Market Overview

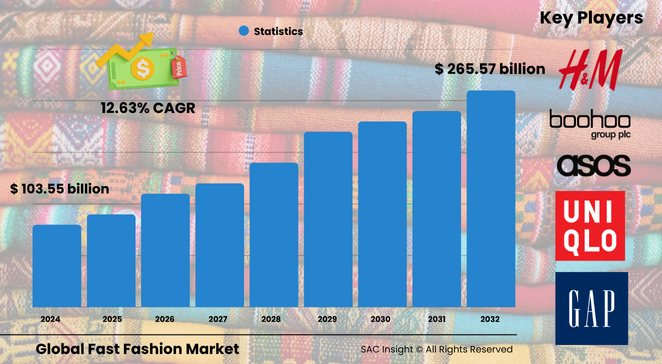

The fast fashion market size is valued at roughly US$ 103.55 billion in 2024 and is projected to climb to about US$ 265.57 billion by 2032, advancing at an average 12.63% CAGR. SAC Insight industry insights highlight three principal growth engines: social-media–driven demand for constant newness, the continued rise of e-commerce logistics that shrink design-to-delivery cycles, and rapid expansion into emerging middle-income populations across Asia-Pacific and Latin America.

SAC Insight's deep market evaluation shows the United States fast fashion market alone could move from an estimated US$ 19 billion in 2024 to roughly US$ 48 billion by 2032 as online mass-market apparel and celebrity-inspired capsule drops gain traction.

Summary of Market Trends & Drivers

• Ultra-short production runs powered by digital design tools let brands refresh collections weekly, keeping consumer attention high and wardrobes turning over faster.

• Sustainability concerns are steering brands toward recycled fabrics and transparent supply chains; those that balance speed with greener practices are set to capture incremental market share.

Key Market Players

The competitive landscape blends legacy apparel giants with digitally native disruptors. Established names such as H&M, Inditex (Zara, Pull & Bear, Bershka), Gap, and Uniqlo leverage global sourcing networks and dense store footprints to preserve scale advantages. Online-first specialists—Shein, Boohoo Group, Fashion Nova, PrettyLittleThing, and ASOS—use data-driven trend spotting and influencer partnerships to release thousands of styles daily, resetting consumer expectations for price and delivery speed. Strategic priorities now center on circular-fashion pilots, AI-assisted demand forecasting, and regional micro-warehousing that slashes last-mile costs.

Key Takeaways

• Current global market size (2024): US$ 103.55 billion

• Projected global market size (2032): US$ 265.57 billion at a 12.63% CAGR

• Asia-Pacific already generates the largest market share owing to China’s vast manufacturing base and an expanding urban middle class

• Online stores captured nearly 30 % of 2023 revenue and remain the fastest-growing distribution channel

• Men’s fast fashion is narrowing the historical gap with women’s apparel as social media normalizes frequent outfit changes across genders

• Brands integrating recycled polyester and closed-loop take-back schemes report double-digit gains in customer loyalty scores

Market Dynamics

Drivers

• Always-on social feeds and short-form video keep trends cycling rapidly, amplifying demand for affordable new looks.

• E-commerce logistics networks compress shipping times, letting consumers globally access runway-inspired items within days.

• Rising disposable incomes in India, Southeast Asia, and Latin America unlock new audiences seeking trendy yet inexpensive clothing.

Restraints

• Mounting scrutiny of labor practices and carbon footprints pressures brands to invest in compliance and transparency, raising costs.

• Inflation in raw-material prices and energy can erode already thin operating margins.

Opportunities

• Investment in recycled fibers and digital traceability tools creates differentiation and meets tightening regulatory standards.

• Expansion into niche segments such as modest fashion or size-inclusive collections can attract loyal, underserved demographics.

Challenges

• Intensifying competition keeps price wars fierce, making sustainable profitability difficult for smaller labels.

• Regulatory moves—such as extended producer responsibility laws in the EU—could mandate end-of-life collection and add logistical complexity.

Regional Analysis

Asia-Pacific dominates market growth thanks to integrated manufacturing clusters, fast adoption of social-commerce platforms, and large, young consumer bases. Europe remains influential in setting style direction and sustainability standards, while North America drives premiumization and celebrity collaborations.

• North America – Strong online penetration and rising demand for ethical fast fashion

• Europe – Tightening regulations push transparency and recycled materials

• Asia-Pacific – Largest production hub and fastest volume growth, led by China and India

• Latin America – Growing middle class fuels demand; local influencers accelerate trend diffusion

• Middle East & Africa – Increasing mall development and smartphone adoption introduce new shoppers to low-cost fashion

Segmentation Analysis

By Gender

• Male – Rapid catch-up phase.

The male segment is gaining ground as streetwear and athleisure trends shorten wardrobe refresh cycles; brands offering coordinated drops see high sell-through rates.

• Female – Long-standing core.

Women’s fast fashion continues to command the bulk of revenue, driven by high trend turnover and extensive category depth from dresses to accessories.

By End User

• Adults – Primary revenue engine.

Adults account for the largest spend due to higher purchasing power and growing acceptance of workplace-casual attire that changes seasonally.

• Teens – Style-setting cohort.

Teen shoppers drive viral trends on TikTok and Instagram, propelling micro-collections and limited-edition collaborations that often sell out within hours.

• Kids – Emerging focus.

Parents increasingly seek affordable, stylish children’s wear for social media moments, nudging brands to launch mini-me versions of top-selling adult lines.

By Distribution Channel

• Independent Retailers – Local reach cornerstone.

Small boutiques and value chains capture impulse buyers with curated selections tailored to regional tastes and climates.

• Online Stores – Fastest-growing route.

Pure-play e-tailers and marketplace storefronts enable real-time inventory refresh and personalized recommendations, underpinning double-digit annual market growth.

• Brand Stores – Experience centers.

Flagship locations showcase new drops, run in-house returns for online orders, and host sustainability take-back counters, strengthening omnichannel loyalty.

Industry Developments & Instances

• August 2024 – A major online retailer announced a circular-fashion partnership using blockchain to track garment recyclability from factory to resale.

• January 2024 – Leading Asian manufacturer installed AI-driven fabric-cutting machines, reducing material waste by 12 % and shortening production lead times to five days.

• May 2023 – A U.S. chain launched a size-inclusive denim line up to 5XL, reporting a 35 % lift in repeat purchases among new shoppers.

Facts & Figures

• More than 70 % of fast fashion purchases worldwide are now influenced by social-media content.

• Average design-to-shelf cycle time has fallen below 21 days for top online-only brands.

• Recycled polyester represented roughly 15 % of total fast fashion fabric consumption in 2023, up from 8 % in 2020.

• Mobile commerce accounts for about 60 % of global fast fashion online sales transactions.

• AI-based demand forecasting can reduce excess inventory by up to 30 %, improving cash flow and markdown margins.

Analyst Review & Recommendations

Market analysis indicates that speed remains non-negotiable, but credibility around ethics and environment is the next competitive frontier. Brands that marry rapid product development with visible progress on recycled inputs, fair-wage certification, and transparent carbon reporting will capture loyal, higher-margin shoppers. We recommend investing in modular micro-factory setups near key consumption regions to shorten lead times, adopting digital product passports for traceability, and partnering with resale marketplaces to extend garment life and reinforce brand equity."