Market Overview

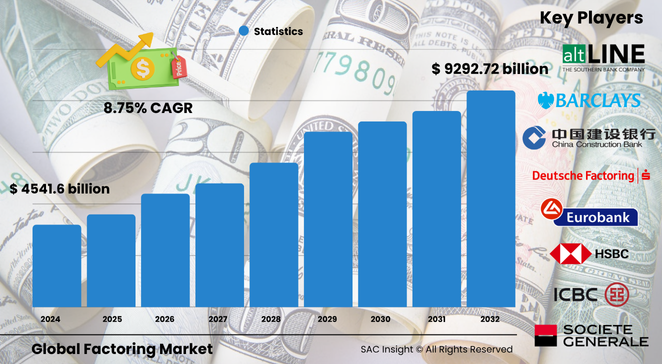

The global factoring market size is valued at US$ 4,541.6 billion in 2024 and is projected to reach about US$ 9,292.72 billion by 2032, expanding at an average 8.75 % CAGR. First-hand industry insights highlight three structural growth engines: the scramble for fast, collateral-light working capital among SMEs, rapid adoption of AI-driven risk tools that compress decision times, and the steady shift of banks toward fee-based services as interest margins tighten. SAC Insight's deep market evaluation shows the United States factoring market alone could advance from US$ 4,503.12 billion in 2024 to around US$ 9,220.71 billion by 2032 as domestic suppliers leverage digital onboarding and state-level disclosure rules to win market share from traditional credit lines.

Summary of Market Trends & Drivers

• Digital origination portals and embedded-finance APIs are cutting invoice-to-funding cycles from weeks to hours, widening the addressable base of micro-enterprises.

• Regulatory clarity in Europe and selected U.S. states is professionalising the sector, while blockchain pilots promise end-to-end invoice provenance that reduces fraud losses.

• Strategic M&A among banks and fintechs signals a race for data scale, advanced analytics, and cross-border capabilities that underpin sustainable market growth.

Key Market Players

Established factoring market lenders and nimble specialists shape competitive dynamics. Barclays, BNP Paribas, HSBC, Société Générale, and China Construction Bank anchor the high-volume segment with global reach and strong balance sheets. They use in-house AI to pre-score debtors and bundle supply-chain finance, thereby defending market share against digital challengers.

Alongside them, firms such as altLINE, Deutsche Factoring Bank, Eurobank, Factor Funding Co., Mizuho, RTS Financial Service, Hitachi Capital (UK), TCI Business Capital, ICBC, and Kuke Finance concentrate on sector niches—transport, staffing, advertising, and cross-border e-commerce—deploying cloud-native platforms that integrate directly with accounting software to capture underserved clients.

Key Takeaways

• Current global factoring market size (2024): USD$ 4,541.6 billion

• Projected global market size (2032): USD$ 9,292.72 billion at an 8.75 % CAGR

• Domestic factoring retains the largest market share, but international services post the fastest gains on the back of borderless B2B marketplaces

• Banks account for over 80 % of funded volume; non-banking financial institutions (NBFIs) show the quickest percentage growth thanks to flexible underwriting

• Healthcare and information-technology invoices represent the highest non-manufacturing opportunity pool as slow payer cycles strain provider cash flow

• AI-enabled credit analytics and blockchain-based invoice tracing are headline market trends that reshape risk pricing and compliance workloads

Market Dynamics

Drivers

• Persistent SME demand for off-balance-sheet liquidity in the face of tight credit standards

• Proliferation of e-invoicing mandates that create clean, machine-readable data for automated factoring workflows

• Rising trade volumes on B2B marketplaces, fostering cross-border factoring uptake

Restraints

• Uneven regulatory regimes that raise compliance costs for multi-state or multi-country programs

• Competition from cheaper revolving-credit facilities during low-rate cycles

• Perception of higher fees versus bank loans among finance managers unfamiliar with modern solutions

Opportunities

• Embedded-finance partnerships with ERP and e-commerce platforms unlock new client funnels

• Non-recourse products bundled with credit insurance appeal to exporters in volatile markets

• Green-supply-chain factoring tied to ESG targets creates differentiated premium offerings

Challenges

• Data-privacy rules limit debtor information sharing, complicating credit assessment models

• Concentration risk in cyclical industries such as construction and apparel

• Need for continuous investment in cybersecurity as transaction volumes migrate online

Regional Analysis

Europe currently dominates the market owing to a mature industrial base, standardized e-invoicing, and supportive disclosure laws, while Asia-Pacific registers the quickest percentage gains as governments promote SME exports and fintech penetration deepens.

