Market Overview

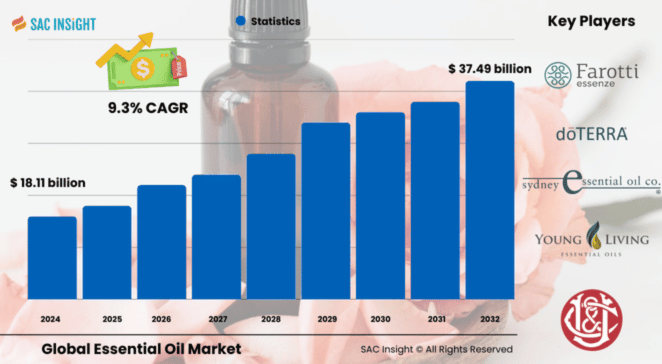

The global essential oils market size is currently valued at around US$ 18.11 billion (2024) and, according to SAC Insight analysis, is on track to reach at US$ 37.49 billion by 2032, expanding at a 9.3% CAGR during the forecast year. First‑hand industry insights highlight three structural forces behind this market growth: rising consumer preference for natural ingredients across food, personal care, and home‑care categories; a post‑pandemic wellness mindset driving aromatherapy and immune‑support products; and steady improvements in extraction technology that lower cost per kilogram and improve yield. In the United States, the market is forecast to top roughly US$ 8.4 billion by 2032, supported by premium product uptake and robust direct‑selling networks.

Summary of Market Trends & Drivers

• Wellness mainstreaming: Demand for clean‑label flavors, fragrances, and topical remedies keeps natural oils at the center of formulation pipelines.

• Technology lift: Super‑critical CO₂ and low‑temperature distillation cut solvent use and improve bio‑active retention, boosting both quality and market share for high‑purity grades.

• Green consumerism: Brands leverage traceable supply chains and fair‑trade certifications to meet eco‑conscious buyer expectations, reinforcing long‑term market trends.

Key Market Players

The essential oils market report profiles global and regional leaders such as Givaudan, International Flavors & Fragrances, Symrise, ROBERTET, Young Living, and doTERRA, alongside fast‑scaling specialists from India, New Zealand, and Eastern Europe. These companies shape competitive tempo through targeted M&A, backward integration into plantations, and aggressive multi‑level marketing strategies that deepen consumer reach.

Key Takeaways

• Market value (2024): ~US$ 18.11 billion

• Projected value (2032): ~US$ 37.49 billion at a 9.3% CAGR

• Europe holds the largest market share with an average of 46.43% between 2023 and 2024, with Asia‑Pacific registering the fastest gains.

• Citrus and orange oils remain volume leaders, while lavender and tea‑tree oils show double‑digit value growth.

• Direct selling accounts for nearly half of global revenue, but online retail is the quickest‑rising channel.

• CO₂ extraction is the fastest‑growing method, prized for solvent‑free purity and higher terpene retention.

Market Dynamics

Drivers

• Surge in demand for natural preservatives in ready‑to‑eat foods and beverages.

• Growing consumer spending on spa & relaxation products amid rising stress levels.

• Advancements in green chemistry and biotech‑assisted cultivation that improve yield and sustainability.

Restraints

• High raw‑material intensity (e.g., >200 kg of lavender flowers for 1 kg of oil) keeps prices elevated.

• Supply‑side pressure from land conversion, climate variability, and stricter harvesting regulations.

Opportunities

• Untapped aromatherapy potential in large emerging economies where disposable income is climbing.

• Expansion of certified organic and fair‑trade product lines that command premium pricing.

• Integration of essential‑oil actives into functional beverages, nutraceutical gummies, and pet‑care.

Challenges

• Counterfeit and adulterated oils erode consumer trust and force costly quality‑control regimes.

• Regulatory divergence between regions complicates global roll‑outs and label claims.

Regional Analysis

Europe continues to dominate thanks to a mature perfumery heritage, supportive regulations, and a dense network of flavor & fragrance houses. Asia‑Pacific is the growth engine, driven by abundant feedstock, low‑cost processing, and a booming middle class seeking natural wellness solutions. North America remains opportunity‑rich for premium, sustainably sourced SKUs.

• Europe: Early‑stage adoption of biotech cultivation and strong aromatherapy culture.

