Market Overview

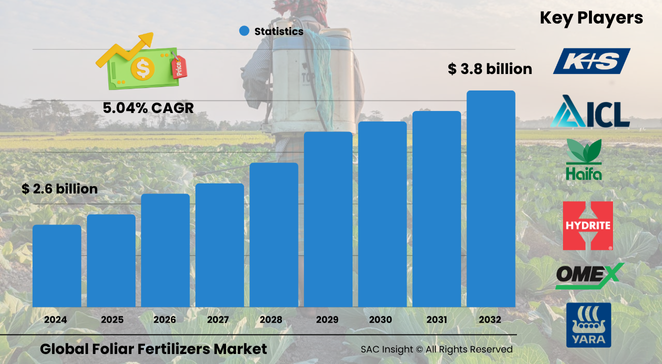

The global foliar fertilizers market size stood at about US$ 2.68 billion in 2024 and is projected to reach nearly US$ 3.802 billion by 2032, expanding at a 5.04 % CAGR. First-hand industry insights reveal three pivotal forces behind this market growth: the shift toward precision farming, rising demand for high-value horticultural produce, and government programs that encourage nutrient-efficient inputs.

SAC Insight’s deep market evaluation indicates the United States foliar fertilizers market could grow from roughly US$ 400 million in 2024 to around US$ 610 million by 2032 as large-scale producers look to cut soil losses and speed nutrient uptake.

Summary of Market Trends & Drivers

• Drone-enabled spraying, GPS mapping, and real-time leaf diagnostics are turning foliar feeding into a data-driven practice rather than an emergency fix.

• Rapid uptake of biostimulant-infused formulations is reshaping product portfolios, promising higher absorption rates and improved plant resilience.

Key Market Players

Regional champions such as Coromandel International Limited and IFFCO are scaling in-house R&D and farmer-outreach programs, while global suppliers like Haifa Group leverage water-soluble expertise to deliver crop-specific spray regimes. These firms compete on formulation efficiency, field support, and distribution reach, often collaborating with ag-tech start-ups to integrate foliar programs into digital farm-management platforms.

Key Takeaways

• Current global market size (2024): USD$ 2.68 billion

• Projected global market size (2032): USD$ 3.802 billion at a 5.04 % CAGR

• Horticulture accounts for the largest market share, exceeding 40 % of revenue

• Biostimulant-based sprays are the fastest-growing product class, tracking above 7 % annual market growth

• Precision-application tools can cut fertilizer use by up to 30 % while lifting yields in micronutrient-deficient soils

Market Dynamics

Drivers

• Wider precision-farming adoption delivers targeted sprays, reducing run-off and maximizing nutrient efficiency

• Government subsidies and clean-plant programs accelerate foliar use in export-oriented fruit and vegetable chains

• Growth in protected cultivation—polyhouses and greenhouses—demands quick-acting, foliar-friendly nutrients

Restraints

• Limited awareness among smallholders and concerns over leaf scorch slow penetration in rain-fed regions

• Supply-chain fragmentation and counterfeit products erode farmer trust and margin potential

Opportunities

• Nano-scale formulations and hybrid blends open premium pricing tiers for both staple and specialty crops

• Digital crop-advisory platforms create after-sale service revenue, turning inputs into subscription bundles

Challenges

• Varied regulatory approvals across regions delay product launches and raise compliance costs

• Volatile raw-material prices pressure margins, prompting a shift toward in-country sourcing and flexible manufacturing

Regional Analysis

Asia-Pacific commands the largest market share thanks to intensive horticulture and supportive subsidy frameworks, while North America leads in precision-spray technology adoption. Europe’s demand is shaped by tight nutrient-run-off regulations, driving rapid uptake of low-salt, foliar-only programs.

• North America – High adoption of drone and sensor-guided foliar feeding in broad-acre crops

• Europe – Strict environmental rules favor low-volume, high-efficiency sprays

• Asia-Pacific – Dominant share on the back of fruit, vegetable, and cash-crop expansion

• Latin America – Robust sugarcane and citrus sectors propel biostimulant demand

• Middle East & Africa – Emerging greenhouse hubs rely on foliar feeds to manage poor soils and salinity

Segmentation Analysis

By Product

• Mineral Liquid / Suspension – Core volume driver.

These traditional formulations supply essential NPK and micronutrients in a readily available form, dominating commodity-crop programs where cost per hectare matters.

• Biostimulants – Fastest-growing niche.

Seaweed extracts, amino acids, and organic acids improve stress tolerance and nutrient uptake, finding favor with export-oriented fruit and vegetable growers who seek residue-free inputs.

• Hybrid Blends – Value-added segment.

Combining mineral nutrients with biostimulants offers a one-spray solution that boosts both yield and quality, appealing to farmers aiming to simplify spray schedules.

By Application

• Horticulture Openfield – Main demand engine.

High-value produce like grapes, citrus, and tomatoes relies on foliar sprays for quick micronutrient correction, directly influencing color, size, and shelf life.

• Horticulture Greenhouse – Precision-intensive pocket.

Controlled-environment farms favor low-volume foliar programs to fine-tune growth stages without altering substrate EC levels.

• Field Crops – Growing supplemental use.

Foliar nitrogen and micronutrient top-ups mitigate mid-season deficiencies in cereals and oilseeds, especially under erratic rainfall.

• Turf & Ornamental – Steady niche.

Golf courses and landscape managers use rapid-uptake irons and chelates to maintain uniform greening while avoiding soil accumulation.

• Others – Specialty and seed treatments.

Seed priming and late-season grain fill sprays represent emerging micro-segments with high margin potential.

Industry Developments & Instances

• October 2024 – Coromandel International opened a hi-tech polyhouse R&D farm in Telangana to accelerate foliar formulation testing under precision conditions.

• August 2024 – The Indian government launched a USD$ 210 million Clean Plant Programme aimed at modern horticulture and advanced nutrition practices.

• December 2024 – Nationwide campaign promoted Nano DAP seed and foliar treatments, targeting a 20 % cut in conventional DAP usage over five years.

• January 2025 – Haifa Group established Haifa India Fertilizers & Technologies to localize water-soluble foliar blends and fertigation programs.

Facts & Figures

• Foliar application can achieve up to 90 % nutrient uptake efficiency versus 45-60 % for soil fertilization.

• Biostimulant-infused sprays are forecast to capture nearly 30 % market share by 2032.

• Precision sprayers can reduce fertilizer volumes by 15-30 % while maintaining or increasing yields.

• Horticulture represents roughly 45 % of total foliar fertilizer consumption in 2024.

• More than 2 million hectares in India adopted foliar nutrition programs in 2024, an 18 % year-on-year increase.

Analyst Review & Recommendations

Market analysis underscores a clear pivot from corrective foliar sprays to proactive, data-guided nutrition regimes. Suppliers that integrate sensor analytics, nano-technology, and agronomic advisory into one service package will outpace average market growth. To capture this upside, prioritize field-demonstration programs that quantify yield gains, develop low-salt blends for regulated markets, and invest in scalable manufacturing that can flex with volatile raw-material costs.