Market Overview

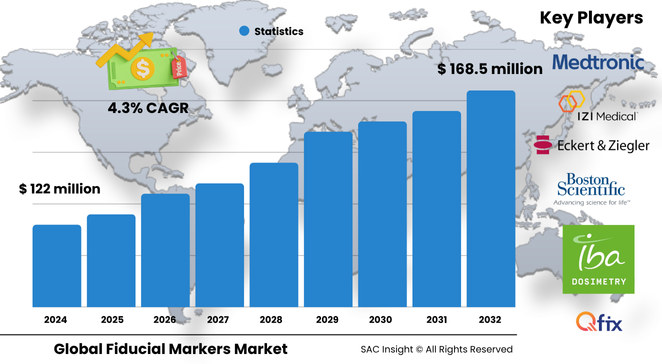

The global fiducial markers market size is roughly valued at US$ 122.05 million in 2024 and is projected to climb to about US$ 168.58 million by 2032, reflecting a steady 4.35 % CAGR over 2025-2032. SAC Insight industry insights confirm three growth engines: a rising global cancer burden, rapid adoption of image-guided radiotherapy, and continuous upgrades in marker visibility and biocompatibility.

SAC Insight’s deep market evaluation shows the United States fiducial markers market alone could move from an estimated US$ 42 million in 2024 to nearly US$ 58 million by 2032 as outpatient radiotherapy centers expand capacity and reimbursement stays favorable.

Summary Of Market Trends & Drivers

• Shift toward hypofractionated and stereotactic body radiotherapy demands ultra-precise tumor localization, lifting marker shipments.

• Polymer and liquid designs are gaining traction as clinicians seek options that minimize migration artifacts and scanning glare.

• Growing public-private funding for oncology research accelerates product approvals and clinical trial pipelines, underpinning long-run market growth.

Key Market Players

The competitive landscape is led by a tight circle of specialist manufacturers supplying both gold-based coils and next-generation polymer or liquid markers. Well-established vendors differentiate through broad catalogues that support CT, MRI, ultrasound, and CBCT workflows, while smaller innovators focus on novel shapes that anchor firmly in soft tissue. Technical partnerships with radiotherapy equipment makers and distribution alliances in emerging economies have become the preferred routes to widen market share.

R&D pipelines reveal a pivot toward combination materials—such as gold-titanium hybrids—and pre-loaded delivery systems that shave minutes off procedure time. At the same time, frequent acquisition activity shows large players consolidating niche suppliers to secure intellectual property and speed market entry across new modalities.

Key Takeaways

• Current global market size (2024): about USD$ 122.05 million

• Projected global market size (2032): roughly USD$ 168.58 million at a 4.35 % CAGR

• Metal-based markers dominate revenue today, yet polymer and liquid segments show the fastest uptick

• CT/CBCT retains the largest modality share, but ultrasound-guided placement posts the quickest adoption curve

• Prostate cancer remains the leading application; lung and breast segments accelerate on screening program expansion

• Independent radiotherapy centers edge ahead of hospitals as most-active end users due to outpatient workflow efficiencies

Market Dynamics

Drivers

• Rising incidence of prostate, breast, and lung cancers pushes procedural volumes that depend on fiducial guidance.

• Wider installed base of MRI-LINAC systems fuels demand for markers compatible with soft-tissue imaging.

• Government grants and philanthropic funds for precision oncology trials shorten innovation timelines.

Restraints

• Minor but notable complications—bleeding, discomfort, or migration—temper adoption among risk-averse clinicians.

• Limited oncology budgets in lower-income countries slow technology diffusion despite unmet need.

Opportunities

• Integration of biodegradable polymers creates room for markers that resorb post-therapy, cutting retrieval costs.

• AI-driven treatment-planning software opens avenues for smart markers embedding RFID or radiopaque coding.

Challenges

• Shortage of highly trained interventional radiologists in emerging markets restricts procedural throughput.

• Pricing pressure as procurement groups bundle consumables with linear-accelerator contracts can squeeze margins.

