Market Overview

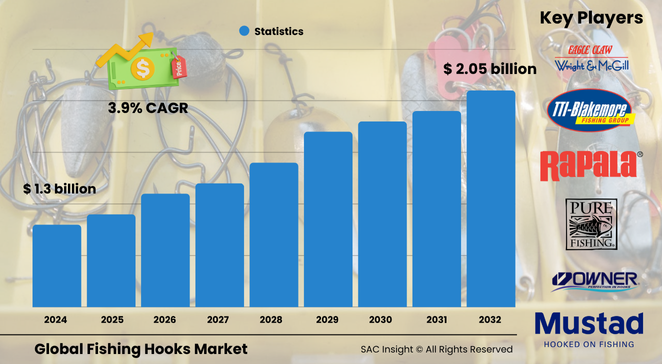

The global fishing hooks market size sat near US$ 1.399 billion in 2024 and is on course to reach roughly US$ 2.055 billion by 2032, expanding at a healthy 3.95 % CAGR. First-hand industry insights show momentum coming from booming recreational angling, steady aquaculture spending, and rapid e-commerce penetration that gives even niche brands global reach.

SAC Insight’s deep market evaluation indicates the United States fishing hooks market alone could advance from about US$ 0.50 billion in 2024 to nearly US$ 0.69 billion by 2032 as freshwater outings, bass tournaments, and coastal charters fuel premium hook demand.

Summary of Market Trends & Drivers

• Surge in catch-and-release ethics is lifting demand for barbless and circle hooks that reduce fish injury.

• Social-media “fishing challenge” culture and adventure tourism are broadening participation across younger demographics, driving steady market growth.

• Hook designs are shifting toward high-carbon micro-points, eco-friendly coatings, and biodegradable materials as sustainability expectations tighten.

Key Market Players

Market leadership spans a mix of heritage manufacturers and agile specialists. Brands such as Mustad & Son, Gamakatsu, Rapala VMC, Owner, and Eagle Claw command significant market share with vast portfolios that cover everything from cost-effective J-hooks to tournament-grade chemically-sharpened models. They leverage global distribution, pro-staff sponsorships, and continuous R&D to stay ahead of regional regulations and species-specific preferences.

Alongside the giants, focused innovators including Tiemco, Hayabusa, and specialty start-ups view the shift to environmentally safe tackle as an opening to gain traction. Their strategies revolve around limited-run premium hooks, influencer partnerships, and rapid fulfillment through online channels, intensifying competitive dynamics worldwide.

Key Takeaways

• Current global market size (2024): about USD$ 1.399 billion

• Forecast market size (2032): around USD$ 2.055 billion at a 3.95 % CAGR

• North America retains the biggest revenue slice, buoyed by 45 % regional market share in 2024

• Barbed hooks remain volume leaders, yet barbless variants post the fastest revenue climb above 5 % CAGR

• Online stores already account for more than 30 % of global sales and could top 45 % by 2032

• High-carbon steel dominates material choice thanks to superior point retention and tensile strength

Market Dynamics

Drivers

• Rising disposable incomes and wellness-oriented lifestyles turn fishing into a mainstream weekend pursuit across urban centers.

• Governments promote recreational angling for tourism and rural job creation, expanding licensing programs and lakeside infrastructure.

• Continuous product innovation—micro-barbs, nano-coatings, ergonomic hook eyes—enhances hook-up rates and supports premium pricing.

Restraints

• Environmental scrutiny over lost tackle and by-catch is prompting stricter gear regulations that may slow traditional barbed hook sales.

• Raw-material cost swings for specialty alloys pressure margins, particularly for small and mid-size firms.

• Counterfeit hooks traded online can erode brand equity and undercut pricing discipline.

Opportunities

• Biodegradable and corrosion-controlled hooks present a clear path to differentiate and win eco-certifications.

• Growth of women- and youth-focused fishing leagues opens fresh marketing channels and product bundling possibilities.

• Augmented-reality tackle apps offering rig tutorials and personalized sizing advice can boost direct-to-consumer engagement.

Challenges

• Balancing ultra-sharp micro-points with durability is technically demanding, raising R&D outlays.

• Supply-chain disruptions for specialty plating chemicals may delay production schedules.

• Educating emerging markets on species-specific hook selection is essential yet resource-intensive.

Regional Analysis

North America dominates thanks to large angler communities, strong consumer spending power, and abundant freshwater bodies. Europe follows, driven by recreational fishing tourism and progressive sustainability mandates that favor barbless designs. Asia Pacific is the fastest-growing market, lifted by surging coastal leisure fishing in China, Japan, and Australia alongside robust aquaculture investments.

