Market Overview

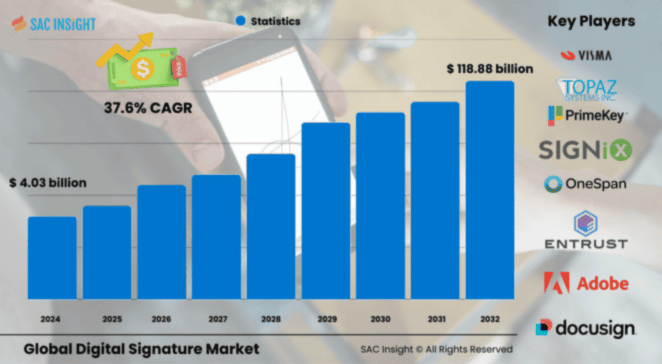

The global digital signature market size was valued at roughly US$ 4.03 billion in 2024 and is on course to reach US$ 118.88 billion by 2032, expanding at ~37.6% CAGR between 2025 and 2032. First-hand industry insights indicate three structural forces behind this rapid market growth: the wholesale shift to paper-free workflows, stricter identity-assurance regulations, and the integration of AI- and blockchain-based verification engines. SAC Insight analysis also shows a post-pandemic step-change in adoption as remote work normalized electronic approvals across banking, healthcare, and public services. The U.S. market alone is projected to approach US$ 35 billion by 2032, underscoring the technology’s mainstream status in high-volume transactional environments.

Summary of Market Trends & Drivers

24/7 omni-device signing is now a baseline customer expectation, pushing enterprises to embed e-signature APIs directly into CRM, ERP, and loan-origination platforms. AI-driven identity proofing, blockchain time-stamping, and biometric multi-factor authentication are becoming standard add-ons, raising both security and auditability. Sustainability mandates and cost-out programs continue to reward firms that eliminate paper, courier fees, and branch visits.

Key Market Players

The digital signature market report profiles global leaders and fast-scaling challengers shaping competitive intensity. Established vendors dominate large-enterprise roll-outs with end-to-end trust platforms, while specialist firms focus on qualified electronic signatures, sector-specific compliance modules, and lightweight SMB offerings. A wave of partnerships between signature providers, cloud platforms, and identity-verification start-ups is accelerating feature convergence and geographic reach.

Key Takeaways

• Digital Signature Market value (2024): ≈ USD$ 4.03 billion

• Projected value (2032): ≈ USD$ 118.88 billion at ~37.6% CAGR

• North America leads with ~34% market share, followed by Europe and a fast-growing Asia-Pacific corridor.

• Solutions capture ~65% of 2023 revenue, but services are compounding above 40% as enterprises outsource implementation and training.

• Advanced Electronic Signatures (AES) dominate sensitive workflows, yet Qualified Electronic Signatures (QES) are the fastest-rising tier thanks to face-to-face identity proofing.

• Cloud deployment is eclipsing on-premise installs, though regulated entities still favor in-house key custody.

Market Dynamics

Drivers

• Regulatory green lights for e-signatures across major economies, coupled with e-governance programs.

• Rising smartphone and broadband penetration enabling anytime, anywhere approvals.

• Demonstrable ROI from cycle-time cuts, lower error rates, and improved customer experience.

Restraints

• Patchy awareness of legal enforceability in developing markets.

• Dependence on robust PKI infrastructure; outages or certificate mismanagement can stall processes.

Opportunities

• Sector-specific templates (mortgage, pharma consent, public procurement) that shorten onboarding time.

• Zero-knowledge blockchain vaults offering tamper-proof long-term archiving.

Challenges

• Harmonizing cross-border compliance where national trust frameworks differ.

• Growing sophistication of cyber-attacks targeting certificate authorities and identity stores.

Regional Analysis

North America retains pole position thanks to early legislation, deep cloud penetration, and a mature vendor ecosystem. Europe follows closely, buoyed by the eIDAS framework and widespread digital-ID adoption. Asia-Pacific is the standout growth engine as governments in India, China, and ASEAN push paperless initiatives and fintech uptake.

• North America: Early-mover advantage, strong legal clarity, high enterprise cloud spend.

• Europe: eIDAS-driven demand for QES, rapid SME digitization.

• Asia-Pacific: Double-digit expansion on the back of government digital public infrastructure projects.

• Latin America: Accelerating as banks and telcos pursue branchless service models.

• Middle East & Africa: Gradual uptake aligned with national Vision 2030-style digitization agendas.

Segmentation Analysis

By Component

• Solutions – Core signing engines, ~65% share.

They enable secure, remote document execution and remain the primary revenue generator.

• Services – Fastest-growing, >40% CAGR.

Consulting, integration, and managed PKI services help organizations navigate compliance and change-management hurdles.

By Level

• Advanced Electronic Signatures (AES) – Preferred for high-value contracts.

AES leverages strong cryptography to prevent forgery and lower operating costs by removing wet-ink steps.

• Qualified Electronic Signatures (QES) – Highest assurance, fastest uptake.

Face-to-face identity verification and hardware-secured keys make QES the gold standard for regulated industries.

By Deployment

• On-premise – Largest share among heavily regulated sectors.

Local key control satisfies stringent data-sovereignty rules in healthcare and government.

• Cloud – Outpacing on-prem at >40% CAGR.

Elastic scalability and pay-as-you-go pricing attract enterprises looking for rapid rollout and global reach.

By End-user

• Businesses – Command the bulk of volume today.

Integrated e-signature workflows slash sales-cycle friction and improve customer retention.

• Organizations & Individuals – Emerging high-growth niches.

Non-profits and gig-economy professionals increasingly rely on low-cost, mobile-first signature apps.

By Industry Vertical

• BFSI – Largest adopter.

Stringent KYC mandates and the push for digital onboarding keep demand high.

• Government – Fastest CAGR.

Post-pandemic digitization drives e-tendering, permits, and citizen-service portals.

• Healthcare & Life Sciences, IT & Telecom, Retail, Real Estate, and Others each exhibit strong niche growth where secure, auditable approvals are mission-critical.

Industry Developments & Instances

• Mar 2023: A UK-based RegTech firm launched a blockchain-backed signing tool aimed at SMBs.

• Feb 2023: A global trust-service provider rolled out a qualified cloud signing platform compliant with EU standards.

• Jan 2023: A leading e-signature vendor partnered with a regional distributor to accelerate adoption across South Asia.

• Sep 2022: A European ID-verification specialist integrated its video-ID service into a major document-cloud suite.

• Jun 2022: A security software company acquired a cloud-native e-signature start-up to bolster its identity portfolio.

Facts & Figures

• Cloud-based deployments now represent over 55% of new contracts, up from 30% in 2020.

• Automated workflows cut document turnaround time by 70% on average, lifting customer NPS scores by up to 20 points.

• Organizations adopting e-signatures report paper and courier cost savings of 80–85% within the first year.

• 94% of large U.S. enterprises already run at least one mission-critical process in the cloud, easing signature integration.

• Blockchain-anchored signatures reduce document-tampering incidents by >90% compared with email-based approvals.

Analyst Review & Recommendations

SAC Insight evaluation shows the digital signature arena shifting from point solutions to end-to-end trust ecosystems. Vendors that bundle secure identity proofing, AI-based fraud analytics, and compliant cloud infrastructure will outpace pure-play signature providers. For new entrants, mid-priced, API-first offerings tailored to fintech and healthcare niches offer a fast route to scale. Incumbents should double down on zero-trust architectures and cross-border compliance toolkits to defend share and unlock the next wave of enterprise demand.