Market Overview

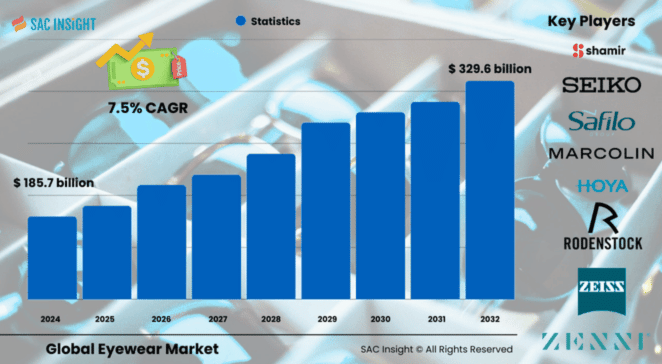

The global eyewear market size was valued at US$ 185.7 billion in 2024 and is projected to climb at US$ 329.6 billion by 2032, expanding at a 7.5% CAGR from 2025 to 2032. This solid market growth is fueled by rising vision-correction needs, fashion-driven frame purchases, and rapid adoption of digitally enabled retail models such as virtual try-ons. First-hand industry insights highlight accelerating demand for blue-light-filter lenses and smart glasses that blend style with function. A SAC Insight evaluation also shows full recovery from pandemic retail disruptions, with e-commerce volumes now surpassing 2019 levels. The U.S. eyewear market is on track to reach around US$ 89 billion by 2032, supported by high prescription uptake and premium frame sales within a comprehensive North American scope projected at about US$ 98.45 billion.

Summary of Market Trends & Drivers

• Tech-led lenses—photochromic, progressive, and blue-light filtering—are moving from niche to mainstream, lifting average selling prices.

• Omni-channel retail strategies and virtual fitting rooms are reshaping the path to purchase, especially for Gen Z and millennial shoppers.

• Sustainability matters: Recycled acetates and bio-based lenses are gaining market share as eco-conscious consumers push brands to clean up supply chains.

Key Market Players

The global eyewear market report profiles established leaders and agile challengers alike. Global heavyweights in lenses, frames, and contact-lens technology dominate revenue, while direct-to-consumer disruptors capture mindshare through sleek online experiences and home-try-on kits. Several companies are leveraging 3-D printing for rapid prototyping and custom sizing, underscoring an innovation race that keeps margins healthy despite intense price competition.

A rising cohort of smart-eyewear specialists is also nudging incumbents toward digital services—think voice-enabled frames, fitness tracking, and camera-equipped models—redefining where eyewear ends and wearables begin.

Key Takeaways

• Market value (2024): USD$ 185.7 billion

• Projected value (2032): USD$ 329.6 billion at a 7.5% CAGR

• Prescription glasses remain the revenue backbone. Sunglasses, however, show impressive volume gains.

• E-commerce now accounts for roughly one-quarter of global eyewear market share and is still growing.

• Asia Pacific is the pace-setter, logging mid-single-digit unit gains on the back of rising myopia rates and disposable incomes.

• Smart glasses and 3-D-printed custom frames are top technology stories to watch through 2032.

Market Dynamics

Drivers

• Rising visual-impairment prevalence: Growing digital-screen time accelerates myopia and presbyopia cases, driving sustained demand for corrective lenses.

• Fashion and brand consciousness: Frames have evolved into lifestyle accessories, encouraging multiple-pair ownership and frequent upgrades.

• Lens technology advances: Thinner, lighter, scratch-resistant substrates and blue-light blockers boost product appeal and command premium pricing.

Restraints

• Proliferation of low-cost knock-offs in emerging markets suppresses average selling prices for mid-tier brands.

• High import duties on premium eyewear in select regions dampen luxury-segment sales.

• Limited insurance coverage for vision care in developing economies restricts uptake of higher-end products.

Opportunities

• Eco-friendly materials—recycled acetates, bio-nylon, and plant-based resins—create differentiation and win over sustainability-minded consumers.

• Smart eyewear integration with audio, camera, and health-tracking features opens fresh revenue streams beyond traditional optics.