• North America – Largest revenue base; expanding bass and salmon circuits sustain premium demand.

• Europe – Solid growth; catch-and-release policies lift barbless market share.

• Asia Pacific – Quickest CAGR; rising middle-class leisure spending and aquaculture scale-up spur volume.

• Latin America – Growing saltwater charters and sport-fishing events nurture regional uptake.

• Middle East & Africa – Modest but improving; coastal resort development and government tourism drives entry-level segment.

Segmentation Analysis

By Product Type

• Barbed Hooks – Everyday workhorse, broadest market share.

Barbed designs remain popular for secure catch retention in both recreational and commercial settings, especially where regulations allow traditional gear.

• Barbless Hooks – Fastest-growing niche.

Adoption is climbing in conservation-minded regions as these hooks simplify release, minimize tissue damage, and align with tournament rules.

• Circle Hooks – Conservation favorite in saltwater.

The self-setting curve consistently hooks fish in the jaw corner, reducing deep-hooking and earning acceptance from regulators and charter fleets alike.

• Treble Hooks – Lure companion.

Three-point hooks stay vital for crankbaits and spoons, though refinements such as inward-facing micro-barbs seek to curb injury.

• Others – Specialty patterns.

Octopus, worm, and live-bait hooks address specific species or techniques, offering steady albeit smaller revenue streams.

By Application

• Freshwater Fishing – Core demand engine.

Bass, trout, and carp angling across lakes and rivers account for the majority of hook sales thanks to vast participation and frequent gear turnover.

• Saltwater Fishing – Rising blue-water appetite.

Offshore charters and surf casting push demand for corrosion-resistant stainless and circle hooks tailored for larger species.

• Fly Fishing – Premium niche.

Barbless micro-hooks paired with craft flies command high margins as enthusiasts prize precise presentation and quick release.

• Others – Ice, bow, and kayak fishing.

Emerging styles add incremental growth, encouraging manufacturers to bundle hooks with specialized rigs.

By Material

• Stainless Steel – Corrosion champion.

Favored in saltwater, stainless hooks resist pitting and maintain shine, extending product life for coastal anglers.

• High Carbon Steel – Performance standard.

Superior hardness delivers razor-sharp points and robust bending strength, retaining the largest material share across all price tiers.

• Alloy Steel – Cost-effective balance.

Mixed-metal formulations offer mid-range durability at attractive price points, appealing to entry-level buyers and emerging markets.

• Others – Eco-composite lines.

Early-stage biodegradable blends and polymer-steel hybrids aim to address environmental concerns, signaling future product avenues.

By Distribution Channel

• Online Stores – Rapidly scaling storefront.

Market analysis shows anglers increasingly compare specs, watch tutorials, and bulk-buy hooks through e-commerce platforms, accelerating global access for niche brands.

• Specialty Stores – Trusted advisor.

Knowledgeable staff and hands-on product trials keep brick-and-mortar tackle shops relevant, especially for premium and custom rigs.

• Supermarkets/Hypermarkets – Convenience play.

Big-box retailers satisfy casual anglers seeking value packs and seasonal promotions.

• Others – Expos and direct manufacturer sales.

Fishing shows, tournaments, and brand websites create experiential channels that boost loyalty and feedback loops.

Industry Developments & Instances

• February 2025 – A leading brand launched a biodegradable freshwater series featuring plant-based binding resins to cut lost-tackle pollution.

• July 2024 – Major e-commerce marketplace partnered with top hook makers to integrate AI-driven sizing guidance, lifting conversion rates.

• April 2023 – A global outdoor retailer expanded its private-label circle hook line, citing 40 % year-on-year growth in saltwater segments.

• January 2022 – An angling federation mandated barbless hooks for youth tournaments, accelerating category adoption.

Facts & Figures

• Online channels captured roughly 32 % of global hook revenue in 2024.

• Circle hooks now represent close to 18 % of saltwater sales, up from 12 % in 2019.

• High-carbon steel accounts for over 55 % of total material usage worldwide.

• North America logged more than 49 million licensed anglers in 2024, sustaining robust replacement demand.

• Average annual spend per active angler on terminal tackle exceeded USD$ 49 in 2024, a 6 % uptick from the previous year.

Analyst Review & Recommendations

The fishing hooks market is pivoting from commodity hardware toward eco-smart, performance-driven designs. Companies that combine sharper micro-points, sustainable materials, and digital engagement stand to outpace average market growth. Prioritizing barbless and circle ranges for conservation-focused regions, expanding direct-to-consumer logistics, and partnering with angling influencers will strengthen brand relevance and margin resilience through 2032.