Market Overview

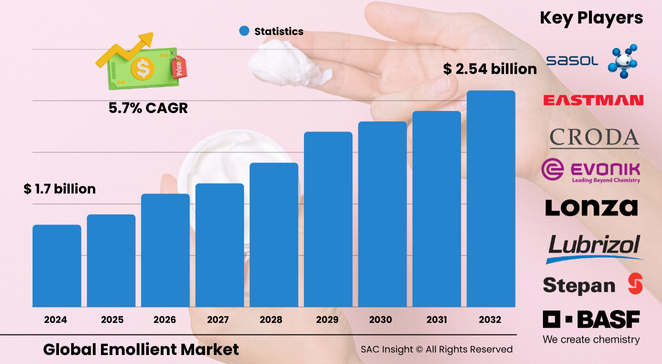

The global emollient market size is currently valued at about US$ 1.7 billion (2024) and is on track to reach roughly US$ 2.54 billion by 2032, expanding at an average 5.7% CAGR. SAC Insight's first-hand industry insights point to three strong growth engines: premiumisation of personal-care routines, consumer migration toward plant-based ingredients, and regulatory pressure to reduce water loss in skin-barrier formulas.

SAC Insight’s deep market evaluation shows the United States emollient market alone could rise from around US$ 200 million in 2024 to approximately US$ 321 million by 2032 as shoppers demand silky textures that double as barrier-repair solutions.

Summary of Market Trends & Drivers

• Shift to clean-label beauty is accelerating the replacement of legacy petrolatum with biodegradable esters and sugar-derived silicones.

• Skin-health awareness and dermatology-backed claims are lifting demand for high-purity, allergy-tested emollients with clinical data.

• Brand competition in Asia for fast-absorbing, humidity-tolerant formulations is driving lightweight ester innovation and local capacity additions.

Key Market Players

The market features a blend of diversified chemical majors and agile specialty firms. Companies such as BASF, Croda, Lubrizol, Evonik, and Cargill leverage global supply chains and robust R&D budgets to secure sizeable market share. Alongside them, Oleon, Innospec, Vantage Specialty Chemicals, and Berg + Schmidt focus on niche plant-derived lines and tailored blends that meet region-specific claims. Competitive dynamics revolve around bio-based feedstock sourcing, sensory testing labs, and formulation co-development agreements with beauty conglomerates.

Key Takeaways

• Current global market size (2024): USD$ 1.7 billion

• Projected global market size (2032): USD$ 2.54 billion at a 5.7 % CAGR

• Esters command the largest product-type market share and post the quickest market growth at around 6.1 % CAGR

• Asia-Pacific already accounts for more than two-fifths of revenue and is the fastest-growing region at roughly 6.4 % CAGR

• U.S. market expected to climb to about USD$ 321 million by 2032, driven by dermatologist-grade skin-barrier products

• Ongoing scale-up of biodegradable silicone alternatives is reshaping long-term market trends

Market Dynamics

Drivers

• Rising disposable income in emerging economies boosts demand for premium sensory experiences across skin-care and hair-care SKUs.

• E-commerce tutorials and social media influencers spark consumer curiosity about “skin feel,” pushing formulators toward next-gen emollients.

• Advances in bio-fermentation and enzymatic esterification reduce the carbon footprint of feedstocks, supporting sustainability claims.

Restraints

• Regulatory scrutiny of cyclic silicones (e.g., D4, D5) in Europe and parts of North America raises reformulation costs.

• Palm-based esters face supply-chain audits linked to deforestation, pressuring manufacturers to certify or switch sources.

• Volatile raw-material prices for fatty alcohols and fatty acids compress margins for smaller producers.

Opportunities

• Custom texture design—combining esters with natural polymers—opens white space in hybrid skin-makeup products.

• Solid-format balms and sticks cater to travel-friendly, waterless beauty trends, boosting growth in solid emollients.

• Pharmaceutical cross-over for eczema and psoriasis creams positions high-purity hydrocarbons for medical-grade market expansion.

Challenges

• Intense competition from multifunctional alternatives such as isopropyl myristate can dilute pricing power.

• Achieving both biodegradability and long-lasting film-forming performance requires costly R&D cycles.

• Fragmented regional standards complicate global rollouts, forcing parallel formulation and labeling strategies.

Regional Analysis

Asia-Pacific dominates the emollient landscape thanks to large consumer bases in China, India, and South Korea, a flourishing K-beauty export machine, and fast-rising disposable incomes. Europe follows, propelled by strict cosmetic regulations that favor high-purity, traceable esters, while North America remains an innovation hub for dermatologist-endorsed barrier-repair lines.

