.

Empowers data subjects to view, rectify, or erase records, slashing administrative overhead.

• Website Scanning & Cookie Compliance – Front-line trust.

Continuously audits tracking scripts, updates consent banners, and produces versioned logs.

• Vendor Risk Assessment – Third-party lens.

Ranks suppliers’ privacy posture, highlights remediation areas, and integrates with procurement workflows.

• Consent Management – Unified recordkeeping.

Captures opt-ins across channels and syncs revocations in real time, ensuring marketing stacks stay lawful.

Industry Developments & Instances

• September 2022 – Spain’s data-protection authority launched Evalua Riesgo, a free DPIA tool that accelerates SME compliance.

• March 2024 – Major cloud provider added auto-classification features, cutting manual tagging effort by 40 %.

• August 2024 – Leading email-security firm integrated breach-response orchestrations with popular SIEM platforms.

• January 2025 – Consortium of European banks adopted a shared vendor-risk scoring standard to streamline audits.

• March 2025 – New hybrid deployment offering pairs on-premises data-discovery with cloud analytics for highly regulated industries.

Facts & Figures

• Cloud deployments captured 65 % of total revenue in 2023 and are growing at a 15 % CAGR.

• Large enterprises account for 70 % of current spend, yet SME subscriptions are climbing 18 % annually.

• Over 160 000 breach notifications were filed in the EU within 18 months of GDPR enforcement.

• Automated data-mapping can reduce audit-preparation time by up to 60 %.

• AI-based risk engines lower false-positive alerts by nearly 35 %, freeing compliance staff for higher-value tasks.

Analyst Review & Recommendations

Market analysis underscores a decisive pivot toward continuous, AI-driven compliance platforms that integrate seamlessly with adjacent privacy frameworks. Vendors that deliver low-code data-discovery, real-time breach orchestration, and third-party risk scoring stand to outpace average market growth. Buyers should prioritize tools with modular APIs, clear upgrade paths, and strong regional advisory networks to keep pace with evolving global regulations while safeguarding brand trust.