• North America – Large revenue base led by the U.S.; niche specialists focus on transport and staffing invoices

• Europe – Highest overall market share, driven by manufacturing hubs and pan-EU trade integration

• Asia-Pacific – Fastest CAGR; China, India, and Southeast Asia benefit from digital marketplaces and government SME programs

• Latin America – Growing adoption among exporters seeking liquidity amid currency volatility

• Middle East & Africa – Emerging demand aligned with supply-chain diversification and public digital-finance investments

Segmentation Analysis

By Category

• Domestic – Core revenue engine.

Domestic factoring supports cash-flow stability for businesses selling within their home market, leveraging real-time credit scoring on local buyers to keep advance rates high and fees competitive.

• International – Quickest-growing slice.

Cross-border offerings pair payment-risk cover with currency solutions, enabling exporters to extend open terms while outsourcing collections in unfamiliar jurisdictions.

By Type

• Recourse – Price-sensitive segment.

Recourse agreements remain popular among firms with reliable customers, trading lower discount rates for continued delinquency exposure.

• Non-Recourse – Risk-transfer option.

Providers assuming full credit risk command higher fees but attract sectors with fragmented debtor bases or lengthy payment cycles, such as healthcare and retail.

By Financial Institution

• Banks – Volume leaders.

Established banks tap cheap funding and broad client rosters, integrating factoring into holistic working-capital suites.

• Non-Banking Financial Institutions – Agile disruptors.

NBFIs tailor contracts, offer faster onboarding, and use alternative data—giving them an edge with start-ups and gig-economy sellers.

By End-use

• Manufacturing – Dominant user.

High invoice values and long receivable terms make factories frequent adopters to cover raw-material purchases and payroll.

• Transport & Logistics – Cash-intensive niche.

Carriers leverage same-day funding to bridge fuel and maintenance costs while waiting 30-plus days for freight invoices to settle.

• Information Technology – Expanding vertical.

Project-based billing and milestone payments drive adoption among software integrators seeking smoother cash flow.

• Healthcare – Rapidly rising.

Hospitals and clinics offset slow insurer reimbursements through factoring, securing capital for critical supplies.

• Construction, Staffing, Others – Opportunistic users.

Sectors with seasonal or project-based revenue use invoice sales to align cash inflows with wage and material outlays.

Industry Developments & Instances

• February 2024 – A five-year extension of a major European bank’s partnership with a global payments processor aims to embed invoice-payment services for corporate clients.

• March 2024 – A global trade-finance firm supplied an extra €35 million facility to a multinational steel producer, signalling strong appetite for large-ticket collateral-light funding.

• June 2023 – A U.K. lender acquired a rival’s working-capital finance division, adding 2,500 SME customers and accelerating its digital-platform rollout.

Facts & Figures

• More than 91 % of financial-services providers now deploy some form of AI in underwriting or fraud monitoring.

• Domestic factoring captured roughly 76 % of total revenue in 2023.

• Average invoice-approval time has fallen below 12 hours on cloud platforms, down from 3-5 days in 2020.

• Healthcare invoices show payment lags exceeding 45 days, the longest among tracked sectors.

• Non-banking financial institutions are expected to post an 11.9 % CAGR through 2030, outpacing the overall market growth rate.

Analyst Review & Recommendations

The SAC Insight's factoring market analysis confirms a decisive move toward fully digital, data-rich factoring ecosystems. Providers that fuse advanced credit analytics, seamless ERP integrations, and flexible contract structures will outstrip baseline market growth. We recommend prioritising API-driven onboarding, partnering with credit insurers to scale non-recourse products, and investing in blockchain pilots that deliver verifiable invoice trails—steps that build trust, cut costs, and secure competitive advantage in a market headed for near-doubling by 2032.