Market Overview

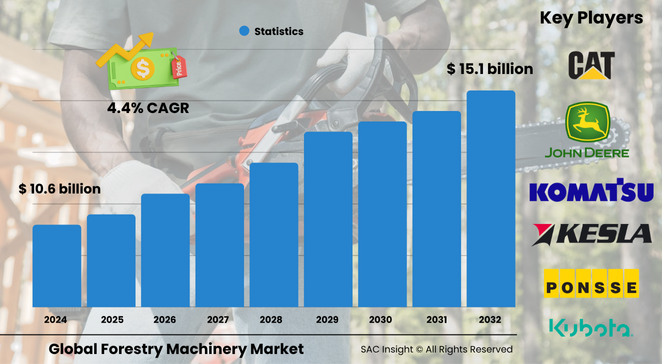

The global forestry machinery market size is valued at roughly US$ 10.69 billion in 2024 and is projected to reach about US$ 15.10 billion by 2032, advancing at an average 4.4 % CAGR. First-hand industry insights highlight three clear growth engines: expanding sustainable forest management mandates, a steady rise in global roundwood demand, and rapid technology upgrades—ranging from low-emission drivetrains to GPS-enabled precision harvesting—that lift productivity while shrinking carbon footprints.

SAC Insight's deep market evaluation shows the United States forestry machinery market alone could move from approximately US$ 1.4 billion in 2024 to nearly US$ 2.0 billion by 2032 as large timber operators refresh fleets for data-driven, low-impact logging.

Summary of Market Trends & Drivers

• Accelerated mechanization in both mature and emerging timber regions is pushing cut-to-length adoption, boosting sales of forwarders and harvesters.

• Hybrid and fully electric prototypes, such as battery-powered forwarders, signal a decisive pivot toward emissions-compliant operations and lower lifetime operating costs.

• Telematics and onboard analytics are turning forestry equipment into connected assets, enabling real-time machine health monitoring and precise yield mapping that underpin smarter forest planning.

Key Market Players

Industry leadership rests with a mix of diversified heavy-equipment manufacturers and forestry specialists. Deere & Company, Komatsu, Caterpillar, Tigercat, and Ponsse anchor the market with broad product lines, factory telematics, and global dealer networks. Volvo, Barko Hydraulics, Kubota, Hitachi Construction Machinery, and Rottne Industri keep competitive pressure high through focused innovation—lightweight swing processors, intelligent boom control, and modular powertrains designed for selective harvesting and thinning.

Key Takeaways

• Current global market size (2024): USD$ 10.69 billion

• Projected global market size (2032): USD$ 15.10 billion at a 4.4 % CAGR

• Europe holds the largest market share, while Asia-Pacific posts the fastest market growth on the back of plantation expansion and government mechanization programs

• Electric and hybrid powertrains move from pilot to early commercial phase, cutting on-site emissions by up to 80 %

• Telematics adoption exceeds 60 % in new-build harvesters, enabling predictive maintenance and optimized machine utilization

• Used-equipment channels gain traction among smaller contractors seeking affordable entry into mechanized logging

Market Dynamics

Drivers

• Growing demand for sustainable timber, wood pellets, and fiber-based packaging boosts fleet renewal across industrial forestry.

• Government incentives for low-emission machinery accelerate electric and hybrid introductions.

• Precision forestry practices leverage GNSS, LiDAR, and onboard sensors to maximize yield and minimize waste.

Restraints

• High upfront capital costs can deter smaller logging outfits from upgrading to advanced harvesters and forwarders.

• Skilled-operator shortages slow adoption of sophisticated equipment in remote regions.

Opportunities

• Battery-swapping infrastructure in high-volume logging corridors could unlock broader electric-fleet deployment.

• Retrofit telematics kits for legacy machines offer service providers a recurring revenue stream and extend asset life.

Challenges

• Volatile timber prices pressure margins, delaying procurement cycles during downturns.

• Fragmented regulatory frameworks for forest mechanization complicate cross-border fleet utilization.

