Market Overview

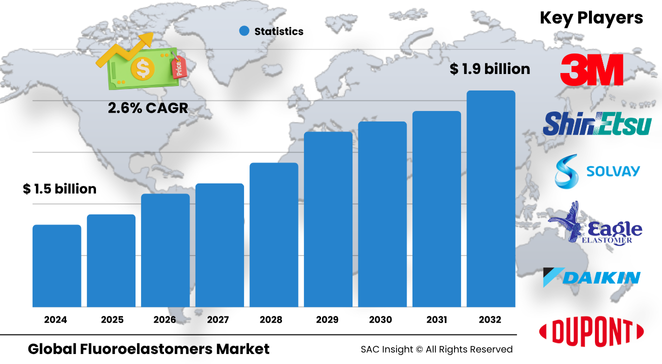

The global fluoroelastomers market size is currently valued at about US$ 1.588 billion (2024) and is on track to reach roughly US$ 1.953 billion by 2032, reflecting steady market growth at a 2.65 % CAGR. First-hand industry insights show demand is fueled by tougher emissions rules, electrified powertrains that run hotter, and a broad shift toward low-maintenance sealing solutions across automotive, aerospace, oil & gas, and chemical plants.

SAC Insight’s deep market evaluation indicates the U.S. fluoroelastomers market alone could rise from approximately US$ 508.8 million in 2024 to around US$ 625.8 million by 2032 as domestic OEMs push for lighter, more fuel-efficient designs.

Summary of Market Trends & Drivers

• Automakers are downsizing engines and integrating advanced air-management systems, raising under-hood temperatures and lifting demand for high-heat seals.

• Aerospace and oilfield operators are standardizing on FKM and FFKM compounds that withstand aggressive fuels, bio-jet blends, and corrosive drilling fluids.

• Sustainability initiatives are nudging suppliers toward non-fluorinated surfactants and bio-based modifiers without sacrificing chemical resistance.

Key Market Players

Global market share remains concentrated among a handful of specialty-polymer leaders. Companies such as Chemours, Daikin, 3M, Solvay, and AGC anchor the high-performance end of the spectrum, leveraging advanced polymer architecture and precision compounding to meet OEM specifications. Regional champions—including Gujarat Fluorochemicals, Dongyue, and Shin-Etsu—focus on cost-effective grades and local technical support, intensifying competition in Asia-Pacific.

Competitive dynamics revolve around capacity expansions, material innovation, and sustainability credentials. Recent investments in peroxide-curable lines, FDA-compliant compounds, and low-carbon manufacturing processes illustrate how producers are aligning portfolios with evolving regulatory and customer targets.

Key Takeaways

• Current global market size (2024): about USD$ 1.588 billion

• Projected global market size (2032): roughly USD$ 1.953 billion at a 2.65 % CAGR

• U.S. market expected to exceed USD$ 625 million by 2032 as EV and hybrid volumes climb

• Fluorocarbon elastomers account for the largest market share thanks to balanced cost-performance

• Seals & gaskets hold roughly 31 % of revenue; battery and powertrain upgrades are widening use cases

• Sustainability moves—non-fluorinated surfactants, energy-efficient reactors—are emerging as key market trends

Market Dynamics

Drivers

• Rising engine temperatures and aggressive biofuels heighten the need for heat- and chemical-resistant sealing solutions.

• Stricter emissions and safety standards across mobility and process industries spur material upgrades.

• Expanding renewable-energy assets require durable gaskets for high-temperature power electronics.

Restraints

• High raw-material and processing costs keep prices above conventional elastomers.

• Environmental concerns over non-biodegradable fluoropolymers attract regulatory scrutiny.

Opportunities

• Customized food- and pharma-grade compounds open premium niches with higher margins.

• Advanced mixing and precision molding unlock thinner, lighter components for EV battery packs.

Challenges

• Smaller suppliers face steep capital requirements and complex quality audits to enter OEM supply chains.

• Supply-chain volatility in fluorspar and specialty additives can disrupt production schedules.

Regional Analysis

Asia-Pacific commands the largest market share on the back of expansive automotive, electronics, and industrial bases in China, Japan, South Korea, and India. North America follows, driven by a resilient aerospace sector and rapid electrification of vehicles, while Europe benefits from stringent chemical safety regulations that favor high-performance materials.

• North America – High adoption in aerospace MRO and tight crude-oil drilling operations.

