Market Overview

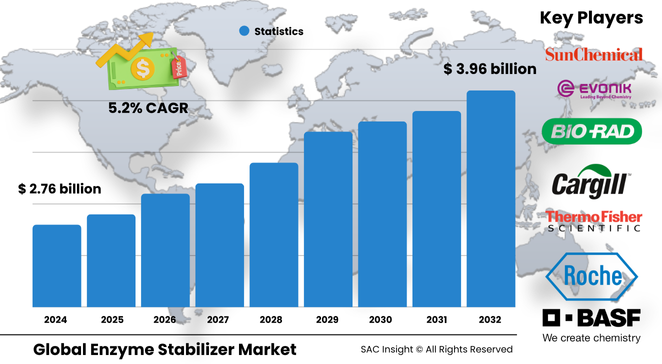

The global enzyme stabilizer market size stands at roughly US$ 2.76 billion in 2024 and is forecast to reach about US$ 3.96 billion by 2032, reflecting steady market growth at an average 5.23 % CAGR. SAC Insight's first-hand industry insights point to three structural drivers: soaring demand for clean-label processing aids, the widening use of enzymes in biofuel and waste-treatment streams, and rapid advances in encapsulation chemistry that double shelf life in harsh formulations.

SAC Insight’s deep market evaluation shows the United States enzyme stabilizer market alone could advance from around US$ 0.78 billion in 2024 to nearly US$ 1.2 billion by 2032 as food, detergent, and pharmaceutical producers invest in higher-performance biocatalysts.

Summary of Market Trends & Drivers

• Natural and plant-derived stabilizers are eclipsing synthetic additives, mirroring consumer preference for recognizable ingredients.

• Multifunctional blends that combine protection, activation, and pH buffering are cutting formulation costs and simplifying labels.

• Growth of biodiesel, bioplastics, and enzyme-enabled recycling is opening fresh demand pockets beyond traditional food and laundry applications.

Key Market Players

Global leadership rests with a mix of diversified chemical majors and biotech specialists. Firms such as Novozymes, DuPont, BASF, and DSM leverage extensive enzyme portfolios and in-house fermentation capacity to supply tailored stabilizer systems for food, detergent, and pharma customers. Alongside them, niche innovators—AB Enzymes, Biocatalysts International, Dyadic, Lonza, Cargill, Archer Daniels Midland, Chr. Hansen, Sigma Aldrich, Bitop, and Biomol—focus on proprietary polyol, amino-acid, and encapsulation technologies that boost thermal and pH tolerance.

Competitive dynamics increasingly revolve around collaborative development with formulators, regional production footprints for quicker scale-up, and targeted acquisitions that add novel carrier chemistries or immobilization know-how.

Key Takeaways

• Current global market size (2024): USD$ 2.76 billion

• Projected global market size (2032): USD$ 3.96 billion at a 5.23 % CAGR

• North America captures the largest regional market share, driven by enzyme-rich food and detergent sectors

• Liquid formulations command the lead form segment thanks to faster dispersion and higher reaction efficiency

• Covalent-bond stabilizers remain the dominant mechanism, yet non-covalent complexes are showing the quickest uptake in premium beverages and biologics

• Tier-1 suppliers control roughly 50 % of total revenue, but agile regional players are carving out share with plant-based solutions

Market Dynamics

Drivers

• Accelerating adoption of enzymes for clean-label food processing, sustainable detergents, and eco-friendly textiles

• Rising R&D investment in enzyme engineering and immobilization to unlock high-temperature, high-alkaline processes

• Government incentives for biofuel production and industrial waste reduction that rely on enzyme catalysis

Restraints

• Price volatility in key stabilizer inputs such as sorbitol and trehalose

• Stringent regulatory clearance for new additives, especially in infant nutrition and injectable pharmaceuticals

Opportunities

• Development of stabilizers that also enhance nutritional content—e.g., amino-acid carriers that fortify protein beverages

• Growth potential in emerging markets where cold-chain limitations raise demand for room-temperature-stable enzyme products

Challenges

• Balancing high performance with clean-label expectations; consumers resist chemical-sounding names

• Ensuring consistent activity across global supply chains with varying humidity and temperature profiles

Regional Analysis

North America leads the market thanks to a dense concentration of biotech manufacturing, stringent product-quality standards, and robust funding for enzyme research. Europe follows closely, propelled by sustainability mandates and cutting-edge food innovation hubs. Asia-Pacific records the fastest percentage gains, underpinned by expanding urban populations and aggressive investments in bio-based chemicals.

• North America – Largest revenue base; strong food and detergent demand

• Europe – High regulatory focus on clean-label and sustainability fuels premium stabilizer uptake

• Asia-Pacific – Fastest CAGR with China and India ramping enzyme production and textile processing

• Latin America – Rising biodiesel blending mandates create new consumption channels

• Middle East & Africa – Gradual growth as packaged food and water-treatment projects scale

Segmentation Analysis

By Type

• Enzyme Protectors – Core revenue pillar.