• North America – Strong demand for hypoallergenic, dermatologist-tested lines fuels steady market growth

• Europe – Regulatory leadership on clean beauty drives rapid silicone substitution and ester adoption

• Asia-Pacific – Fastest CAGR; beauty ritual sophistication and local manufacturing incentives spur capacity scale-ups

• Latin America – Climate-specific hair-care routines boost silicone-ester blends for frizz control

• Middle East & Africa – Growing middle class and halal-certified beauty lines expand addressable market

Segmentation Analysis

By Form

• Solid – Targeted, mess-free formats gaining traction.

Solid sticks and balms allow precise application on dry patches and lips, matching on-the-go lifestyles and reducing packaging waste.

• Semi-Solid – Classic creams maintain trust.

These forms remain the backbone of over-the-counter moisturisers, balancing spreadability with occlusive protection for sensitive skin.

• Liquid – Fastest-growing due to serums and light lotions.

Light liquids deliver quick absorption and layering compatibility sought in multi-step routines, especially in humid climates.

• Powder/Flakes – Niche but rising in DIY blends.

Fine powders enable customisation in indie beauty and water-free formulations, though dispersion challenges limit mainstream use.

By Chemical Type

• Esters – High market share and fastest CAGR.

They provide a non-greasy, velvety finish and excellent spreadability, making them staples in premium skin-finish products.

Esters’ versatility in polarity allows formulators to fine-tune viscosity and sensorial cues without compromising natural-origin claims.

• Silicones – Silky glide and moisture-lock.

Dimethicone and amodimethicone continue to anchor high-performance hair-care and colour cosmetics despite cyclic restrictions.

Their smooth film counters frizz and delivers transfer resistance; lower-cyclic or crosslinked variants address eco-labels.

• Fatty Alcohols – Texture builders with mildness.

They thicken aqueous creams and stabilise emulsions, supporting gentler alternatives to harsher surfactants.

Consumers associate fatty alcohols with “skin-friendly” labels, sustaining demand in baby-care and sensitive-skin lines.

• Fatty Acids – Barrier boosters.

Long-chain acids such as stearic aid in replenishing lipids and enhancing cream body, appealing to dermatology-led brands.

• Ethers – Lightweight sensorial enhancers.

Used in oil-free gels and mattifying primers, ethers add slip without shine, fitting make-up base formulations.

• Hydrocarbons – Cost-effective occlusion.

Medical-grade petrolatum and mineral oil offer unrivalled transepidermal water-loss protection, retaining relevance in therapeutic ointments.

By Application

• Skin Care – Core demand engine.

Moisturisers, barrier creams, and anti-aging serums drive over half of total emollient consumption thanks to daily-use frequency.

Hydration claims allied with sensorial luxury encourage multi-layer routines, sustaining volume growth.

• Hair Care – Rising need for shine and frizz control.

Leave-in treatments and silicone-ester blends dominate Asian markets where humidity management is prized.

• Oral Care – Emerging niche.

Ester-based emollients soften lipid-rich toothpastes and medicated mouthgels, improving mouthfeel.

• Fragrances – Enhance perfume longevity.

Silicone oils extend scent projection and skin adhesion, appealing to luxury perfume houses.

• Toiletries – Everyday essentials.

Soaps and shower oils integrate lightweight esters to combat cleanser-induced dryness, widening mass-market penetration.

• Cosmetics – Long-wear trends.

Transfer-proof foundations rely on emollient-silicone matrices that resist sweat while delivering comfort.

Industry Developments & Instances

• February 2025 – A leading multinational launched a sugar-derived silicone alternative with 60 % lower carbon footprint.

• August 2024 – A European clean-beauty brand partnered with a specialty ester producer to co-create biodegradable lipstick bases.

• March 2024 – An Asian contract manufacturer expanded ester capacity by 20 % to serve booming K-beauty exports.

• November 2023 – A major chemical company acquired a plant-based fatty-alcohol start-up, securing vertically integrated supply.

Facts & Figures

• Asia-Pacific captured more than 41 % of global market share in 2023.

• Liquid formats are forecast to grow at about 6.6 % CAGR from 2024 to 2032.

• Esters account for roughly 45 % of product-type revenue and could exceed USD$ 880 million by 2032.

• Dermatologist-recommended emollient launches rose by nearly 18 % in 2024 compared with 2022.

• Bio-based feedstocks now meet about 30 % of total emollient demand, up from 22 % in 2021.

Analyst Review & Recommendations

Market analysis indicates a decisive shift toward sensorially rich yet eco-conscious formulations. Producers that blend high-purity esters with traceable bio-silicones while securing palm-free supply chains will outpace average market growth. Investment in rapid skin-feel testing labs, portfolio-wide biodegradability metrics, and collaborative brand innovation hubs is recommended to capture the premium segment through 2032.