• Europe – Strong regulatory push for low-permeation fuel systems and sustainable production.

• Asia-Pacific – Fastest market growth as regional OEMs ramp up EV exports and chemical capacity.

• Latin America – Niche demand linked to refinery upgrades and deepwater exploration.

• Middle East & Africa – Gradual uptake in petrochemical and gas-processing facilities.

Segmentation Analysis

By Type

• Fluorocarbon (FKM) – Workhorse, largest revenue slice.

FKM’s balance of heat, fluid, and compression-set resistance keeps it the default choice for powertrain seals, turbocharger hoses, and fuel-system gaskets across light-vehicle and industrial platforms.

• Perfluoroelastomers (FFKM) – Premium niche, unmatched chemical tolerance.

FFKM components protect semiconductor tools, pharmaceutical reactors, and harsh-acid lines where even trace contamination or seal failure can halt production, justifying their higher cost.

By Application

• Seals & gaskets – Anchor at roughly 31 % of revenue.

Continuous downsizing of engines and the rise of high-pressure direct injection increase the number and criticality of gaskets that must remain leak-free for 200 000+ km duty cycles.

• O-rings – Fast replacement cycle, high mix.

Standardized sizes allow O-rings to serve everything from hydraulic controls to spacecraft valves, and FKM grades extend service intervals by resisting swelling in mixed-fuel environments.

• Hoses & tubings – Vital for aggressive-fluid transfer.

Fluoroelastomer linings enable lightweight, flexible fuel and coolant lines that resist permeation, a critical factor in meeting evaporative-emission limits.

• Others – Diaphragms, shaft seals, expansion joints.

Specialty parts exploiting FKM’s low compression set keep vacuum systems, chemical pumps, and metering equipment operating reliably.

By End-Use Industry

• Automotive – Chief consumer.

Powertrain electrification raises under-hood temperatures, while low-permeation mandates favor FKM in fuel vapor and battery-coolant circuits.

• Aerospace – Reliability at altitude.

FKM maintains elasticity down to –40 °C and up to 230 °C, ensuring leak-free hydraulic and fuel systems in wide-body fleets.

• Oil & gas – Harsh downhole chemistry.

Packers, bladders, and completion tools rely on FFKM for sour-gas resistance and prolonged exposure to supercritical CO2.

• Chemical processing – Corrosion defense.

Seals in reactors and transfer lines withstand concentrated acids, caustics, and solvents, cutting unplanned downtime.

• Energy & power / Pharmaceutical & food – Emerging adopters.

High-purity FKM grades satisfy FDA and EU food-contact rules, while grid-scale batteries and fuel cells need long-life gaskets.

Industry Developments & Instances

• April 2024 – Chemours introduced Advanced Polymer Architecture technology for Viton to eliminate fluorinated surfactants.

• November 2023 – Daikin unveiled a next-generation fluoroelastomer boasting improved acid resistance for semiconductor and EV battery applications.

• May 2022 – Chemours commenced sustainable Viton production using a non-fluorinated surfactant platform, lowering greenhouse-gas intensity.

• October 2019 – Solvay expanded peroxide-curable FKM capacity in Italy to serve growing automotive and oilfield demand.

• May 2017 – Asahi Glass launched AFLAS 600X, targeting high-pressure packers and gaskets.

• August 2017 – Daikin acquired Heroflon, adding specialty fluoropolymer compounding capability in Europe.

Facts & Figures

• Fluorocarbon elastomers represent roughly 58 % of total market volume.

• Average replacement interval for FKM turbo-oil seals has doubled from 120 000 km to 240 000 km over the past decade.

• Electric-vehicle battery packs can contain more than 20 % additional FKM content versus internal-combustion vehicles due to thermal-management needs.

• Advanced mixing lines cut scrap rates by up to 15 %, improving overall equipment efficiency.

• U.S. aerospace MRO consumes nearly 2 000 tons of FKM annually for hydraulic-system overhauls.

Analyst Review & Recommendations

Our market analysis highlights a clear pivot toward high-performance, sustainable formulations that align with stricter emissions targets and longer product lifecycles. Producers that combine non-fluorinated processing aids, precision compounding, and rapid prototyping services will capture outsized market share. End users should lock in multi-year supply agreements to hedge raw-material volatility and collaborate closely with material scientists to tailor compounds for next-generation EV, hydrogen, and semiconductor applications.