Provide barrier protection against heat, oxidation, and shear, securing more than half of global demand.

Their dominance stems from broad compatibility with amylase and protease systems essential in bakery, brewing, and detergent recipes.

• Enzyme Inhibitors – Precision control niche.

Used to fine-tune reaction rates in pharmaceuticals and specialty chemicals where over-activity can spoil yield.

• Enzyme Activators – Emerging performance boosters.

Allosteric and covalent activators are gaining traction in high-protein beverages and animal feed to unlock higher digestibility.

By Target Enzyme

• Amylases – Staple for starch breakdown.

Bakery and brewing plants rely on stabilized amylases to maintain crumb softness and fermentation efficiency under variable storage.

• Proteases – Critical for stain removal and protein hydrolysis.

Laundry formulations and collagen extraction lines favor long-lasting protease blends to maximize cleaning and peptide yield.

• Lipases – Key to fat conversion.

Biodiesel producers and dairy processors select robust lipase complexes that stay active in oily matrices.

• Lactases – Essential for lactose-free dairy.

Shelf-stable lactase drops and powders enable extended-life lactose-free milk without refrigerated transport.

By Application

• Enzyme Production – Largest uptake.

Manufacturers dose stabilizers directly into fermentation broth or downstream blends to guarantee activity through packaging.

• Enzyme Laundry Treatment – Rapidly expanding.

Concentrated liquids with protective polyols let detergents maintain stain-fighting power even after months on shelf.

• Enzyme Detergents – Mature yet innovating.

Multienzyme cocktails stabilized by sugars and amino acids enable low-temperature wash cycles that cut energy use.

• Food Industry – Significant, diversified demand.

Stabilizers secure flavor, texture, and nutritional integrity in baked goods, juices, and plant-based proteins.

By Mechanism

• Covalent Bond Formation – Strongest, irreversible grip.

Favored where extreme heat or caustic pH would denature free enzymes, such as industrial bleaching and textile desizing.

• Non-Covalent Complex Formation – Flexible and reversible.

Hydrogen-bond and electrostatic frameworks deliver high activity retention with minimal label impact in beverages and nutraceuticals.

• Encapsulation – Steadily growing, controlled release.

Microcapsules shield enzymes until triggering conditions release them, ideal for multi-step detergent pods.

By Dosage

• Low Dosage – Dominant in cost-sensitive mass markets.

Precise carrier technologies allow micro-dosing without performance loss, cutting raw-material spend.

• Medium Dosage – Fastest climbing tier, especially in biofuel reactors requiring elevated stabilization.

• High Dosage – Industrial specialty niche for harsh chemical settings where maximum protection outweighs cost.

By Form

• Liquid – Leading share.

Liquids disperse quickly and support inline dosing, crucial for continuous beverage and detergent lines.

• Powder & Granules – Preferred for dry blends and easy handling in bakery premixes and feed mills.

By End-use Application

• Food Processing – Core demand engine as brands pursue clean-label stability and extended shelf life.

• Animal Nutrition – Growing interest in feed enzymes that survive pelleting heat.

• Pharmaceuticals – High-value segment for injectable and diagnostic enzymes requiring ultrapure stabilizers.

• Cleaning Agents – Constant reformulation to hit low-temperature wash claims.

• Chemical Industries – Enzyme-assisted syntheses and textile wet-processing seek heat-resistant stabilizers.

Industry Developments & Instances

• June 2025 – A leading supplier launched a plant-based polyol blend offering 20 % longer protease stability in liquid detergents.

• March 2025 – Strategic partnership announced between a biotech start-up and a global brewer to co-develop encapsulated amylases for ultra-low carb beer.

• December 2024 – Major chemical firm acquired a German amino-acid stabilizer specialist to expand clean-label portfolio.

• August 2024 – New encapsulation line commissioned in Singapore, boosting regional output by 15 % and cutting lead times for APAC clients.

Facts & Figures

• Liquid enzyme stabilizers account for roughly 60 % of global market share.

• Tier-1 companies hold about 50 % of total revenue.

• Covalent-bond products represented nearly 45 % of mechanism sales in 2024.

• Amylase-targeted stabilizers generated over USD$ 0.8 billion in revenue last year.

• Average shelf-life extension achieved with next-gen polyol blends exceeds 18 months at 30 °C.

Analyst Review & Recommendations

The market analysis underscores a decisive pivot toward multifunctional, plant-based stabilizer systems that satisfy clean-label rules while withstanding broader temperature and pH windows. Suppliers that pair carrier innovation with enzyme-engineering expertise will outpace average market trends. We recommend prioritizing liquid encapsulation capacity in growth regions, deepening co-development ties with biofuel and waste-treatment players, and sharpening regulatory support teams to accelerate product approvals in infant nutrition and injectables.