• Personalized 3-D printing shortens supply chains and enables on-the-spot custom frames, cutting inventory risk.

Challenges

• Stringent prescription regulations and data-privacy rules complicate cross-border e-commerce expansion.

• Skill gaps in fitting and servicing smart devices may slow adoption in traditional optical shops.

• Supply-chain volatility in acetate, titanium, and specialty polymers threatens cost stability.

Regional Analysis

North America currently commands the largest market share thanks to established insurance benefits, high discretionary spend, and strong omni-channel adoption. Asia Pacific, however, records the fastest market growth as urban lifestyles, digital learning, and fashion awareness converge. Europe remains a steady value market with premium brand loyalty, while Latin America and the Middle East & Africa show incremental gains as organized retail footprints widen.

• North America – High prescription penetration, robust online sales, strong demand for premium and smart frames.

• Europe – Mature market; sustainability and designer collaborations drive upgrades.

• Asia Pacific – Rapid unit expansion, escalating myopia prevalence, soaring e-commerce share.

• Latin America – Growing middle class fuels sunglasses and affordable RX frames.

• Middle East & Africa – Gradual uptake; luxury sunglasses lead, aided by tourism and rising disposable income.

Segmentation Analysis

By Product

• Prescription Glasses – Core revenue engine.

Corrective lenses dominate due to escalating refractive errors worldwide. Light, thin, scratch-resistant materials keep wearers comfortable and stylish, ensuring repeat purchases.

• Sunglasses – Fastest CAGR segment.

Demand is propelled by UV awareness and fashion cycles. Polarized and photochromic lenses attract outdoor enthusiasts, while prescription sunglasses fuse vision correction with sun protection.

• Contact Lenses – Niche but sticky customer base.

Daily disposables and silicone hydrogel materials enhance comfort and hygiene, supporting steady subscription-style sales.

By Distribution Channel

• Brick-and-Mortar – Experience-driven purchasing.

Physical stores remain vital for professional fitting, instant adjustments, and immediate gratification, particularly for progressive lenses and premium frames.

• E-Commerce – Double-digit growth.

Virtual try-ons, competitive pricing, and swift fulfillment make online the channel of choice for savvy, time-pressed consumers, especially in urban Asia and North America.

By End Use

• Female – Style-centric dominance.

Women’s frames capture the largest share, driven by fashion appeal and rising workforce participation.

• Kids – Rapid growth lane.

Screen-heavy schooling and parental awareness spur demand for durable, protective eyewear in younger demographics.

Industry Developments & Instances

• Jul 2024 – A leading integrated optics group acquired a Romanian chain, bolstering Central-European distribution.

• Jun 2024 – A top lens maker launched daily disposables for astigmatism with moisture-rich polymers to combat dryness.

• Jun 2024 – A German retail giant bought a Midwest U.S. chain, adding 220 outlets to its North-American network.

• Oct 2023 – Monthly water-gradient multifocal lenses debuted, targeting presbyopia sufferers seeking all-day comfort.

• Sep 2023 – Smart-glass pioneer unveiled a next-gen 3-D-printing platform, streamlining prescription integration for wearable tech.

Facts & Figures

• Roughly 70% of global adults report wearing some form of vision-correction eyewear.

• Virtual try-on usage jumped from 15% in 2020 to 42% in 2024 across major online retailers.

• Blue-light filtering lenses now account for ≈18% of prescription lens sales, up from 8% five years ago.

• Recycled or bio-based frame materials represent about 6% of total frame output and are forecast to double by 2030.

• Average online order value for eyewear has risen ≈12% since 2021, aided by premium lens add-ons.

Analyst Review & Recommendations

The eyewear sector is shifting from commodity optics to lifestyle-plus-technology solutions. Players that combine fashion-forward design with lens innovation, eco-credentials, and seamless omni-channel experiences should outpace generic competitors. For newcomers, mid-priced polarized sunglasses and custom 3-D-printed frames offer fast-track entry, especially in Asia Pacific’s millennial middle class. Established brands should double down on smart eyewear partnerships and recycled materials to safeguard long-term relevance while maintaining trust through transparent quality controls.