• North America: High per‑capita spend on clean beauty and functional foods.

• Asia‑Pacific: Leading producer of jasmine, davana, and sandalwood oils; fastest retail e‑commerce uptake.

• Latin America: Expanding citrus plantations bolster orange and lemon oil exports.

• Middle East & Africa: Rising hospitality projects integrate spa‑grade oils, though supply chains are still nascent.

Segmentation Analysis

By Product

• Citrus (Orange, Lemon, Grapefruit, Lime) – Cost‑efficient, broad sensory appeal.

Citrus oils dominate volume because they double as flavor enhancers and natural antimicrobials in food and beverage applications, while their bright aroma underpins many household cleaners.

• Lavender – Wellness staple, accelerating in personal‑care SKUs.

Lavender’s calming profile secures a place in sleep aids, skin serums, and diffusers, supporting double‑digit value growth.

• Tea Tree & Eucalyptus – Therapeutic, antibacterial, pandemic‑era boost.

Both oils gained traction for perceived immune support and surface‑cleaning efficacy, keeping them in high demand for OTC formulations.

By Application

• Food & Beverages – Natural flavoring and shelf‑life extension.

Processors swap synthetic additives for botanical extracts to meet clean‑label demands without sacrificing taste or safety.

• Personal Care & Cosmetics – Skin‑ and hair‑care hero ingredients.

Brands tout essential‑oil actives for anti‑inflammatory, antimicrobial, and aromatherapeutic benefits, widening adoption from serums to men’s grooming lines.

• Spa & Relaxation – Largest revenue slice at ~47%.

Essential oils anchor massage blends, diffuser blends, and premium bath products that cater to stress‑relief seekers.

By Distribution Channel

• Direct Selling – Relationship marketing drives 45%+ of global sales.

Community‑based education and loyalty programs accelerate repeat purchases and customer retention.

• Retail & E‑commerce – Fastest‑growing, double‑digit CAGR.

Online marketplaces democratize access, while specialty retailers curate certified organic ranges for discerning buyers.

By Method of Extraction

• Steam Distillation – Cost‑effective workhorse, majority share.

Low capital requirements make it popular among small to mid‑scale producers, though heat can degrade delicate terpenes.

• Cold Press & CO₂ Extraction – Premium‑grade output, rising share.

These methods deliver higher purity and terpene integrity, aligning with clean‑beauty and pharma‑grade specifications.

By Source

• Fruits & Vegetables – Lead in volume, especially citrus.

Readily available feedstock and integrated juice‑processing chains keep costs competitive.

• Flowers, Herbs & Spices – High‑value, niche oils.

Oils such as jasmine, rose, and frankincense command premium pricing due to labor‑intensive harvesting and limited acreage.

Industry Developments & Instances

• Oct 2023: A leading specialty‑chemicals distributor acquired a French perfumery supplier, expanding fine‑fragrance access in Europe.

• Jun 2023: A multinational flavors group purchased a Hungarian botanical‑extract firm to deepen its essential‑oil footprint in F&B.

• Jan 2023: An Indonesian energy conglomerate diversified into essential oils by taking a 46% stake in a local aroma‑crop processor.

• Dec 2022 – Feb 2024: Multiple beauty brands across India, the U.S., and the U.K. launched essential‑oil‑infused skin‑care and hygiene lines, signaling mainstream acceptance.

Facts & Figures

• Direct‑selling giants collectively serve >5 million wholesale customers worldwide.

• Orange oil captured roughly 23% of global revenue in 2023.

• Spa & relaxation applications account for ~46.7% of market share.

• Over 70% of lavender oil exports originate from just three European countries.

• Super‑critical CO₂ units can boost extraction yield by 15‑20% versus conventional steam distillation.

Analyst Review & Recommendations

SAC Insight evaluation confirms a clear shift toward high‑purity, sustainably sourced essential oils integrated into everyday consumer products. Players that secure vertically integrated supply chains, invest in solvent‑free extraction, and build transparent provenance stories will outpace peers. Emerging‑market demand, especially in Asia‑Pacific, calls for mid‑priced, certified‑organic lines backed by local education campaigns. A balanced strategy—premium wellness SKUs for mature markets and affordable aromatherapy basics for high‑growth regions—positions companies for resilient expansion through 2032.