Market Overview

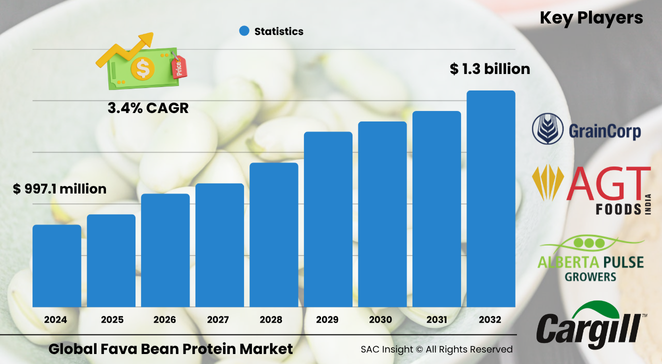

The global fava bean protein market size sits near US$ 997.1 million in 2024 and, according to SAC Insight’s first-hand industry insights, is on track to reach roughly US$ 1.304 billion by 2032, reflecting steady market growth at an average 3.4 % CAGR across the 2025-2032 forecast window. This market analysis shows three main structural tailwinds: rising adoption of plant-based diets, corporate and consumer focus on low-carbon food chains, and processing innovations that deliver neutral-taste, high-functionality protein ingredients.

SAC Insight's deep market evaluation indicates the U.S. fava bean protein market alone could advance toward US$ 288.67 million by 2032 as producers reformulate snacks, beverages, and meat substitutes with allergen-friendly legumes.

Summary of Market Trends & Drivers

• Flexitarian eating patterns and clearer front-of-pack protein claims are lifting demand for minimally processed, complete plant proteins.

• Sustainability metrics—water use, carbon intensity, and soil-building crop rotations—are turning fava beans into a preferred raw material for climate-aligned brands.

• Extrusion, membrane filtration, and low-voltage de-flavoring technologies are refining texture and mouthfeel, opening doors in high-moisture meat analogues and ready-to-mix nutrition powders.

Key Market Players

Agricultural giants and ingredient specialists dominate market share, sharpening their edge through contract farming, vertical integration, and consumer-focused application labs. Firms such as AGT Foods and Ingredients, Cargill, Roquette Frères, Puris Proteins, and GrainCorp supply isolates and concentrates tailored for beverages, bakery, and alt-meat, while regional innovators like Prairie Fava and Vestkorn Milling secure farmer loyalty and shorten supply chains.

Competitive dynamics hinge on scale and sensory performance. Global majors are expanding cold-processing lines that lift protein purity above 90 %, whereas niche players differentiate with organic certification, hypo-allergen positioning, and blended protein systems that cut off-flavors without masking agents.

Key Takeaways

• Current global market size (2024): USD$ 997.1 million

• Projected global market size (2032): USD$ 1.304 billion at a 3.4 % CAGR

• Conventional products lead market share, yet organic variants post faster relative growth

• Protein isolate captures over 60 % of revenue thanks to 90 %+ protein content and neutral taste

• North America drives innovation, while Asia Pacific records the quickest percentage gains

• The U.S. fava bean protein market is expected to approach USD$ 288.67 million by 2032

Market Dynamics

Drivers

• Accelerating shift toward vegetarian, vegan, and flexitarian diets

• Lower water and fertilizer footprint versus animal and soy proteins

• Continuous R&D investments in functional improvements and shelf-life extension

Restraints

• Allergen concerns for individuals with G6PD deficiency complicate labelling

• Competition from pea, lentil, and chickpea proteins pressures price realization

• Limited consumer familiarity in some regions slows initial uptake

Opportunities

• Hybrid blends pairing fava with cereal or algae proteins to achieve complete amino profiles

• Expansion of certified organic acreage for premium positioning

• Co-development with alt-meat and non-dairy start-ups to fast-track launches

Challenges

• Replicating fibrous meat texture without gums or phosphates

• Volatile pulse yields from climate shifts and logistics bottlenecks

• Need for targeted education to dispel taste and preparation misconceptions

Regional Analysis

North America currently commands the largest market share thanks to an established alt-protein ecosystem, sophisticated processing infrastructure, and retailers pushing clear sustainability metrics. Europe follows with strong regulatory support for legume crop rotation, while Asia Pacific shows the highest growth rate as China, India, and Australia scale acreage and processing capacity.