Regional Analysis

Europe leads in market share thanks to stringent sustainability regulations, generous replanting subsidies, and widespread precision-logging practices. North America follows, supported by biomass-fuel demand and large industrial concessions, while Asia-Pacific delivers the quickest gains as plantation forestry scales in China, India, and Southeast Asia.

• North America – Mature mechanized logging; retrofit telematics drives aftermarket sales

• Europe – Largest market; strong compliance focus and operator-assistance innovation

• Asia-Pacific – Fastest CAGR; plantation expansion and government mechanization incentives

• South America – Growing eucalyptus plantations; exporters upgrading to high-capacity skidders

• Middle East & Africa – Niche growth driven by commercial forestry in Southern Africa and selective thinning in Mediterranean zones

Segmentation Analysis

By Machine Type

• Skidders – Core extraction workhorse.

Skidders remain indispensable for cable and grapple extraction in steep or mixed-species stands, where their pull-to-road efficiency lowers cycle times and fuel per cubic meter.

• Forwarders – Rising with cut-to-length methods.

Demand for forwarders is climbing as operators shift to cut-to-length harvesting; their low ground pressure and sorted-log transport reduce site disturbance and slash secondary handling costs.

• Harvesters – High-performance multi-operation tools.

Modern wheeled and tracked harvesters fell, delimb, and buck logs in a single pass, boosting output and enabling data capture for stand-level inventory analytics.

• Bunchers – Efficient felling clusters.

Feller-bunchers deliver rapid stump-to-stump cycles in southern pine and plantation hardwoods, bundling stems for quicker skidder engagement.

• Swing Machines – Versatile processing.

Swing processors with 360-degree house rotation tackle roadside debarking, processing, and stacking, easing logistics where space is tight.

• Loaders – Essential material handling.

Knuckle-boom and front-end loaders feed mills, chip plants, and railcars, directly influencing mill throughput and supply-chain reliability.

• Other Forestry Machinery – Mulchers, yarders, and stump grinders.

These niche units address land clearing, steep-slope cable logging, and residue reduction, rounding out contractor service portfolios.

By Operation

• Diesel – Dominant power source.

High-torque diesel engines paired with load-sensing hydraulics continue to rule core duties, valued for range and quick refueling in remote forests.

• Electric & Hybrid – Fastest-growing slice.

Battery-electric forwarders and hybrid harvesters cut fuel use, reduce noise, and align with net-zero procurement policies, making them the top choice for pilot sustainability projects.

By Sales

• New Units – Technology-driven purchases.

Plantation giants and state agencies favor factory-new machines with integrated telematics, autonomous assist, and warranty coverage.

• Used Units – Cost-effective entry point.

Independent loggers and small cooperatives extend fleet capacity via refurbished skidders and loaders, often adding aftermarket GPS kits for compliance.

Industry Developments & Instances

• November 2023 – A compact excavator-mounted forestry mulcher hit the market, broadening mechanized fuel-reduction options for wildfire-prone regions.

• September 2022 – A major OEM unveiled a battery-powered forwarder, proving zero-tailpipe-emission hauling on eight-hour shifts with on-site charging.

• May 2022 – Intelligent boom control was rolled into high-reach harvesters, using sensors and software to smooth operator motions and curb fatigue, raising daily productivity by up to 12 %.

Facts & Figures

• Europe harvested roughly 550 million m³ of roundwood in 2021, underpinning sustained equipment demand.

• North American industrial roundwood output topped 1,190 million ft³ in 2024, reinforcing fleet-renewal cycles.

• Forwarder registrations in Sweden jumped more than 50 % in 2023, signaling rapid mechanization uptake.

• Telematics-enabled machines report fuel savings of 8 – 15 % through optimized routing and idle-time alerts.

• Electric drive systems can reduce lifetime maintenance costs by up to 30 % owing to fewer moving parts.

Analyst Review & Recommendations

Market analysis indicates a clear pivot toward low-impact, data-rich operations. Manufacturers that blend electric drivetrains with intuitive operator-assist features and remote diagnostics will capture above-average market growth. Contractors should hedge price volatility by deploying mixed fleets—diesel for endurance, electric for sensitive zones—and leverage connected-machine data to prove sustainable harvesting metrics to end-use customers and regulators alike.