Regional Analysis

North America leads on account of mature reimbursement systems, large installed radiotherapy base, and active clinical-trial pipelines. Europe follows, supported by universal healthcare coverage and steady CE-mark approvals, while Asia-Pacific shows the fastest percentage gains as cancer screening programs scale in China and India.

• North America – Largest revenue pool; outpatient radiotherapy center growth sustains demand

• Europe – Aging population and CE-marked liquid markers accelerate uptake

• Asia-Pacific – Quickest CAGR; government import-duty cuts on LINACs enhance affordability

• Latin America – Gradual shift toward image-guided therapy in private hospitals boosts marker imports

• Middle East & Africa – Niche but rising; flagship oncology hubs in Gulf States spur premium-product sales

Segmentation Analysis

By Product

• Metal-based (Pure Gold / Gold Alloys) – Workhorse category, superior imaging contrast.

Pure gold coils and gold-titanium hybrids remain first choice for consistent visibility across CT and X-ray, securing the lion’s market share.

• Polymer-based – Cost-effective, artifact-light.

Lightweight polymer pellets cut MRI glare and reduce migration risk, appealing to budget-conscious centers.

• Liquid Markers – Fastest-growing micro-segment.

Biocompatible hydrogels form a stable bleb that conforms to soft tissue, simplifying placement in irregular tumors.

By Modality

• CT/CBCT – Core modality, integrated in most LINAC suites.

Low-dose CBCT provides real-time orthogonal images, anchoring routine radiotherapy workflows.

• Ultrasound – Rapidest uptake, low radiation exposure.

Real-time volumetric tracking makes it ideal for prostates and mobile organs, driving double-digit growth.

• MRI – Emerging for complex soft-tissue cases.

High-contrast scans plus MRI-LINAC installations push demand for non-ferromagnetic markers.

By Cancer Type

• Prostate Cancer – Largest usage base.

Multiple fractions and mobile gland position favor marker-guided alignment, keeping this segment in front.

• Lung Cancer – Accelerating adoption.

Marker systems pre-loaded in delivery needles lower pneumothorax risk, spurring usage as low-dose CT screening rises.

• Breast Cancer – Growing steadily.

External-beam therapy boosters, especially in early-stage cases, widen marker penetration.

By End User

• Hospitals & Outpatient Facilities – Highest revenue share.

Day-procedure scheduling, combined with reimbursement for marker placement, drives consistent demand.

• Independent Radiotherapy Centers – Fastest CAGR.

Focused treatment throughput and turnkey equipment make these centers prolific marker consumers.

• Cancer Research Centers – Innovation hubs.

Clinical trials test new geometries and materials, influencing future market trends.

Industry Developments & Instances

• March 2025 – A leading vendor introduced a helical gold-polymer coil designed for MRI-LINAC compatibility.

• December 2024 – A multinational acquired a Scandinavian polymer-marker start-up to enhance soft-tissue imaging portfolios.

• July 2024 – Regulatory approval granted for a biodegradable liquid marker in Europe, with post-marketing studies underway.

• May 2024 – A U.S. outpatient network signed a multi-year supply agreement for pre-loaded fiducial delivery kits.

• November 2023 – AI-enabled treatment-planning software launched, optimized for automatic marker recognition and tracking.

Facts & Figures

• Metal-based designs account for roughly 68 % of current market share.

• Average marker placement adds under five minutes to prostate biopsy procedures.

• Ultrasound-guided placements grew almost 9 % year-on-year in 2024.

• Over 3,000 radiotherapy centers worldwide now stock at least two marker types to cover multimodality imaging.

• MRI-compatible markers have reduced localization error in complex cases by up to 30 % in recent clinical studies.

Analyst Review & Recommendations

Market analysis indicates a clear shift from one-size-fits-all gold coils to application-specific polymer and liquid options. Suppliers that align portfolios with emerging MRI-LINAC and ultrasound workflows, offer pre-sterilized delivery kits, and secure training partnerships with high-volume outpatient networks will outpace average market growth. Investing early in biodegradable or smart-marker R&D can unlock premium pricing and guard against commoditization as reimbursement landscapes tighten.