• North America – Innovation hub with high per-capita protein intake

• Europe – Subsidized pulse cultivation and carbon labelling boost demand

• Asia Pacific – Fastest CAGR on government food-security programs

• Latin America – Emerging hubs leveraging favorable climate and exports

• Middle East & Africa – Early-stage but growing interest from wellness-oriented consumers

Segmentation Analysis

By Product

• Fava Bean Protein Isolate – Premium, 90 % protein ingredient dominating revenue.

Isolates offer near-neutral flavor and high solubility, making them the go-to choice for beverages, nutrition powders, and precision-textured meat analogues.

• Fava Bean Protein Concentrate – Balanced nutrient profile at 70 % protein plus native fiber.

Concentrates excel in bakery, snacks, and hybrid patties, providing cost-effective fortification and clean-label viscosity.

• Flour – Native milled bean powder for traditional foods and gluten-free baking.

Though lower in protein, whole-meal flour retains micronutrients and fiber, fitting heritage recipes in Mediterranean and Middle Eastern cuisines.

By Type

• Conventional – Cost-efficient mainstream option with broad supply chain.

It satisfies volume needs for large processors aiming to displace soy at minimal formulation cost.

• Organic – Smaller yet faster-growing segment commanding price premiums.

Certification resonates with shoppers seeking pesticide-free plant proteins and helps brands meet strict clean-label goals.

By Application

• Human Nutrition – Core demand engine exceeding 60 % of market revenue.

Protein bars, RTD shakes, and plant-based meats leverage fava’s complete amino profile and mild taste.

• Food Processing – Rapidly expanding use case for emulsified and baked goods.

Manufacturers value its emulsification and water-hold capacity, reducing egg usage in clean-label reformulations.

• Nutraceuticals – Growing niche for gut-friendly, antioxidant-rich powders.

Formulators highlight natural polyphenols and resistant starch for digestive and heart-health claims.

• Animal Feed – Cost-effective legume protein for aquaculture and pet food.

High lysine content improves feed conversion ratios, offering an alternative to fishmeal and soy.

• Others – Infant nutrition, sports supplements, specialty beverages.

Emerging uses explore hypo-allergenic formulas and recovery drinks demanding mild flavor and balanced amino profiles.

Industry Developments & Instances

• June 2024 – Phytokana Ingredients launched a 70 % protein concentrate addressing off-flavor and anti-nutritional barriers.

• May 2024 – A leading supplier unveiled a 90 % purity isolate in Europe and North America for meat and dairy substitutes.

• February 2023 – A specialty firm introduced a highly soluble fava protein targeting creamy plant-based dairy.

Facts & Figures

• Isolate generated roughly USD$ 624.7 million in 2024 revenue.

• Conventional type contributed about USD$ 624.2 million the same year.

• Asia Pacific market growth is projected at a 4.1 % CAGR through 2032.

• Food processing applications are set to expand at roughly 3.9 % CAGR over the forecast period.

• One cup of cooked fava beans delivers around 39 g of protein, outpacing most cereal grains.

Analyst Review & Recommendations

SAC Insight’s deep market evaluation confirms that sustainable sourcing and process innovation are converging to make fava bean protein a staple of the next protein cycle. Suppliers investing in de-flavoring technology, securing farmer contracts for consistent amino profiles, and partnering with plant-based innovators are best positioned to capture market growth. Transparent carbon metrics and targeted consumer education will further differentiate leaders as retailer and regulatory scrutiny intensifies.